Thelander CVC Digest: April 2024

How CVC Unit Structure Impacts Long Term Incentives

Welcome back to the April edition of our Thelander Digest. Last month, we dug into how CVCs can incentivize existing and prospective employees. This month, we’re going to look at how long term incentives are impacted by CVC unit structures. For context, not off balance sheet CVC units invest directly from the parent company’s balance sheet whereas a separate legal entity invests from a standalone, separate fund.

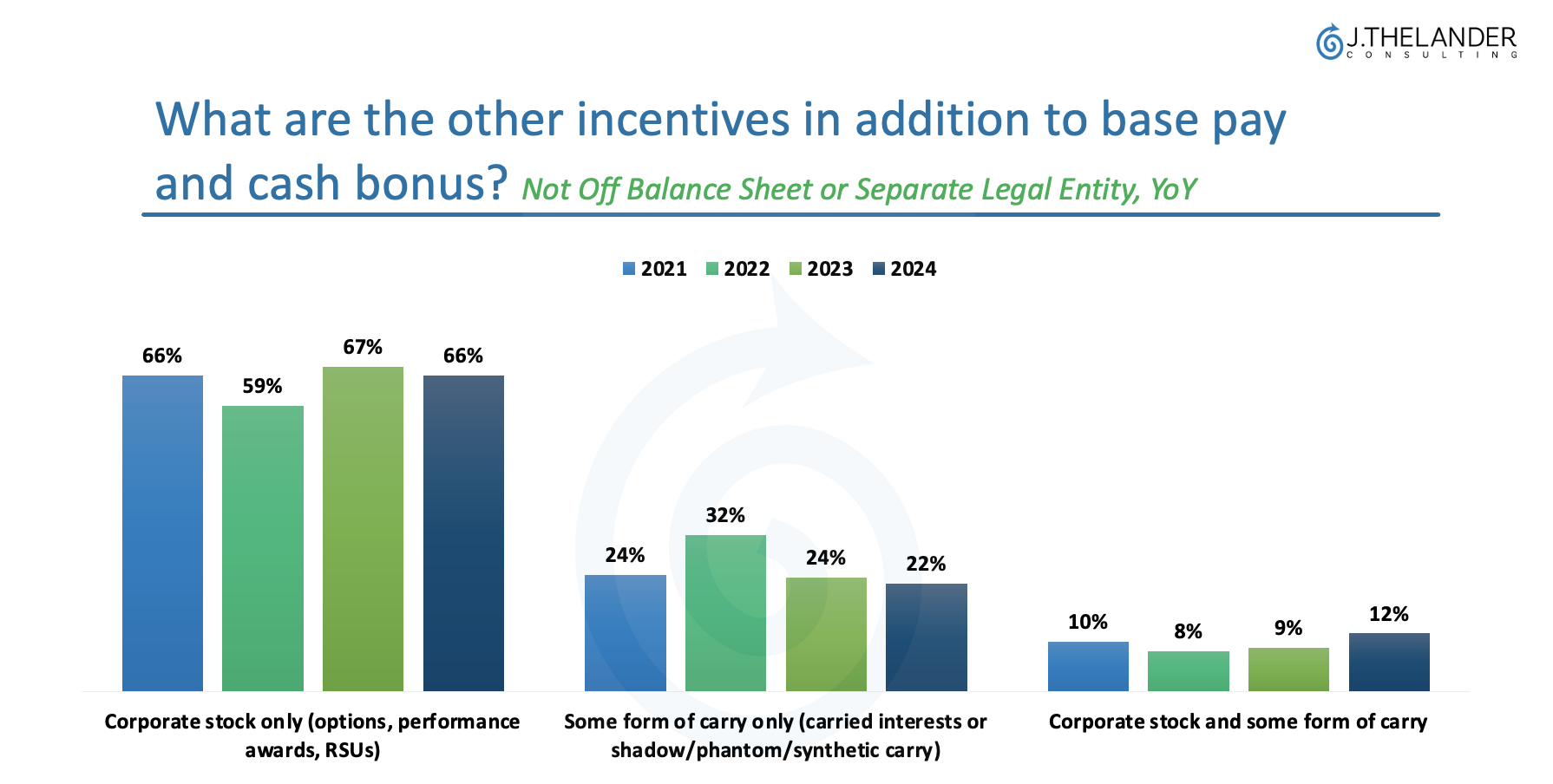

- CVC Units that are not off balance sheet tend to only offer corporate stock, including options, performance awards and RSUs, as an additional incentive.

- In 2024, 66% of CVC units that are not off balance sheet offer corporate stock in addition to base pay and cash bonus as an additional incentive to perform well and stay with the firm.

- Instead of corporate stock, some not off balance sheet CVC units offer some form of carry, including carried interest or shadow/phantom/synthetic carry. The percentage of not off balance CVC units who only offer some form of carry decreased by 10% from the four-year high of 32% in 2022.

- At the same time, the percentage of those who offer both corporate stock and some form of carry slightly YoY.

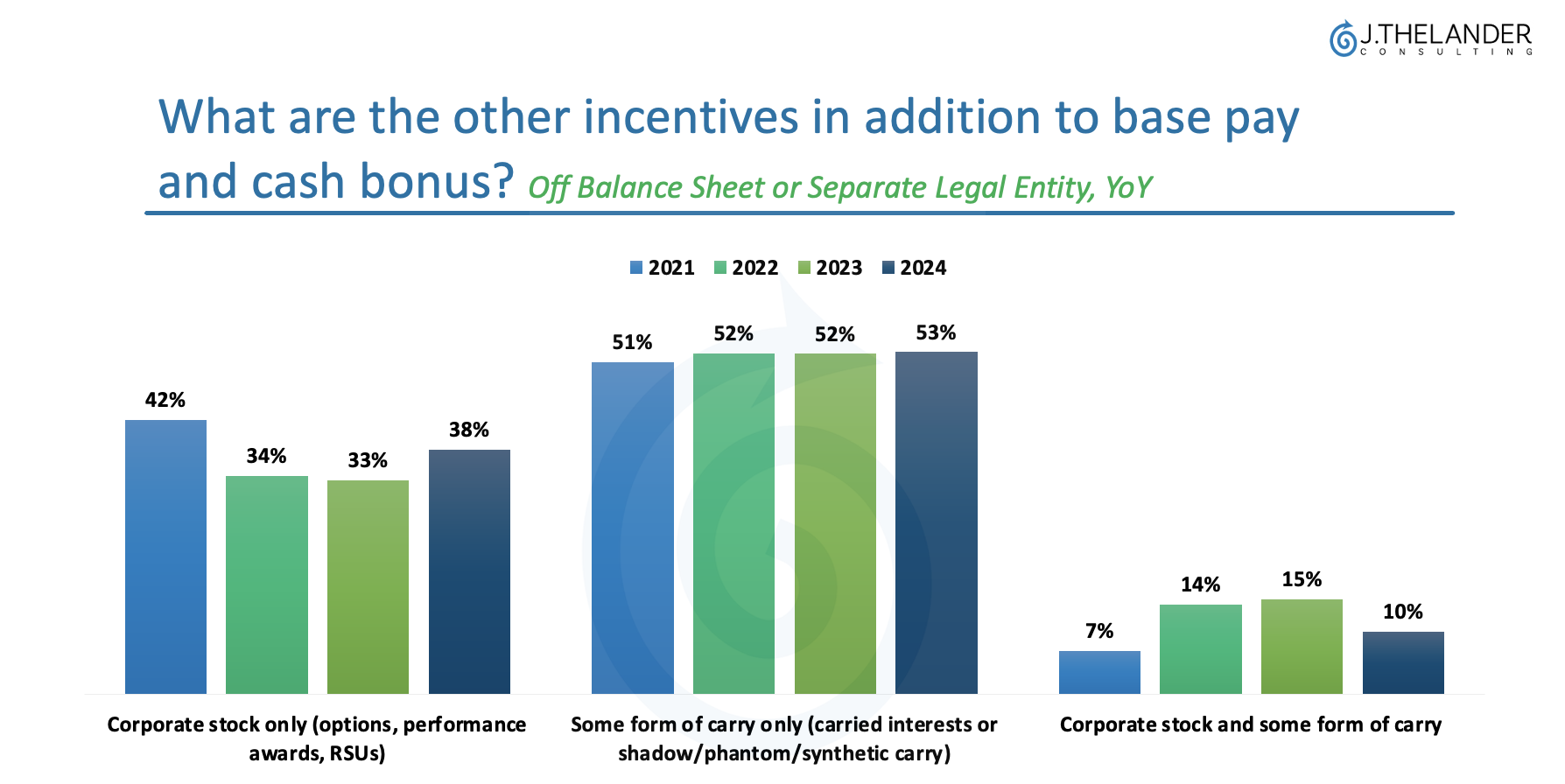

More than half (52%) of CVC Units that are off balance sheet or are a separate legal entities offer some form of carry only.

The percentage of off balance CVC units offering both corporate stock and some form of carry has also grown since 2021, despite decreasing this year after peaking in 2023.

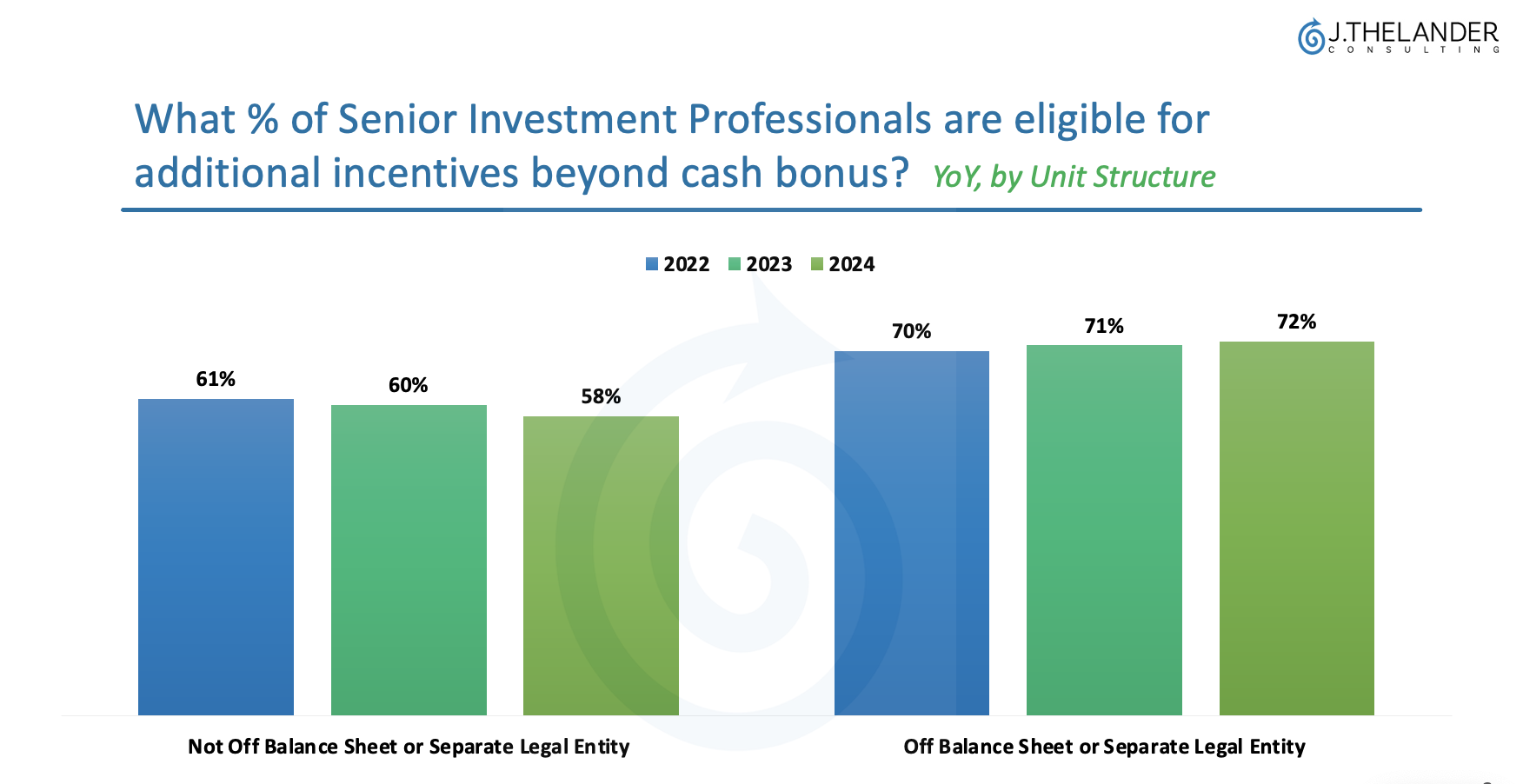

To understand how this translates into compensation – we we looked at the compensation levers for senior investment professionals (SIPs). Overall, SIPs are more likely to be eligible for additional incentives at CVC units that are off balance sheet or are separate legal entities. For example:

- 72% of SIPs at off balance sheet CVCs are eligible for additional incentives beyond cash bonus, compared to 58% of SIPS at not off balance sheet CVCs.

Median total cash also tends to be higher for SIPs at off balance sheet CVC units than those at not off balance sheet firms.

Although, that could be reversing.

- Median total cash for SIPs at off balance sheet CVC units has decreased slightly since 2021, falling from $277,500 in 2021 to $272,277 in 2024.

- At the same time, the median total cash increased at not off balance sheet CVCs from $248,500 in 2021 to $262,500 in 2024.

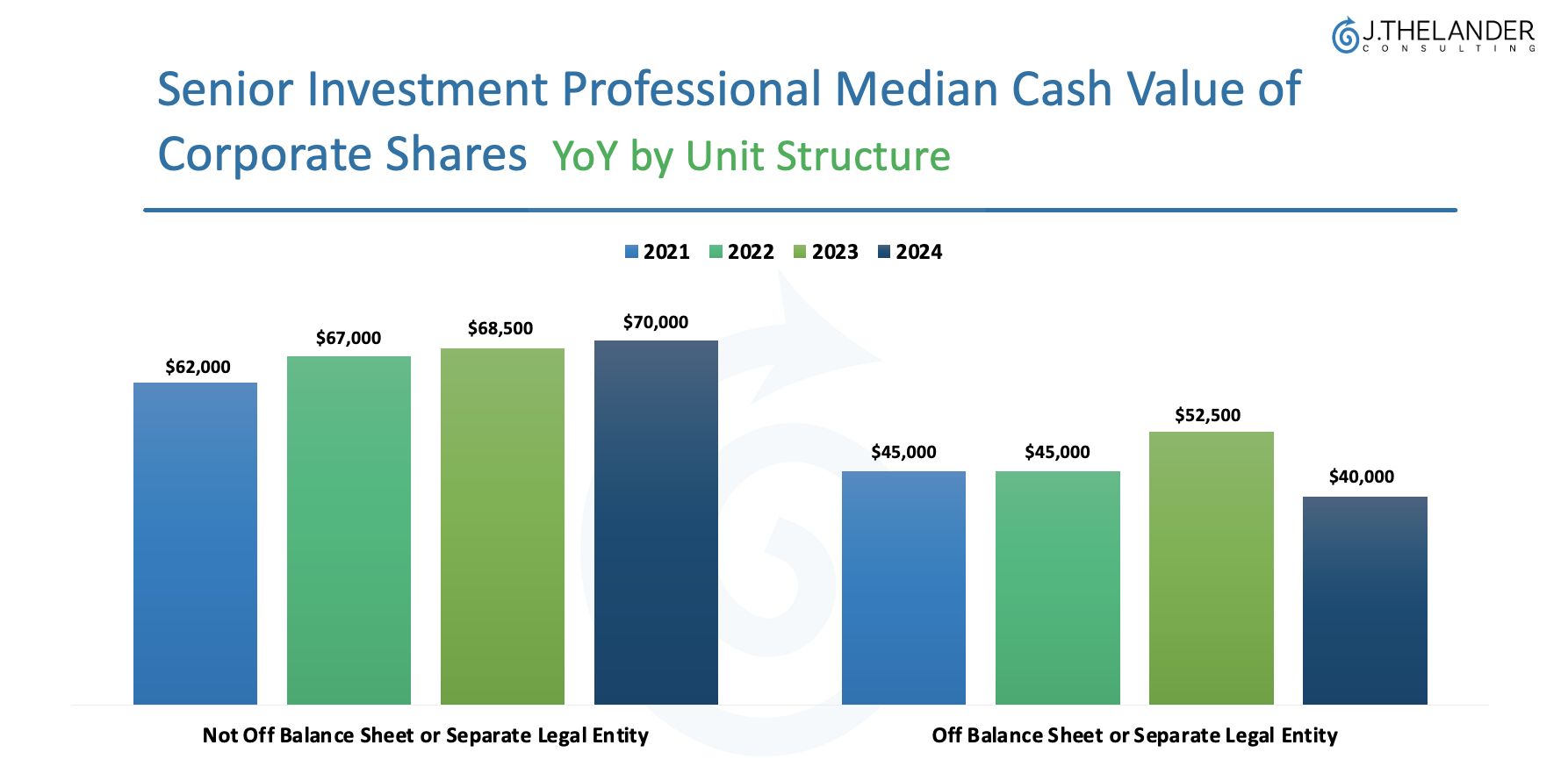

In most cases, SIPs at not off balance sheet CVCs make up for their compensation in corporate stock.

The median cash value of corporate shares has been consistently higher for SIPs at not off balance sheet CVC units, totaling $70,000, compared to $40,000 at off balance sheet CVCs.

Overall, the firm structure impacts the compensation and what long term incentives are utilized.

The Thelander Digest is powered by the no-cost Thelander CVC Compensation Survey. We invite you to participate and secure free access to a subset of the results on our platform. All data is published in aggregate only with no individual names or firm names reported. If you have any questions or would like to speak to team Thelander, you can email or call us: +1.305.793.8605

Tags: CVC, Newsletter