Thelander IF Digest: April 2024

VC Investors Continue to Earn Top Dollar

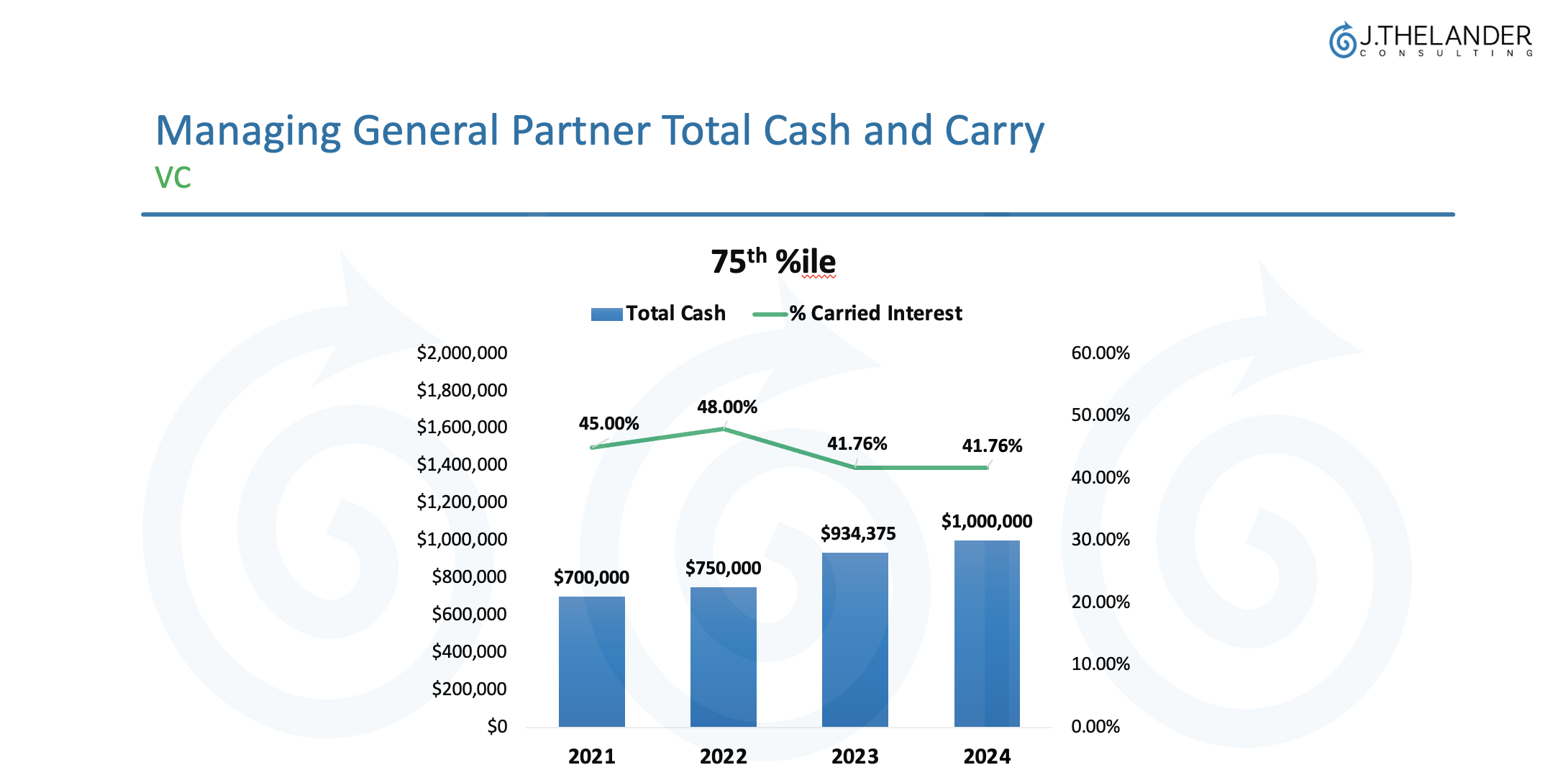

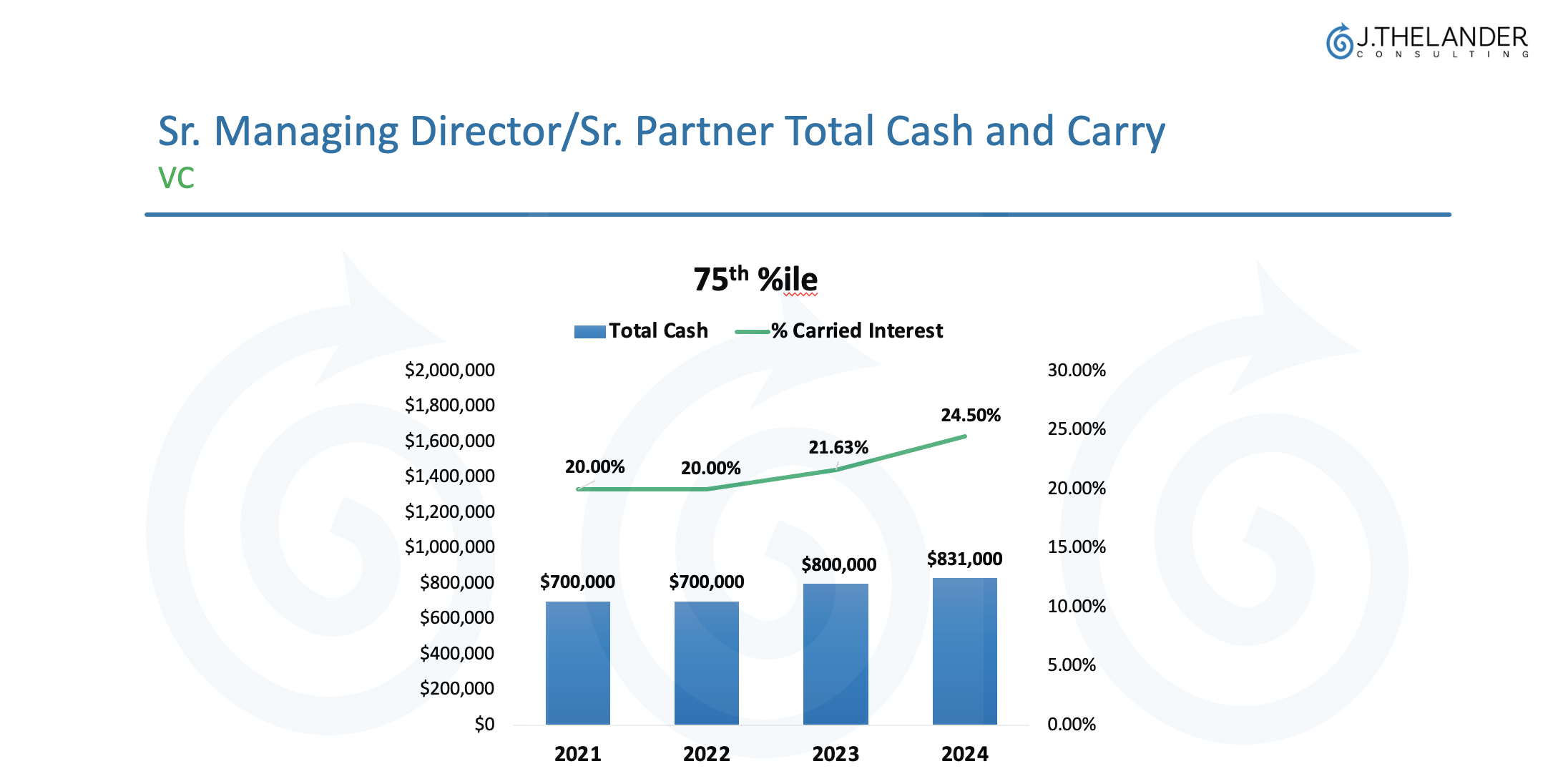

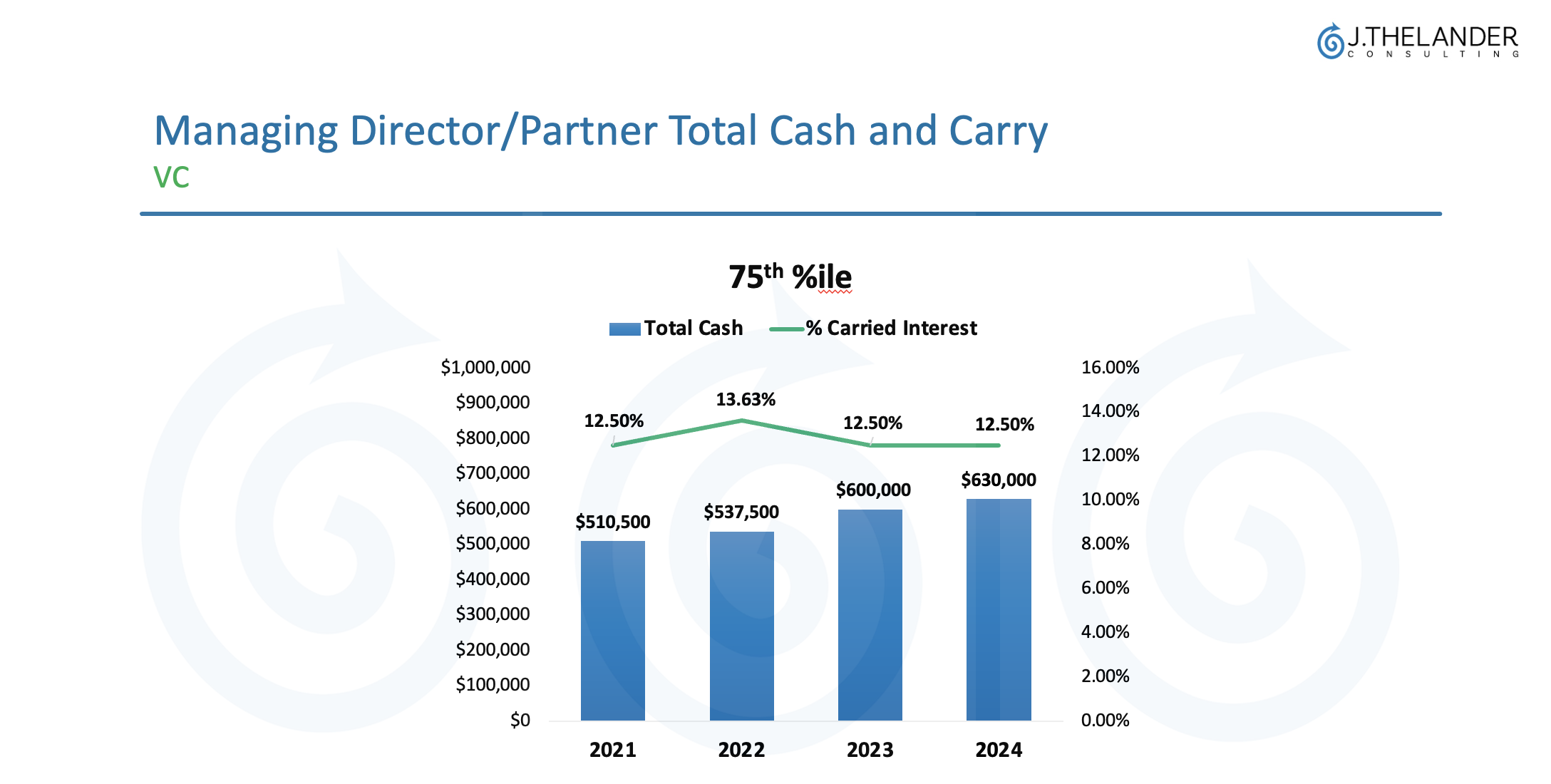

This month, we’re going to dig into compensation trends for the top investment positions at investment firms. Since 2021, the median cash compensation for VC investors has gone up across all positions at the highest levels, including managing general partner, sr. managing director / sr. partner and managing director / partner.

There’s a number of reasons that could be attributed:

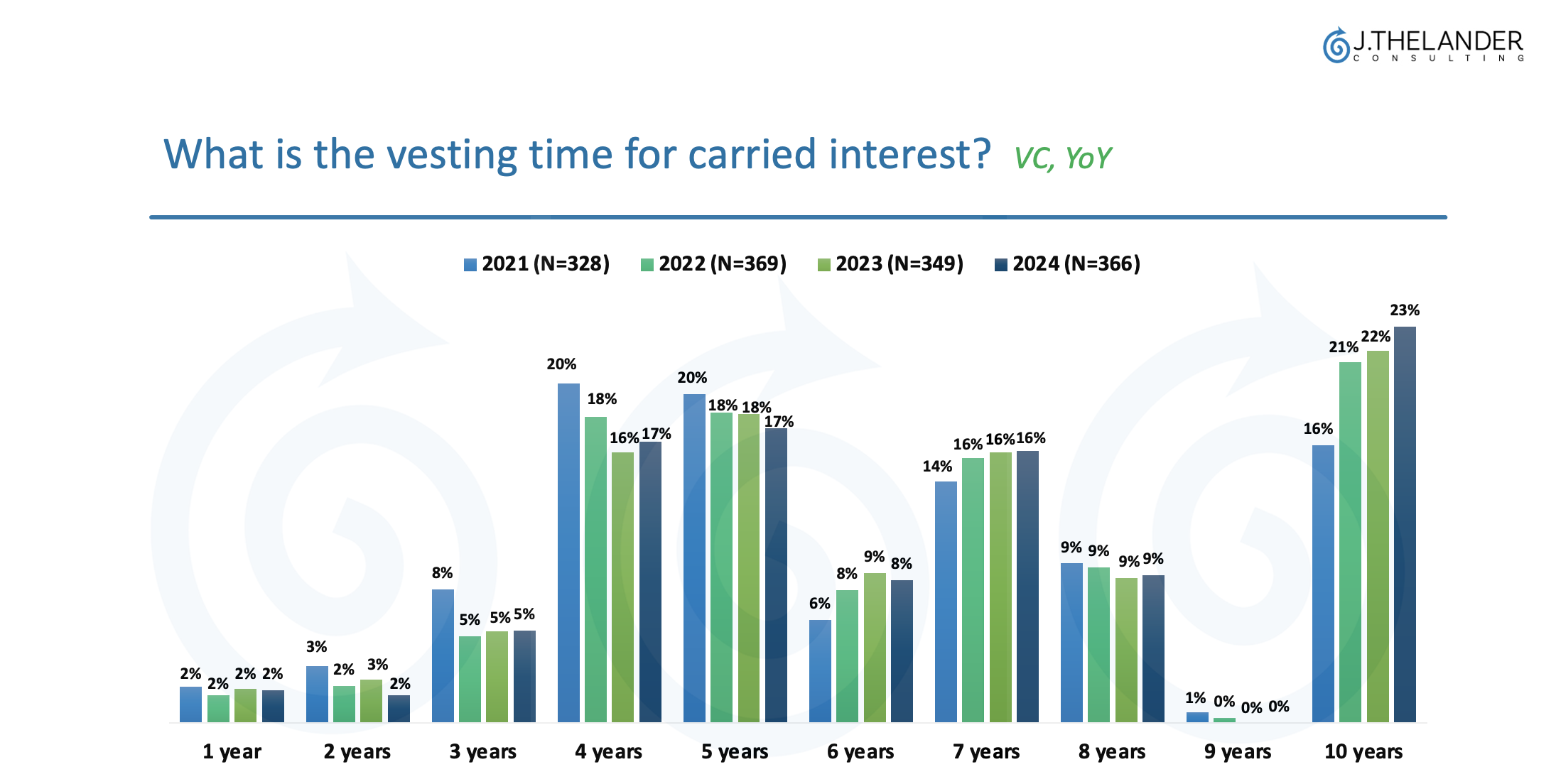

- Due to slower market conditions, vesting periods are getting longer, which means firms must be willing to pay top dollar to recruit and retain top talent.

- The roles and responsibilities of investment professionals have expanded and they expect to be paid accordingly. Clients and colleagues tell us they’re working more than ever, which is driven largely by the level of service provided to portfolio companies and internal partners, and they want to be compensated accordingly.

We’re seeing the biggest jumps in compensation within the 75th %ile.

These are people who, for a number of reasons (including experience and expertise) are paid higher for their skill sets and contributions. Again, because vesting periods are more commonly extending to 10 years, we’re seeing firms make up for the slower liquidity by compensating higher with cash.

In some cases, carry has decreased for the most senior leaders, trickling down to the more junior investment professionals or to new high flying talent that is critical to the firm’s success.

For example:

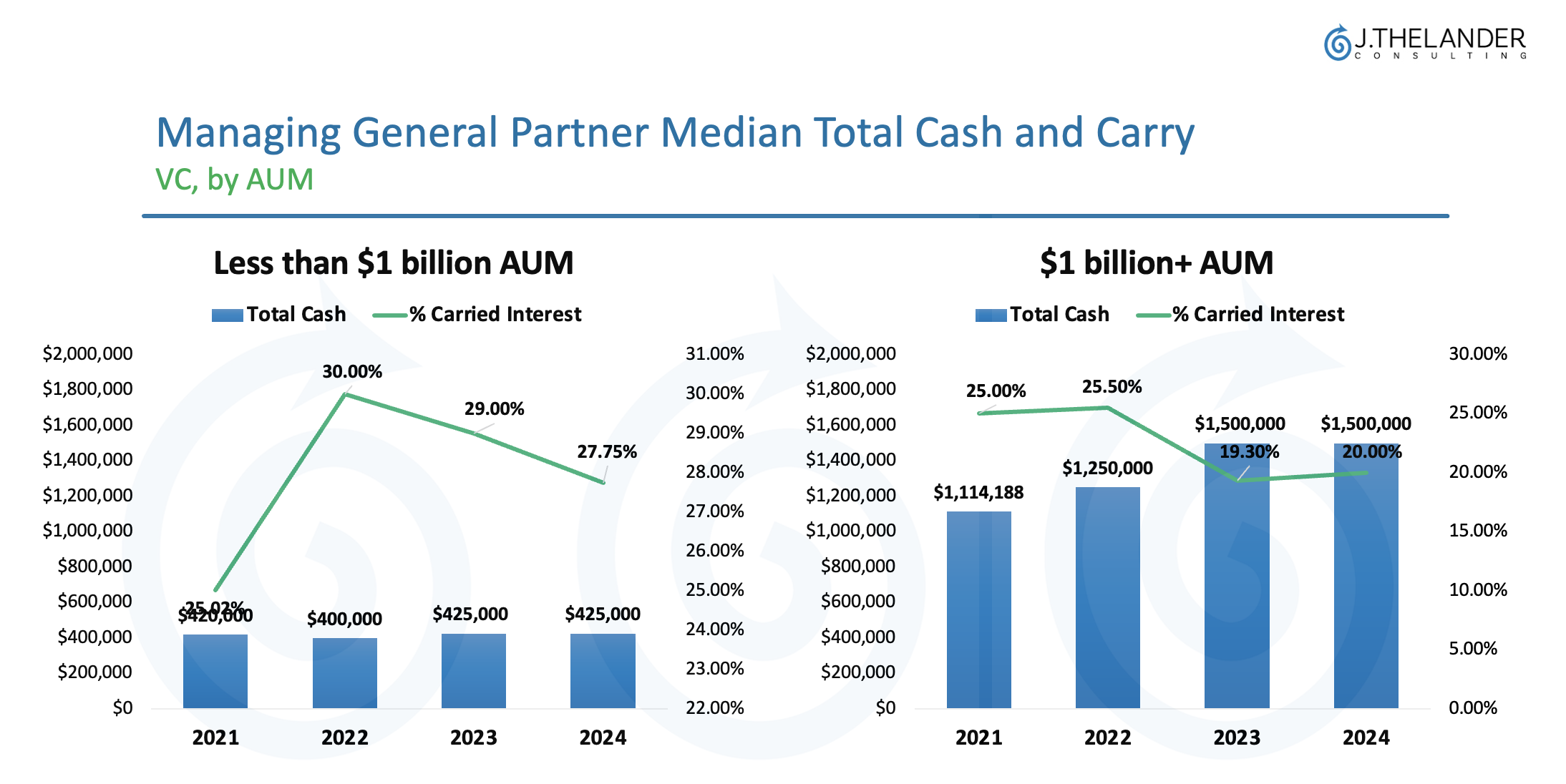

The median carried interest for managing general partners at firms with more than $1 Billion in total AUM has gone down from 2022. The percentage fell from 30% in 2022 to 27.5% in 2024.

Conversely, the median carried interest for managing directors and partners has gone up consistently YoY since 2022, rising from 8% to 10% in 2024.

AUM is a major driver of compensation. Firms with more than $1 Billion in total AUM earn significantly more than those with less than $1 Billion, and the percentage increase in cash compensation is much more notable among larger firms.

Median total cash for managing general partners at VC firms with more than $1 Billion in AUM earn $1.5 Million compared to $425,000 earned by their counterparts at firms with less than $1 Billion in AUM.

As firms work to retain top talent, and in some cases hire new partners, they need to reallocate their carry appropriately and many are coming to Thelander to understand the market data and how to make these decisions.

The Thelander Digest is powered by the no-cost Thelander-PitchBook Investment Firm Compensation Survey. We invite you to participate and secure free access to a subset of the results on our platform. All data is published in aggregate only with no individual names or firm names reported. If you have any questions or would like to speak to team Thelander, you can email or call us: +1.305.793.8605

Tags: Investment Firm, Newsletter