Thelander IF Digest: October 2023

How Does Gender Impact Compensation at Venture Capital Firms?

For our October Digest, we’re looking at gender compensation data for investment professionals. Today, we examine the gender pay gap for three positions:

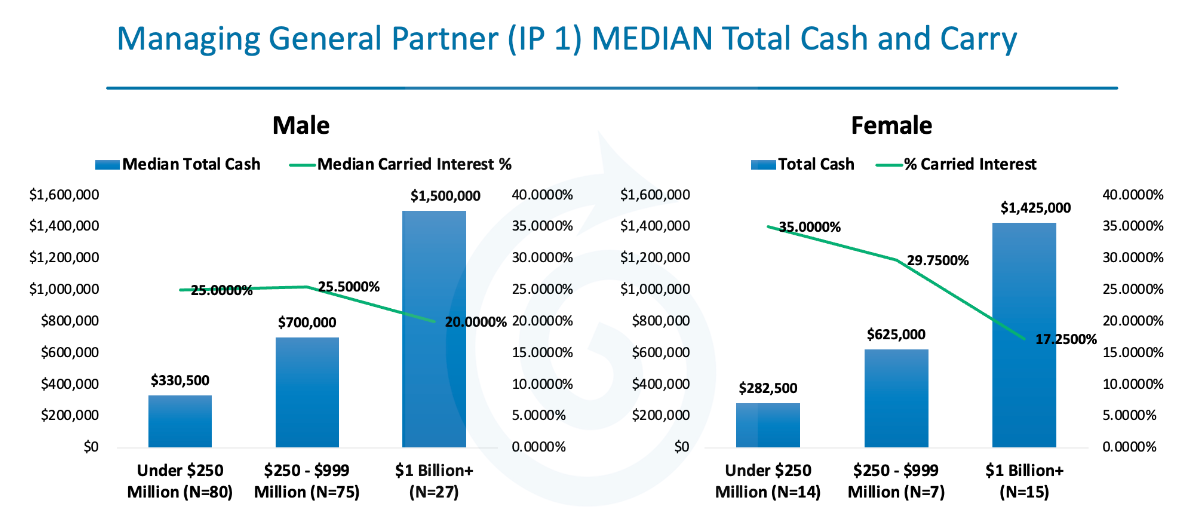

1) Managing General Partner (Investment Professional I)

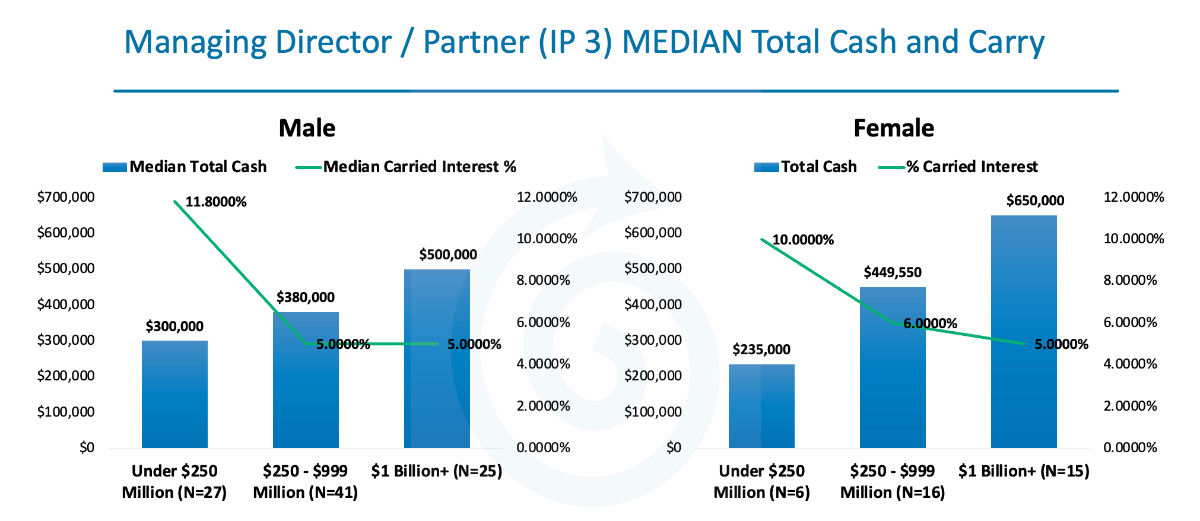

2) Managing Director / Partner (Investment Professional III)

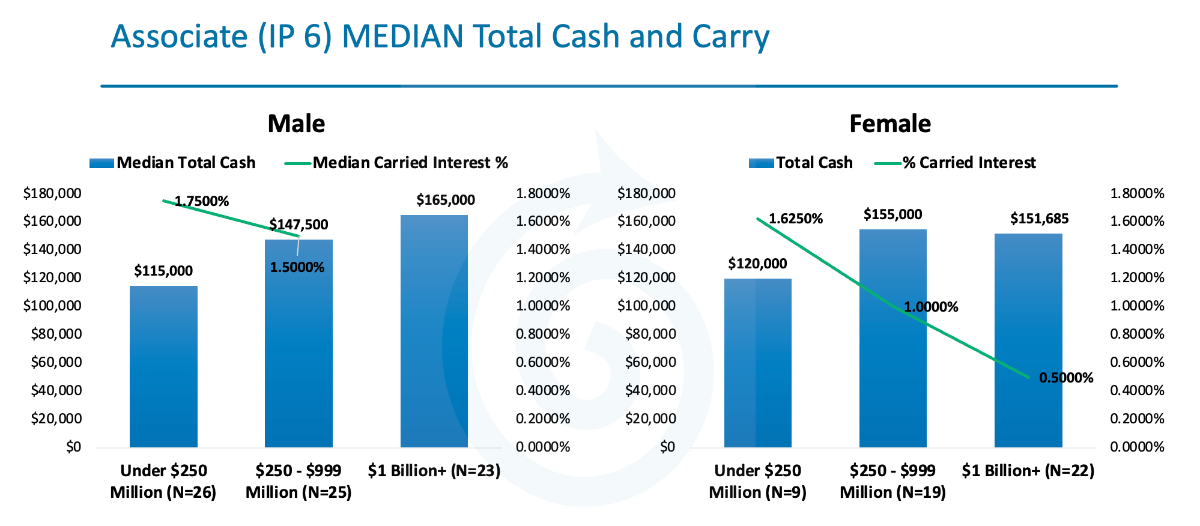

3) Associate (Investment Professional VI)

To do this, we looked at median total cash and carried interest for males and females at venture firms with less than $250 Million in AUM, $250 – $999.99 Million in AUM, and over $1 Billion in AUM.

Thelander has been tracking gender and ethnicity at investment firms for over five years, and we’ve used this exclusive data in our analysis. Let’s jump in!

Chart 1 shows the median total cash and carried interest for male and female Managing General Partners. Across all asset classes, men are making more in median total cash. Women have more carried interest than their male counterparts, except for in the $1 Billion+ category.

Chart 2 shows the median total cash and carried interest for Managing Directors / Partners at venture capital firms.

- Carried interest is competitive across all asset classes for both male and female Managing Directors / Partners.

- Women make more in median total cash at venture capital firms with $250 – $999 Million and $1 Billion+ in AUM.

Chart 3 shows that the median total cash for Associates is competitive across all asset classes with t

he biggest pay gap at the $1 Billion+ level in favor of male Associates. Thelander data shows that female Associates in the $1 Billion+ category are opting for carried interest in lieu of cash.

Our Findings:

Overall, the playing field is more level for male vs. female compensation. However, there are more men at the top (as reflected in the N’s) compared to a more even mix in a lower level position such as Associate. As we’ve discussed in previous newsletters, the total AUM impacts the mix of cash and equity more than any other factor.

Why is this data important?

Having access to market data on base salaries, bonuses, total cash, and carried interest helps level the playing field. It allows us to see what the market is paying based on filters such as total AUM and type of firm. As firms focus on ensuring a diverse candidate pipeline, Thelander will continue to track gender compensation trends.

Know someone that would find this data interesting?

Invite them to subscribe to the Thelander Monthly Digest here.

Participate In The Investment Firm Compensation Survey Here for More Compensation Data

| Interested in learning how your compensation compares to the market? We invite you to participate in the no-cost Thelander-PitchBook Investment Firm Compensation Survey. The survey covers 75+ titles from managing general partner to entry-level analyst, and includes questions on base salary, bonuses, carry dollars at work, and more. When you participate, you can trial the platform and see how your compensation compares to the market for a subset of jobs. Plus, you can upgrade at a discounted price! |