Thelander CVC Digest: January 2025

How Are Long-Term Incentives Evolving at CVC Units?

Welcome back to the first Thelander Digest of 2025. Nearly a year has passed since we last delved into long-term incentives at CVC units. This month, we’re revisiting this crucial topic with an enhanced focus on which incentives are being utilized now vs. in 2023 and 2024 and whether on-balance-sheet or off-balance-sheet makes a difference.

In addition to base pay and cash bonuses, CVC units employ a variety of incentives to attract and retain top talent. These include:

- Corporate stock only

- Carried interest only

- Shadow/phantom/synthetic carry only

- A combination of corporate stock and carried interest

- A combination of corporate stock and shadow/phantom/synthetic carry

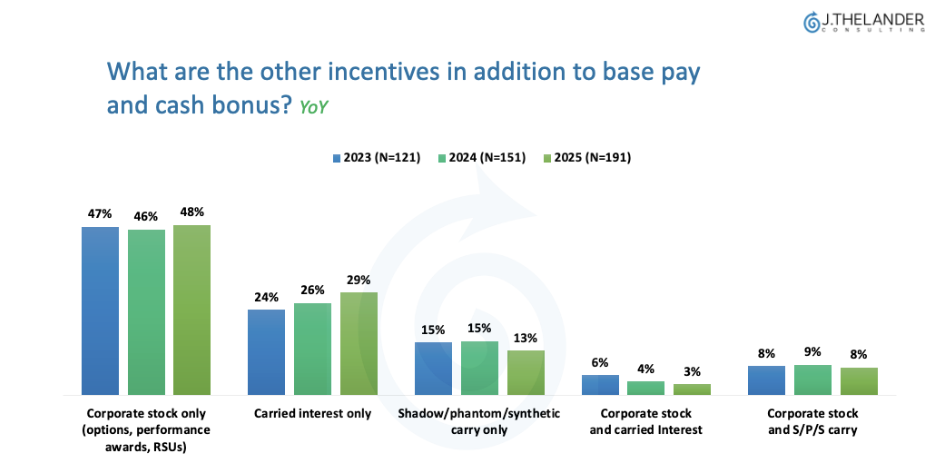

Chart 1 looks at other incentives in addition to base pay and cash bonus and how they’ve changed YoY. We see the following:

Corporate Stock Only: Increased in popularity by 2% from 2024.

Carried Interest: Consistently increased by 4% or 5% since 2023.

Shadow/Phantom/Synthetic Carry (SPS): Experienced a decrease for the first time this year by 2%.

Combination of Corporate Stock and Carried Interest: Consistently decreasing since 2023.

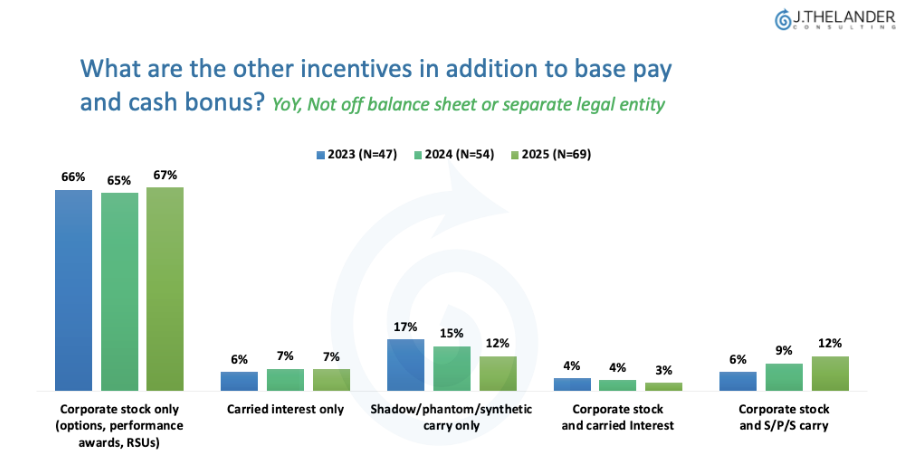

Chart 2 looks at firm structures that are not off balance sheet or separate legal entities. We see the following:

Shadow/Phantom/Synthetic Carry (SPS) Only: Consistently decreasing YoY at by least 2% – from 17% (2023) to 12% (2025).

Combination of Corporate Stock and SPS: Has doubled in popularity since 2023 – from 6% to 12%.

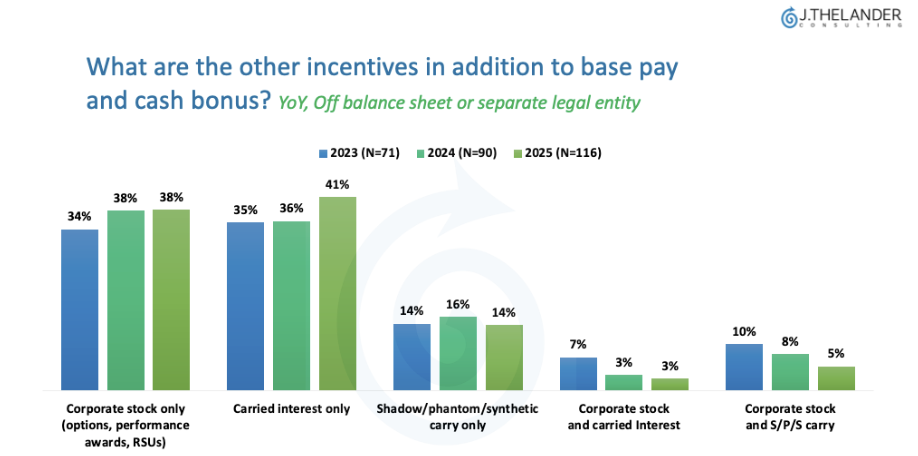

Chart 3 looks at firm structures that are off balance sheet or separate legal entities. We see the following:

Corporate Stock Only: Increased since 2023.

Carried Interest Only: Increased since 2023.

Combination of Corporate Stock and Carried Interest: Consistently decreasing.

The Bottom Line:

Carried interest as standalone incentive has consistently risen since 2023, irrespective of AUM or structure. Our consulting services can assist in establishing a carried interest program tailored to your needs. Additionally, by participating in our compensation survey, you gain access to carried interest percentages for various positions for the next 12 months on our proprietary platform. For more detailed information on our consulting offerings, please respond to this newsletter or schedule a meeting here.

Participate in the Thelander-PitchBook CVC Compensation Survey For More Comp Data

The Thelander Digest is powered by the Thelander Investment Firm dataset. You can trial our platform by participating in the Thelander-PitchBook CVC Salary Increase & Bonus Survey.

By inputting your data, you will be able to secure your free overview report and also access a subset of compensation data for the next 12 months. To see what’s included in your free subscription, schedule a demo. You can also reach us by phone at +1.305.793.8605