Thelander IF Digest: January 2025

Compensating Platform Roles at Investment Firms

As we transition into 2025, our focus this month is on the emerging compensation data for some of the most crucial support roles for your portfolio companies—platform roles. These roles act as a vital link between venture firms, their portfolio companies, and the broader private capital market ecosystem, ensuring that firms deliver value beyond just capital. The growing importance of these roles is evident in our platform, which now features seven new job titles across platform and portfolio operation roles.

| The Thelander Digest leverages data from the Thelander-PitchBook Investment Firm Compensation Survey. Unlike static reports that quickly become outdated, our results are real-time and fully customizable. We invite you to trial the Thelander platform and explore the extensive data available by participating today. By completing your response, you will gain free access to our proprietary platform for 12 months, with guaranteed confidentiality. |

Platform roles, while varying in duties and responsibilities depending on the firm, consistently contribute to adding value to portfolio companies. This dynamic is highlighted in PitchBook’s Venture Monitor Report, which notes, “investors seem to be circling their wagons and making sure their most promising companies are positioned for success before they make new bets.” A significant part of this strategy involves the development of platform and portfolio roles. But what does compensation look like for these crucial team members?

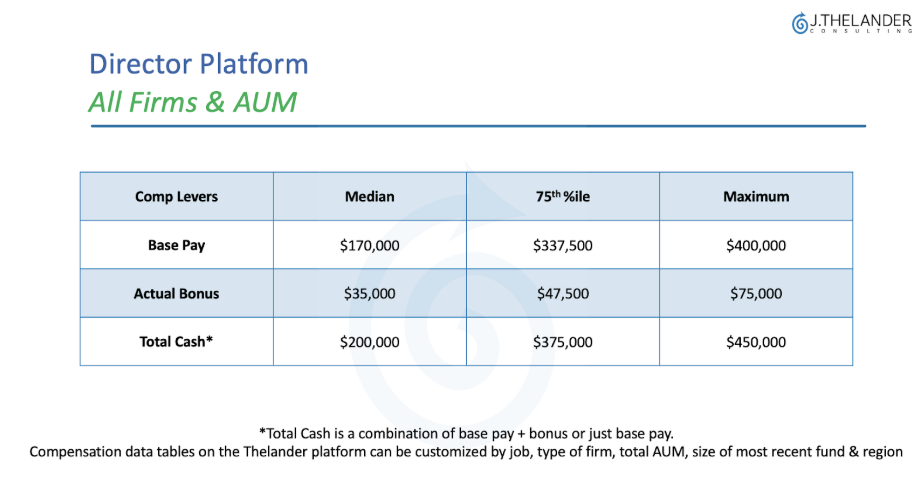

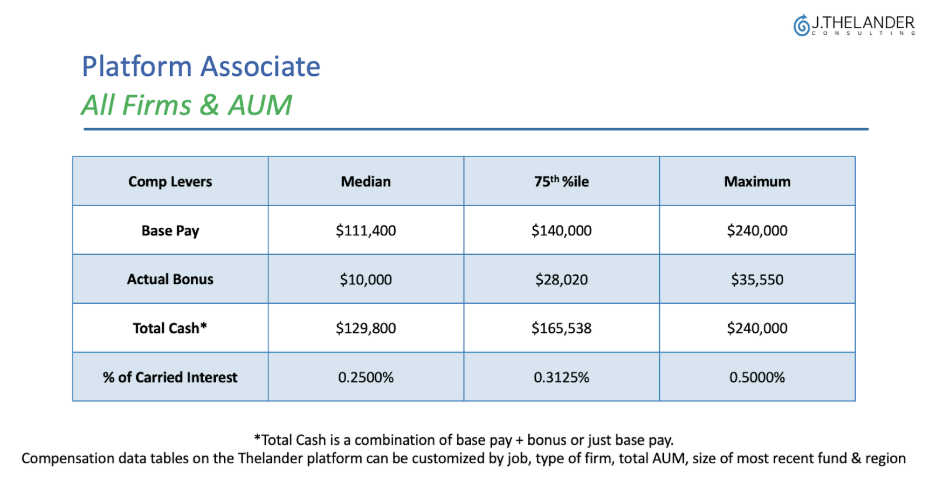

To illustrate, let’s examine the compensation for two key positions: Director Platform and Platform Associate. Remember, total cash combines base pay with bonuses, or simply base pay if no bonus is awarded. The data tables on our platform not only display the number of data points but also include target bonus information.

Table 1 looks at Director Platform. We see the following:

Director Platform Compensation: Total cash earnings range from $200,000 to $450,000 (median to maximum).

Table 2 moves down the ladder as we look at Platform Associate. We see the following:

Median total cash: $129,800

Maximum total cash: $240,000

Carried interest: Ranges from 0.2500% (minimum) to 0.5000% (maximum)

As a global namesake firm, our agility allows us to continually expand our service offerings by adding new job titles and survey questions throughout the year. If you have specific titles or questions you’d like us to consider, please respond to this email with your suggestions. We want to hear from you!

For more compensation data, including platform roles, participate in the Thelander-PitchBook Investment Firm Compensation Survey to gain access to real-time compensation data for your firm and portfolio companies. By participating, you’ll receive a 12-month free subscription to Thelander’s proprietary platform. If you’re currently a PitchBook subscriber and want to activate your complimentary access, simply respond to this email or contact our office at +1.305.793.8605.

Tags: Investment Firm, Newsletter