Thelander CVC Digest: June 2022

The Structure of the CVC Unit Impacts Compensation

Welcome to the first Thelander Digest, our monthly newsletter where we explore compensation insights for corporate venture capital units. Each month we’ll bring you an exclusive look at the compensation landscape within different areas of private capital markets. First up, how does the structure of the CVC unit impact compensation?

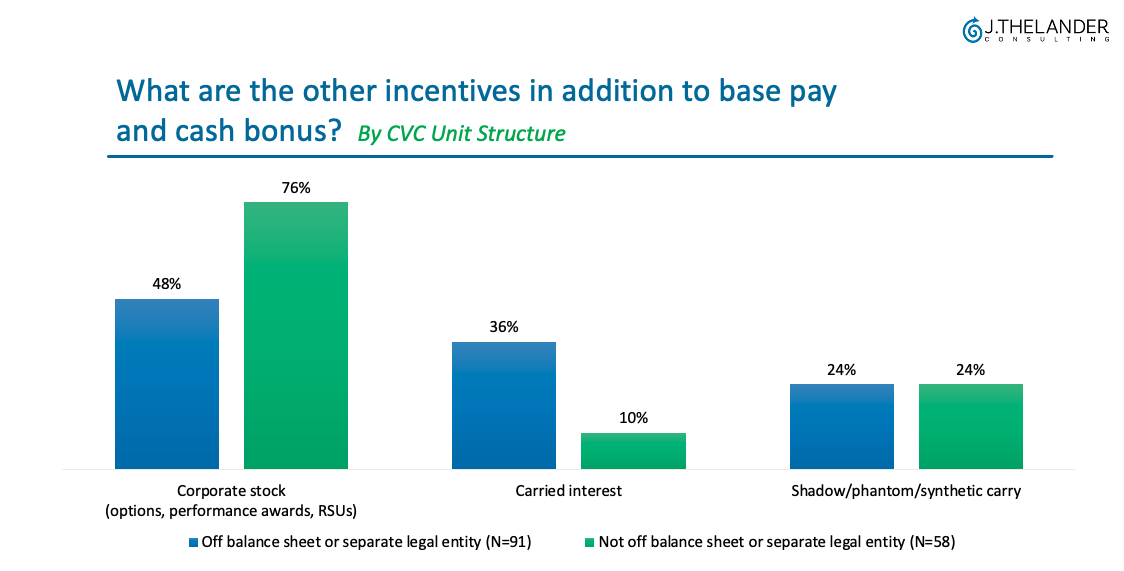

The major structural difference between CVC units is whether they are off balance sheet or separate legal entities, or not. The former has a greater degree of independence in relation to the parent company, and this division can also make a difference in the types of incentives they receive and the value of those incentives. Let’s dive in…

Thelander data indicates:

- Off balance sheet or separate legal entity CVC units are more likely to have carried interest as their incentive, while units that are not off balance sheet are more likely to have corporate stock as an incentive

- Both are equally likely to have shadow carry

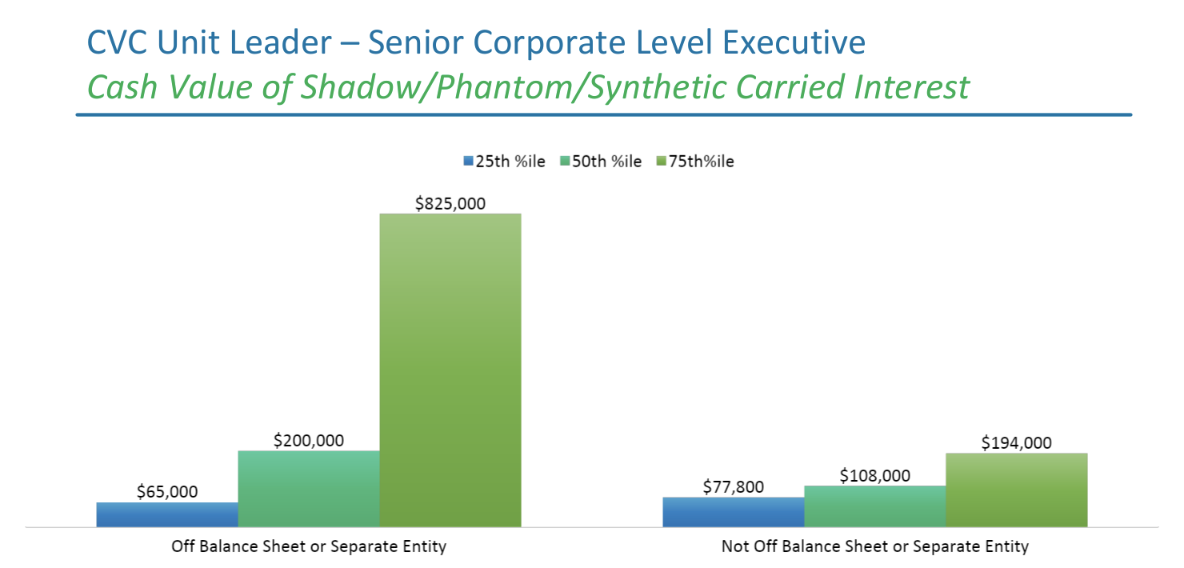

- However, the cash value of that synthetic carry is significantly higher for CVC unit leaders at off balance sheet/separate entity units than at their in-house counterparts shown in the graph above.

Do you want to find additional CVC compensation data? You can access this and many other topics for FREE by participating in our CVC Compensation Survey.

Thelander is the only firm that covers the entire private capital market from your investment firm to your portfolio company’s compensation. Did you enjoy our Thelander Digest, have ideas for future ones, or want to learn more about how J.Thelander Consulting can help you make informed decisions when it comes to hiring, incentivizing, and retaining talent? Email us here or give us a call at 305-793-8605. We love to hear from you!

Tags: CVC, Newsletter