Thelander CVC Digest: August 2024

Liquidation Preferences 101

Welcome to the August edition of the CVC Digest. Thelander is the only firm to cover compensation for the entire private capital market – from your firm to your portfolio companies. That is why we wanted to give you an exclusive preview of the findings from our Thelander Private Company M&A with Change of Control & Severance Survey to look at liquidation preferences and how to stay competitive with market.

Liquidation preferences are a critical component in venture capital deals, determining the payout order during an exit such as a sale or merger. These preferences ensure that investors receive their returns before common stockholders, which can influence the payouts received by other parties. The ideal situation for any VC is for their portfolio company to have a liquidity event that pays a multiple return on their investment. Let’s dive into the data:

Thelander data shows:

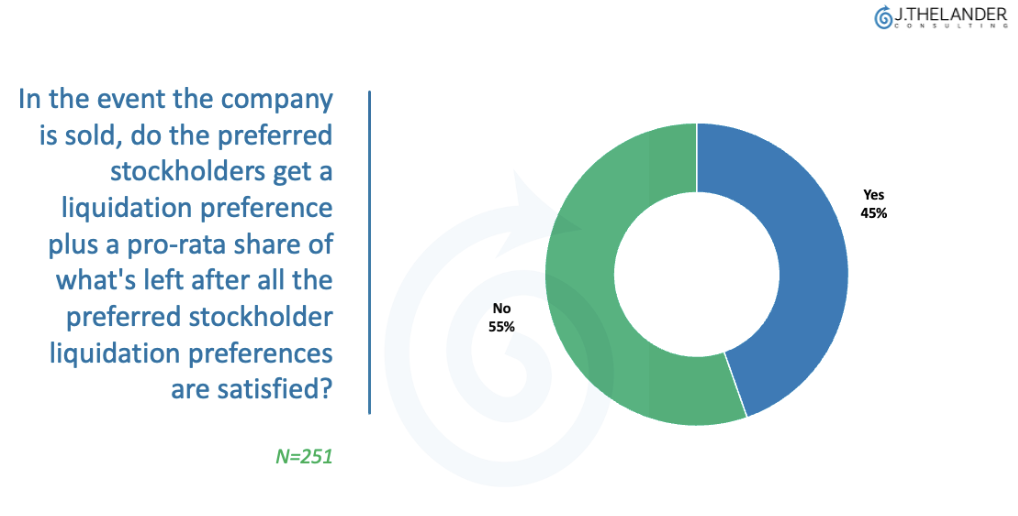

45% of surveyed companies have set liquidation preferences to safeguard investors in the event of an M&A transaction. This setup is crucial for ensuring that VCs secure a multiple return on their investments.

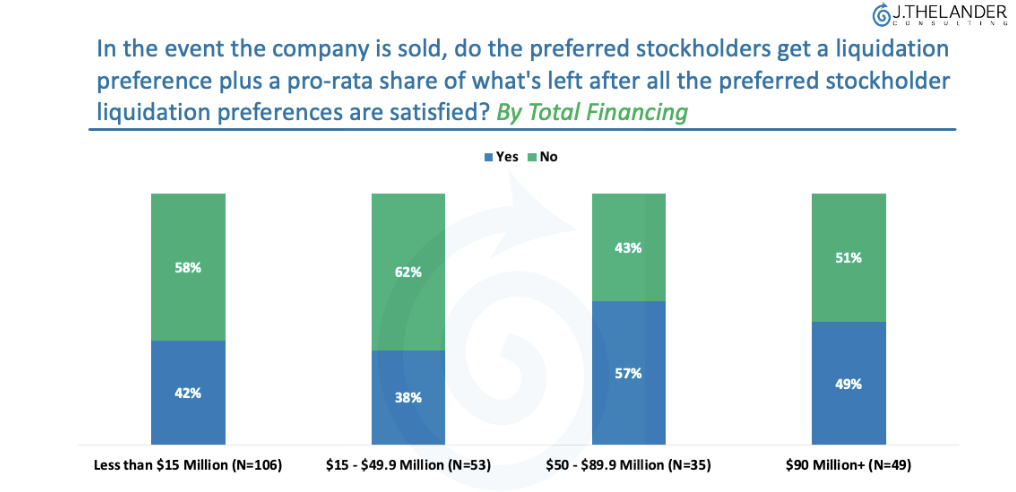

The total amount of financing a company has raised influences liquidation preferences. Once companies have raised more than $50 Million, at least 49% of respondents reported preferred stockholders get a liquidation preference plus a pro-rata share of what’s left after all the preferred stockholder liquidation preferences are met compared to 42% of companies who have raised less than $15 Million.

Preference Stack: The order or “stack” in which preferred stockholders are paid out during a liquidity event. This can greatly affect the outcome for all parties involved.

What about when it comes to more than one time (1x) liquidation preference?

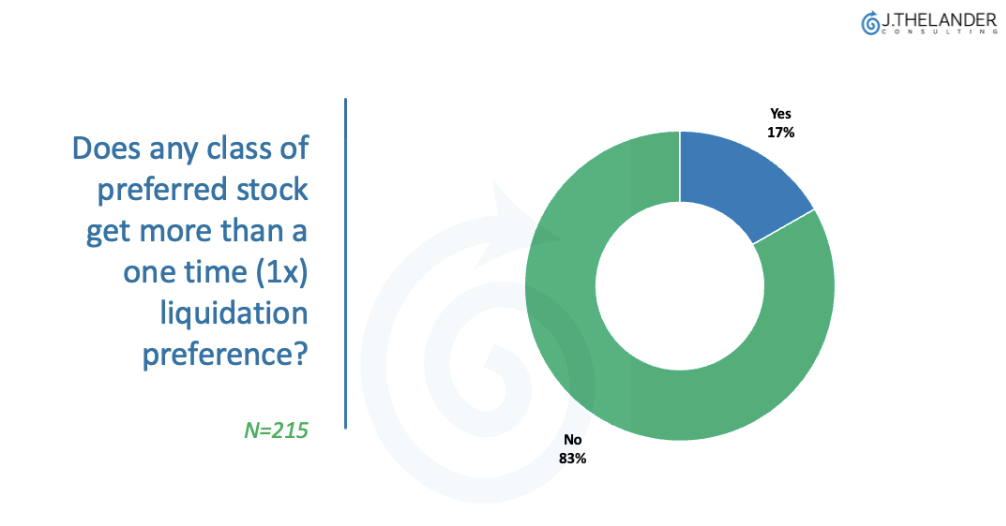

83% of respondents reported “no” to giving any class of preferred stock more than one time (1x) liquidation preference

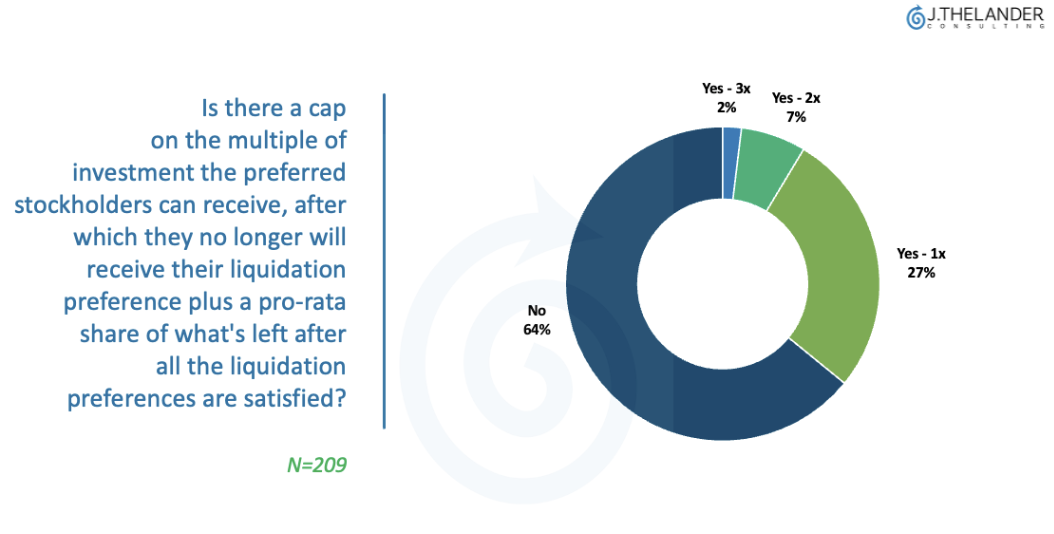

What about a cap? 64% of companies reported “no” – there is not a cap on the multiple of investment the preferred stockholders can receive, after which they no longer will receive their liquidation preference plus a pro-rata share of what’s left after all the liquidation preferences are set.

The bottom line:

We encourage your portfolio companies to participate in the the Thelander M&A and Change of Control & Severance Survey. Participation grants them complimentary access to an overview report and 12 months of compensation data on our platform. You can forward them this email or they can review a preview of data in the Private Company Digest here.

Participate in Thelander M&A and Change of Control & Severance Survey

Already a private company subscriber?

You can download the 2023 M&A report on the Thelander Platform until 2024 is published in October. You can also view our latest webinar recording with Cooley, discussing these critical topics.

Thelander data is in a league of its own. With nearly three decades of experience and trustworthiness, we invite you to level up your compensation game and find out why thousands of the world’s top venture capital, private equity firms, and family offices rely on Thelander’s real-time data and premier services for their firm and portfolio companies. If you are interested in learning more about our private company dataset for your portfolio companies, schedule a call and demo with Morgan Thelander here. You can also reach us by phone at +1.305.793.8605

Tags: CVC, Newsletter