Thelander CVC Digest: March 2023

How CVC Unit Structure Impacts Long Term Incentives

In this months Thelander Digest, we explore how CVC Unit Structure and Investment Capital Under Team Management influence what types of long term incentives are offered in addition to base pay and cash bonus. All of the data presented is collected through the Thelander Investment Firm – CVC Compensation Survey. If you are interested in securing free access to a subset of the results or discounted pricing on full access, you can

Participate in the Survey at No Cost

| Want more exclusive data, insights and analysis? Join us for a CVC Compensation Panel Webinar with DLA Piper and Bell Mason Group on March 30th from 11:00 am – noon pm PT. RSVP here. |

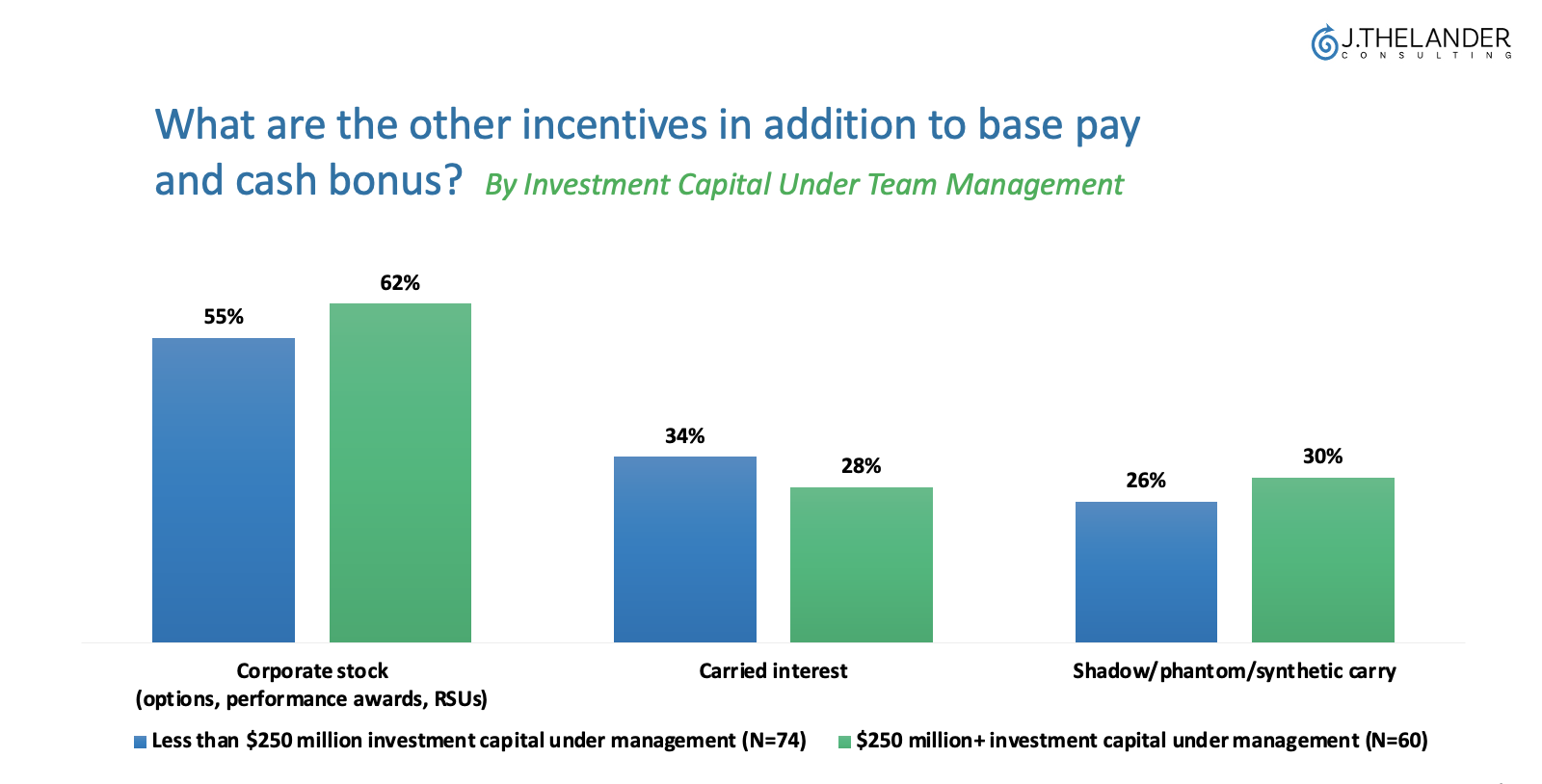

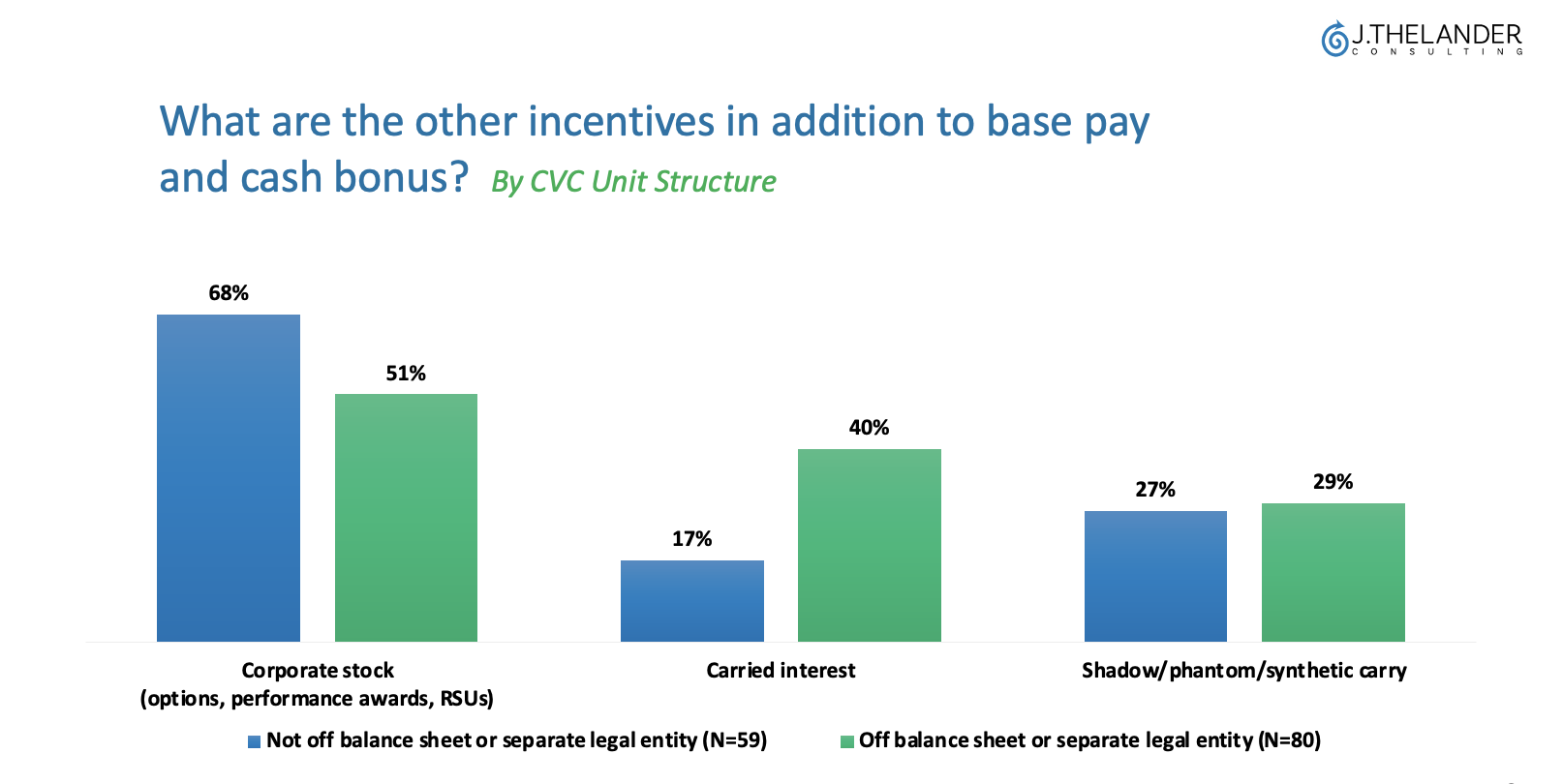

By examining the Thelander data on additional incentives in addition to base pay and cash bonus:

- Corporate stock is the most popular for CVC Unit’s across all asset classes.

- The second most popular option for CVC Unit’s with more than $250 Million in Investment Capital Under Team Management is shadow/phantom/synthetic carry.

- Whereas, the second most popular option for CVC Unit’s with LESS than $250 Million in AUM is carried interest.

- How about CVC Unit Structure? Corporate stock is the #1 choice across “not off balance sheet or separate legal entity” and “off balance sheet or separate legal entity.”

- However, whether a CVC Unit is off-balance sheet or not makes the biggest difference in determining whether they’ll have carried interest or not.

Thelander is the only firm that covers the entire private capital market from your investment firm to your portfolio company’s compensation. Did you enjoy our Thelander Digest, have ideas for future ones, or want to learn more about how J.Thelander Consulting can help you make informed decisions when it comes to hiring, incentivizing, and retaining talent? Email us here or give us a call at 305-793-8605. We love to hear from you!

Tags: CVC, Newsletter