Thelander PC Digest: April 2024

Non-investor Board Member Compensation

One of the most frequently asked questions we get from our survey participants and clients is about how to compensate non-investor/independent board members. Non-investor board members contribute to private company boards because they typically have industry knowledge and valuable contacts that can help the company succeed. By appointing an independent member, the board can also expand past founders and investors, and have a neutral party to help make decisions on behalf of the company.

So, how do non-investor board members get compensated?

The four potential levers are:

- One time equity

- Annual equity

- One time cash

- Annual cash

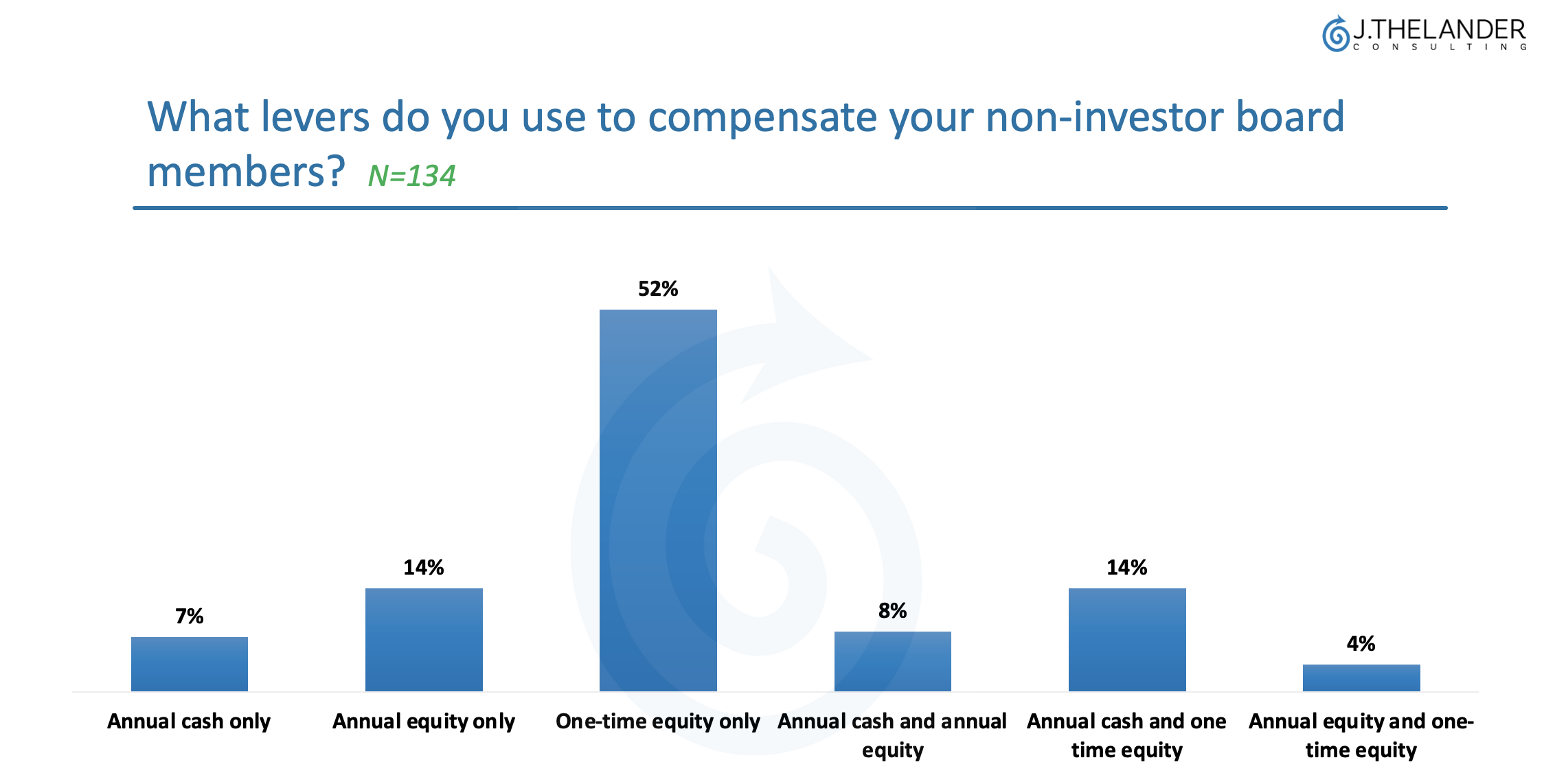

The majority of private companies compensate their non-investor board members with one-time equity (52%). Other companies offer annual equity (14%) or annual cash and one time equity (14%).

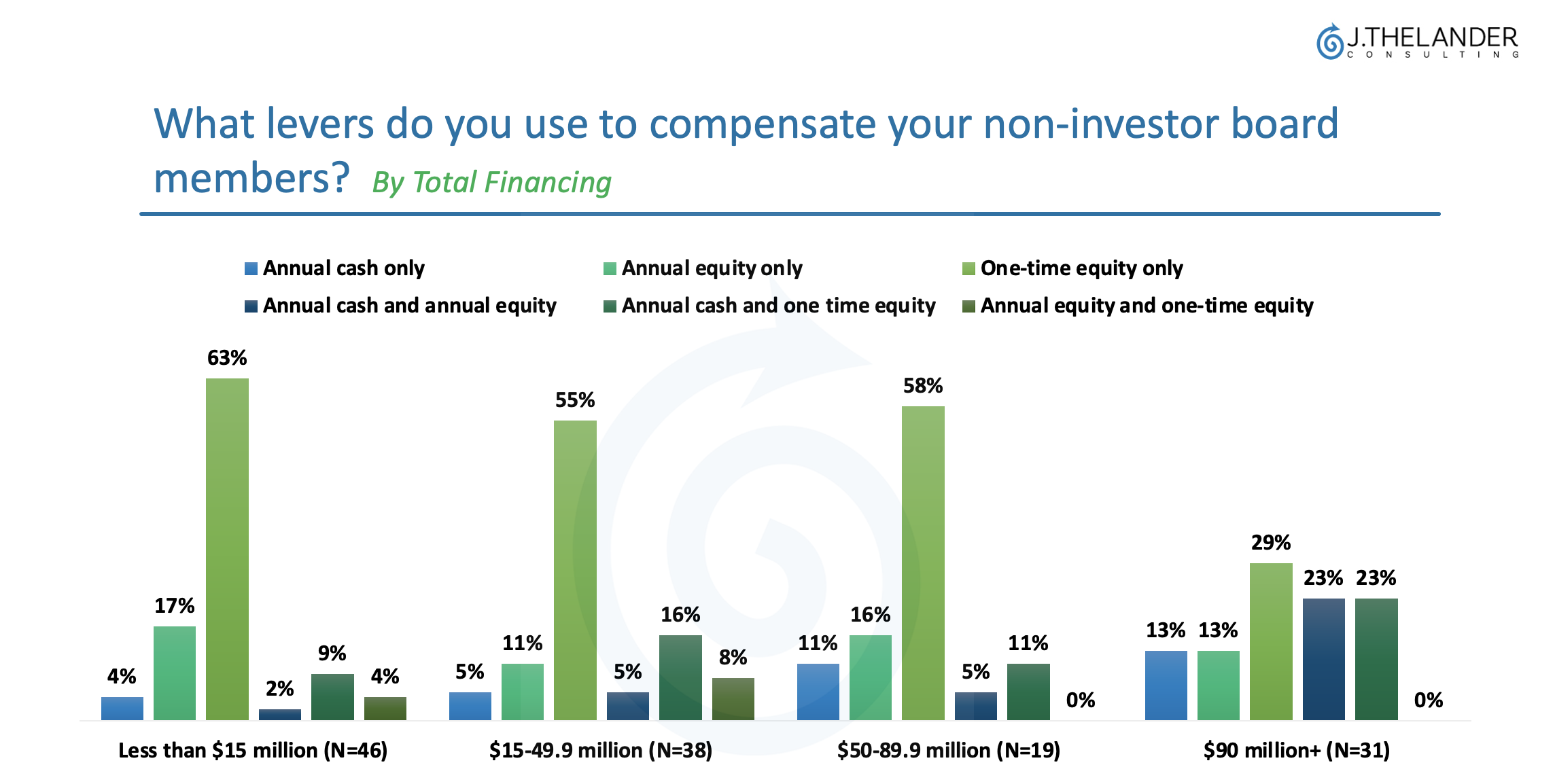

A company’s total amount of financing and industry can impact how they decide to compensate their non-investor board members. Earlier stage companies with less than $15 million in total financing typically opt for one-time equity (63%) whereas later stage companies, those with more than $90 million in financing, offer more of a mix including annual cash and annual equity (23%) as well as annual cash and one-time equity (23%).

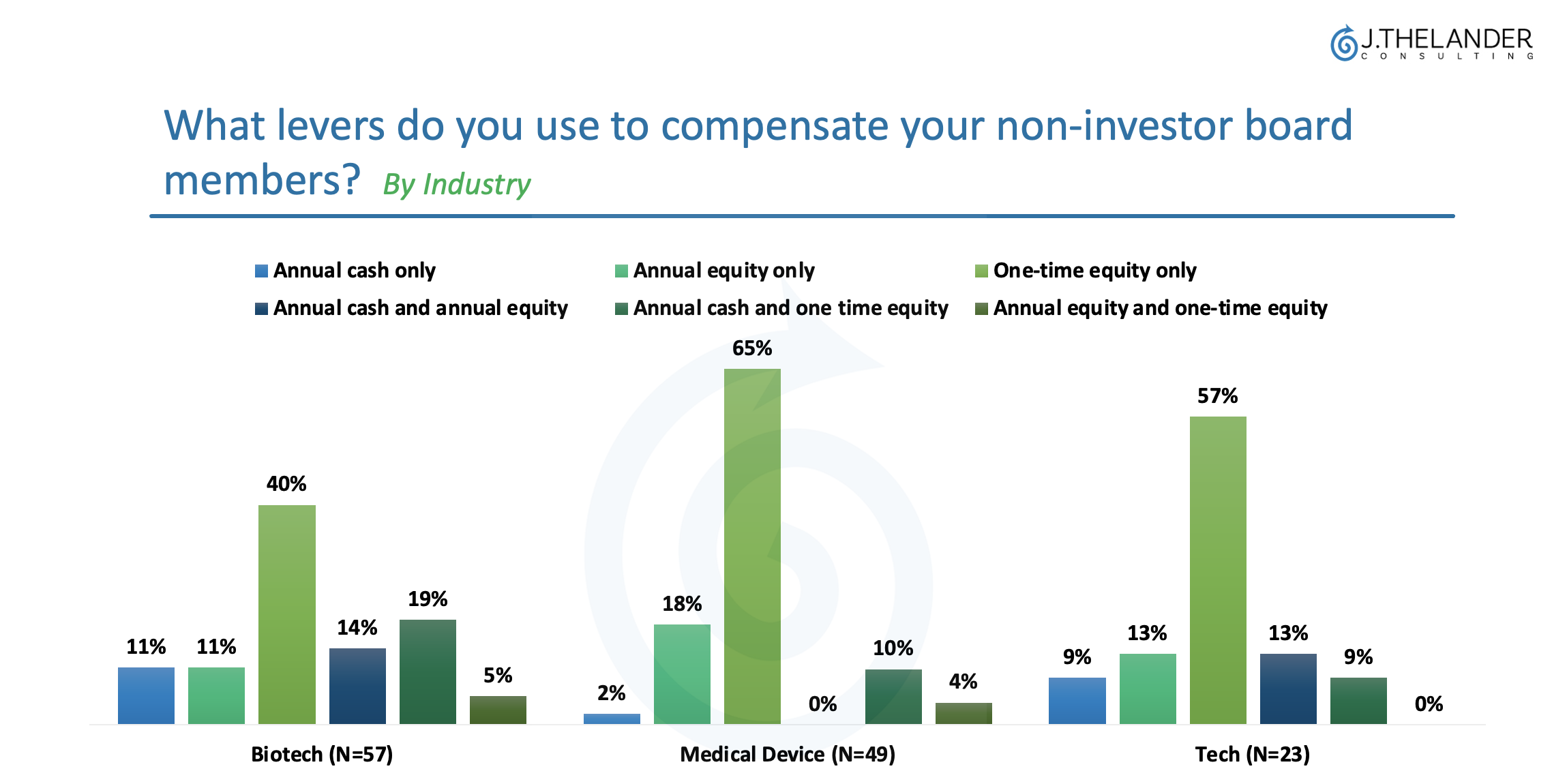

Following the trend, medical device, tech and biotech companies most commonly compensate their non-investor board members with a one-time equity grant (65%, 57% and 40% respectively). However, there are some differences in how they compensate outside of one-time equity grants. For example:

Medical device companies tend to offer annual equity (18%), while biotech companies are more often opting for annual cash and one time equity (18%).

One reason cash is popular, especially for biotech companies, is because these board members are often from medical backgrounds where they’re paid for their time, expertise and contribution.

As noted earlier, one time equity is the most common way to compensate a non-investor board member. The equity percentages range from a minimum of 0.25% to a maximum of 3.00%. The median equity percentage for one time equity is 0.50%.

Companies who are unsure about how to compensate their non-investor board members can utilize the full private company dataset on the Thelander platform to view non-investor board compensation by total amount of financing and industry – both factors that influence the mix and amount of equity and cash. Jody Thelander, our founder & CEO, will be joining Bolster and Everywhere Ventures for a discussion on how to find, onboard and compensate non-investor board members on May 2nd.

The Thelander Digest is powered by the no-cost Thelander Private Company Compensation Survey. We invite you to participate and secure your free subset of data to trial the online platform and see how your base salaries, bonuses, annual cash, founder and non-founder equity, option pool, non-investor board comp and more compare to market. If you’d like to learn more about Thelander or discuss our consulting services, you can email or call us: +1.305.793.8605

Tags: Newsletter, Private Company