Thelander IF Digest: March 2024

The Gender Pay Gap is Closing Among Junior VC Investors

In honor of women’s history month, we dug into the investment firm dataset to analyze how representation of female VC investors has changed over the last four years and what progress has been made in closing the pay gap between men and women in venture.

Here’s what we found:

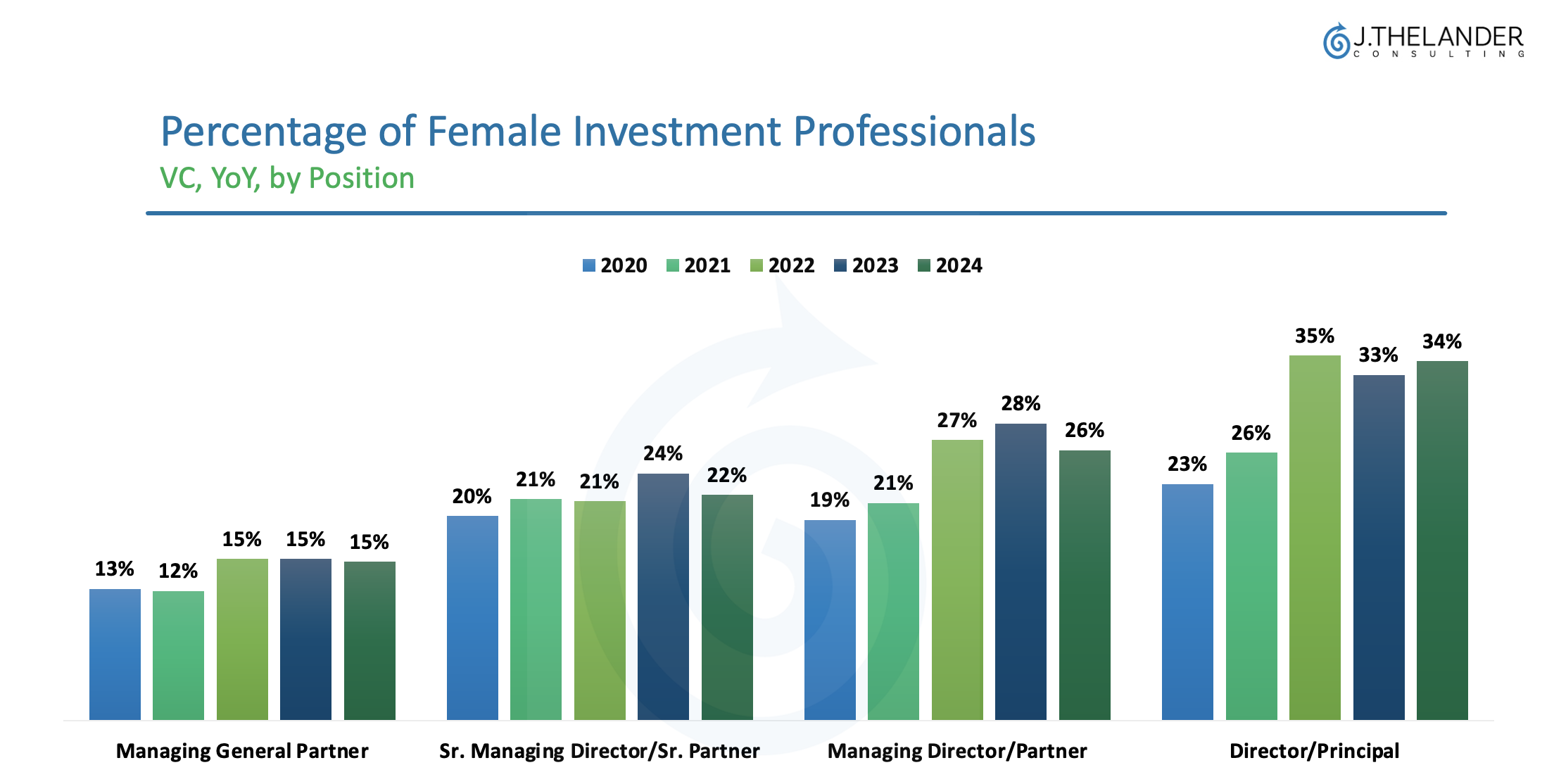

- Women make up for 15% of all managing general partners (IP 1) at venture capital firms, and they’re earning less than their male counterparts.

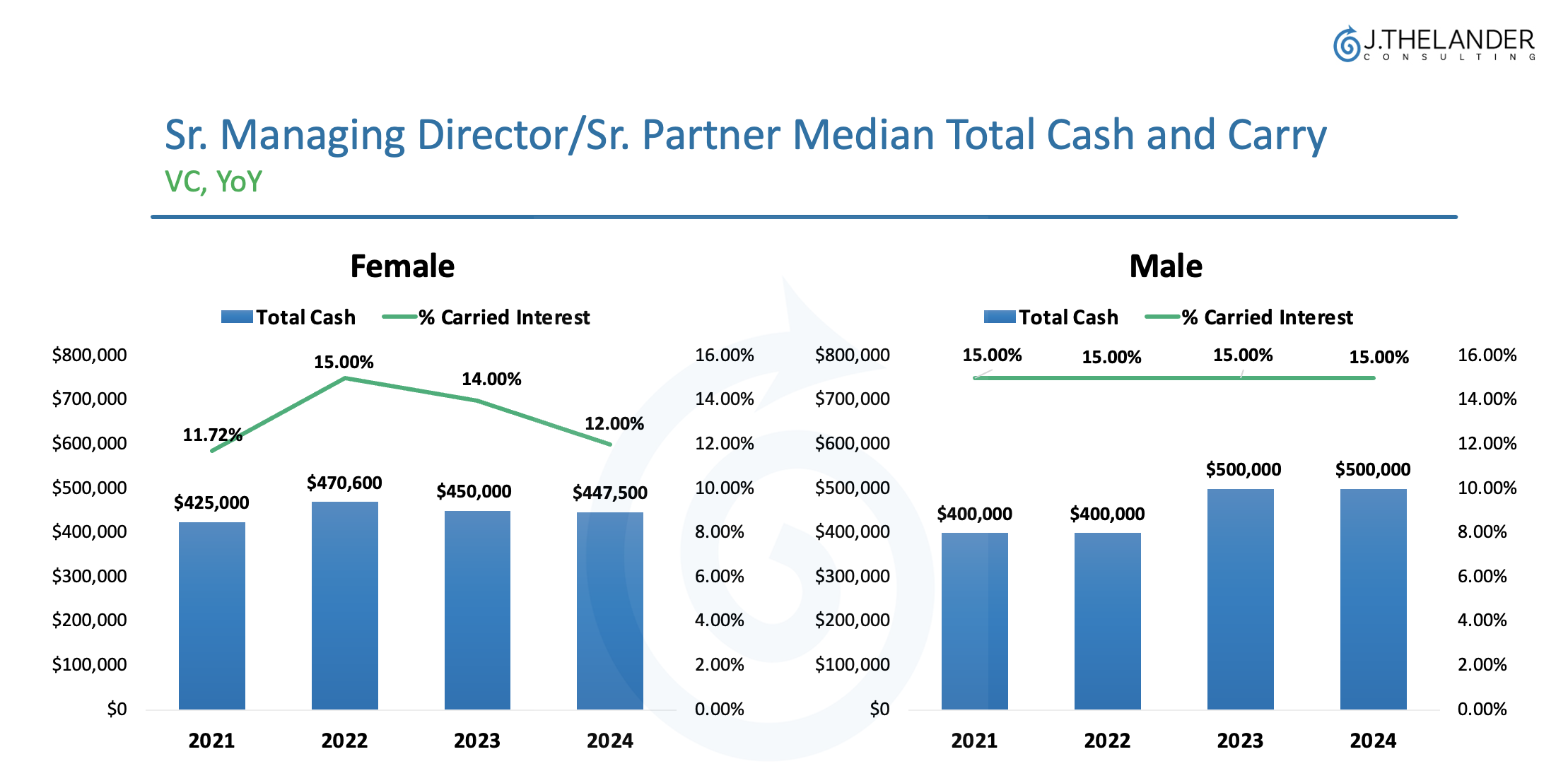

When looking at senior managing directors (IP 2), women earn 12% carried interest compared to 15% earned by their male peers at the median. For women, this represents a two-year decline in the percentage of carried interest allocated to them.

The median total cash compensation (base + bonus, or just base salary) for women is $447,500 for women and $500,000 for men, a pay gap of 11%.

Male senior managing directors also earn a higher percentage of carried interest than women in the same role.

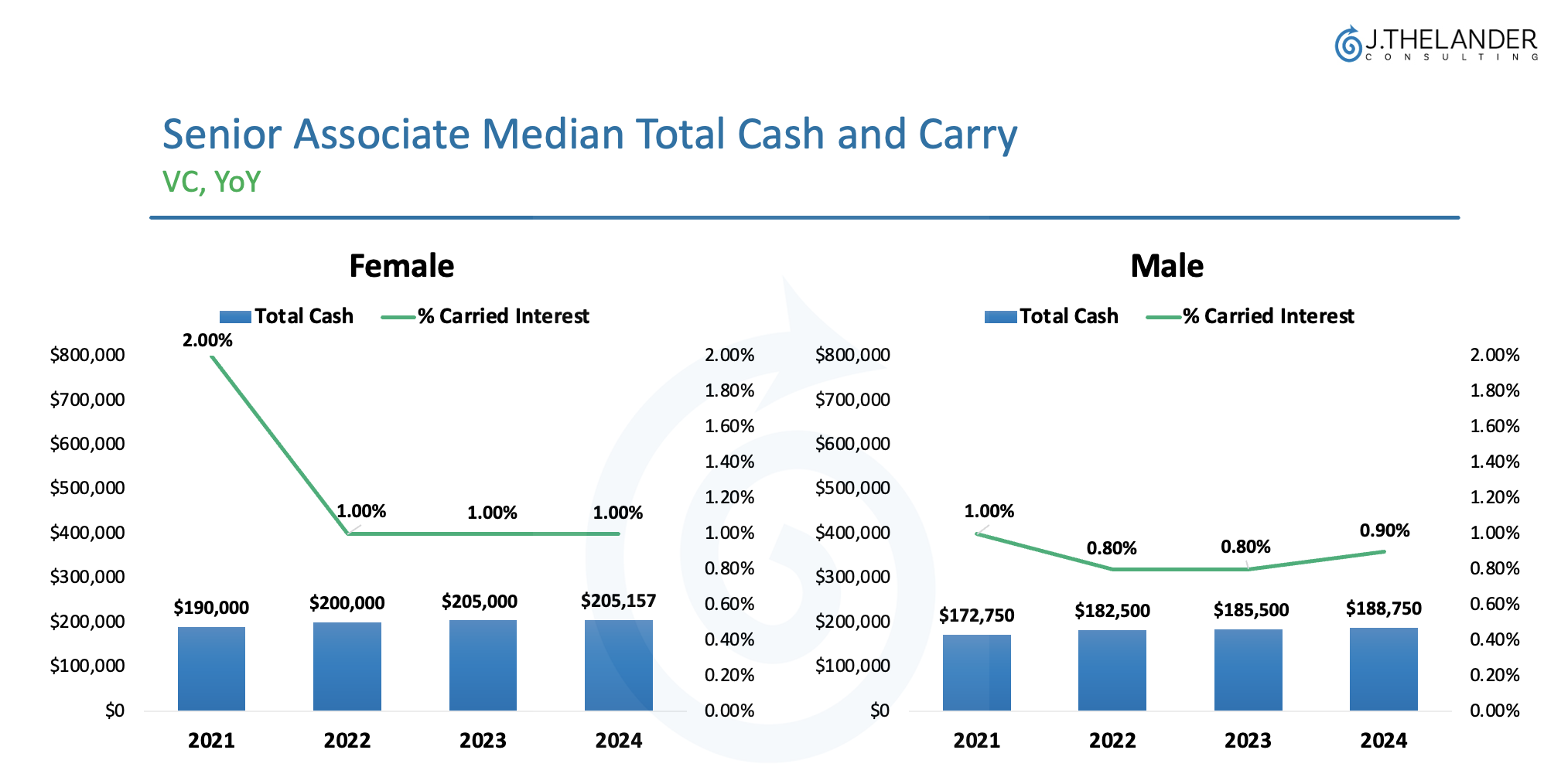

What about more junior positions? When looking at senior associates, women earn more total cash at the median compared to their male counterparts ($205,157 vs. $188,750).

This marks the fourth consecutive year that female senior associates have out-earned their male counterparts in terms of total cash.

The carried interest percentage is almost at parity, with senior associates earning roughly 1% of carried interest at the median regardless of gender.

It’s important to keep in mind that total AUM impacts the mix of cash and carry. Higher AUM typically has less carry and more cash for junior positions. The Thelander platform allows you to customize each data table by a number of filters – including total AUM, size of most recent fund, type of firm and location.

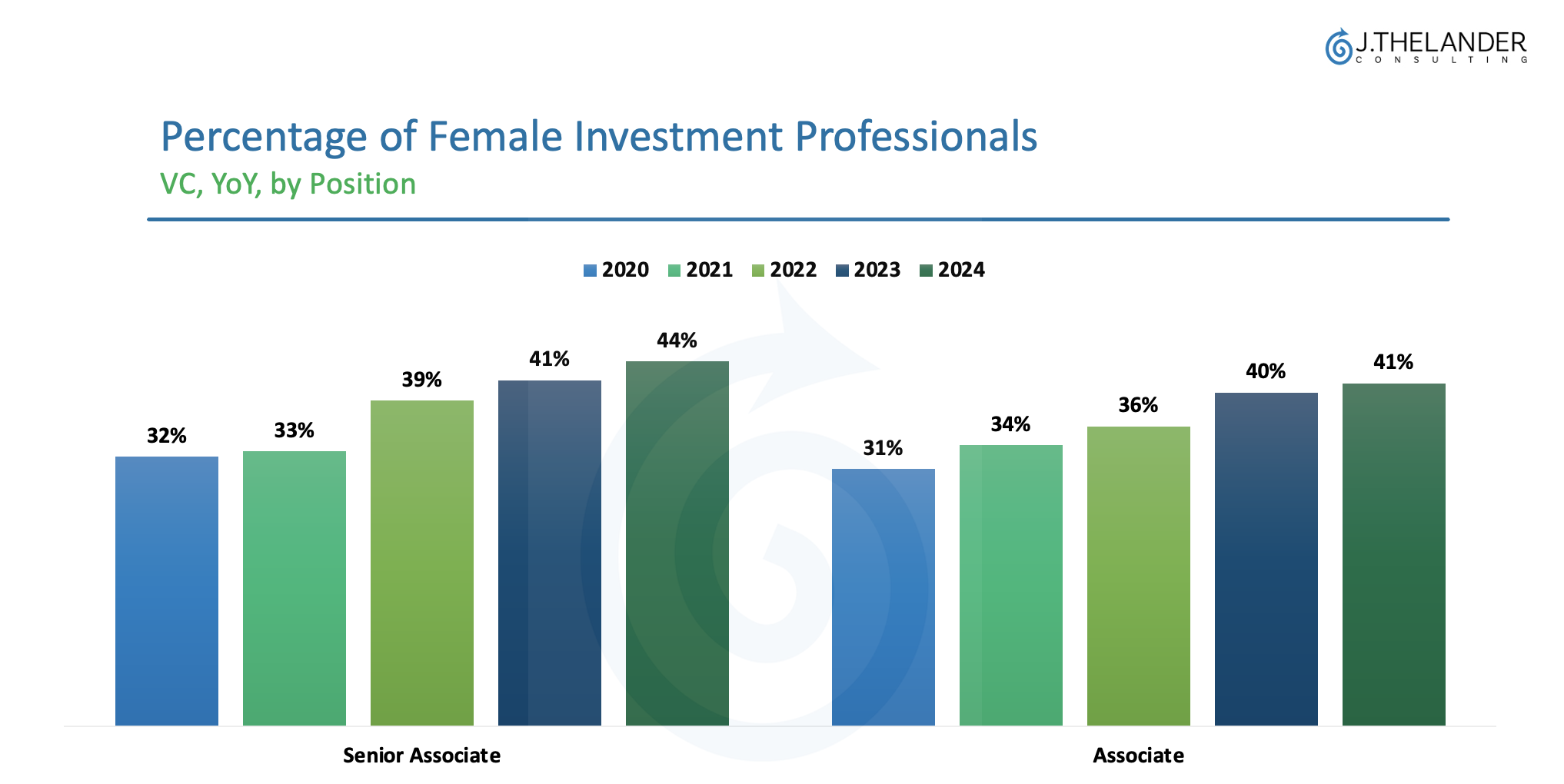

What’s more? Women are increasingly making a career out of venture. In 2024, women make up 44% of senior associates at venture firms, a 12% increase from 2020.

The gender pay gap is narrower among more junior roles, which will have an upward trajectory as these women progress into more senior positions. This progress wouldn’t be possible without access to real-time data like J.Thelander, which has nearly three decades of data and information on private market compensation.

We encourage you to take part in the Thelander-PitchBook Investment Firm Compensation Survey. There is no cost to participate and all respondents receive free access to a subset of compensation data. All data is published in aggregate only with no individual names or firm names reported. If you have any questions or would like to speak to team Thelander, you can email or call us: +1.305.793.8605

Tags: Investment Firm, Newsletter