Thelander CVC Digest: April 2025

CVC vs. VC Compensation

It’s no secret that CVC units heavily recruit talent from VC firms. But are CVC unit’s relying exclusively on better compensation packages to snag top talent? A glimpse at the data shows where salaries might play a big role in building or expanding your team.

Thelander data shows that cash compensation often depends on the size of the fund and the individual’s title.

Our real-time survey data shows that the majority of CVC new hires (52%) come from VC firms, while 39% hail from other CVC units and 33% come from private companies.

Compensation data can help VC firms retain associate-level employees and continue to attract senior investors. It can also help CVCs stay competitive across every level, nurturing talent and keeping key leaders. Let’s dig deeper into the data for more perspective.

What Positions Pay Higher at CVC Units Than VC Firms?

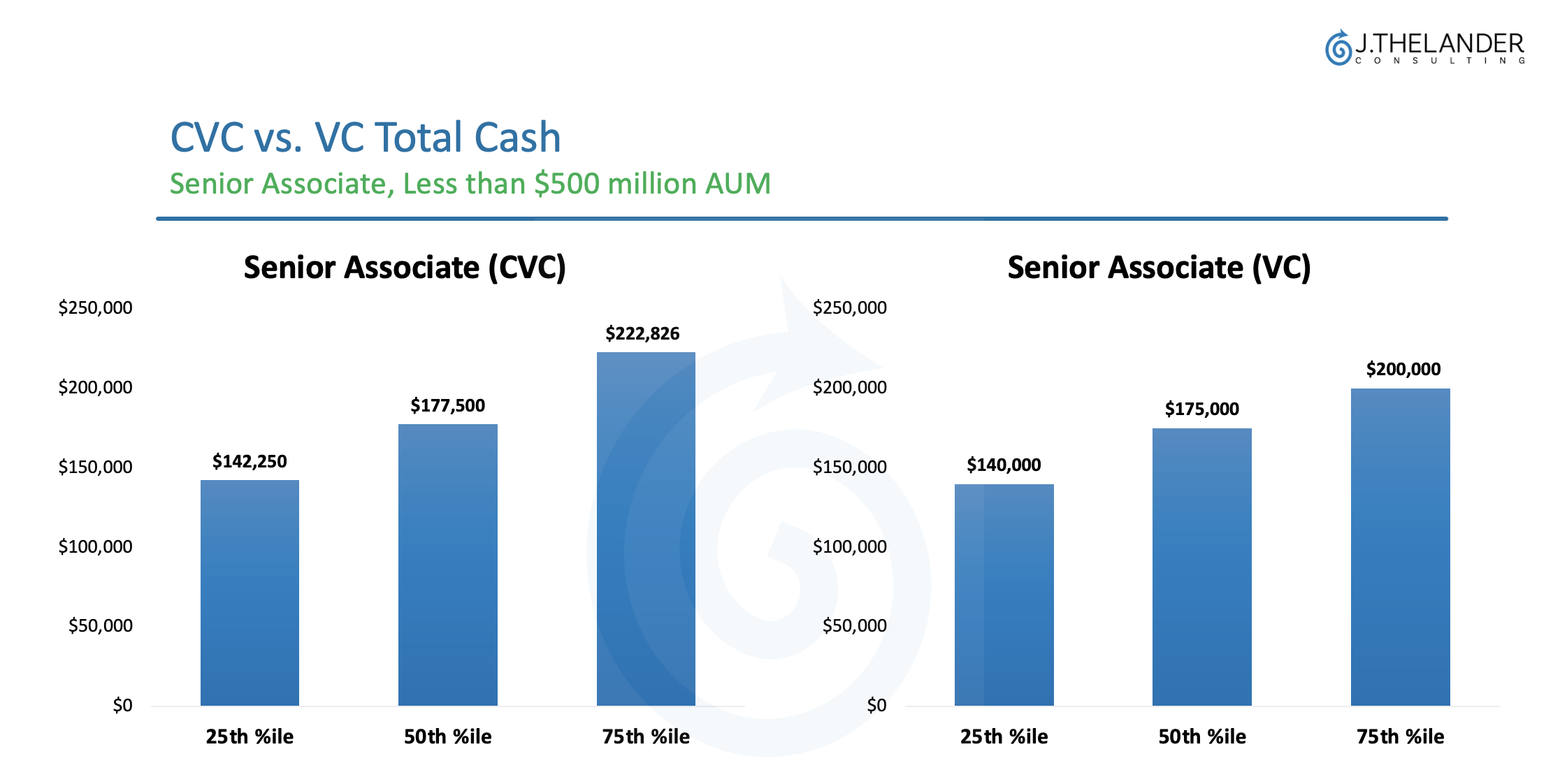

Senior associates at venture capital firms with less than $500 million in AUM make less than their counterparts at CVC units. The gap widens as the salary increases at higher percentiles.

Senior associates at VC firms make less than CVCs at the 25th percentile, 1% less at the median and 10% less at the 75th percentile. The higher a senior associates salary is at a VC firm, the more they could potentially make by moving to a CVC unit of a similar size.

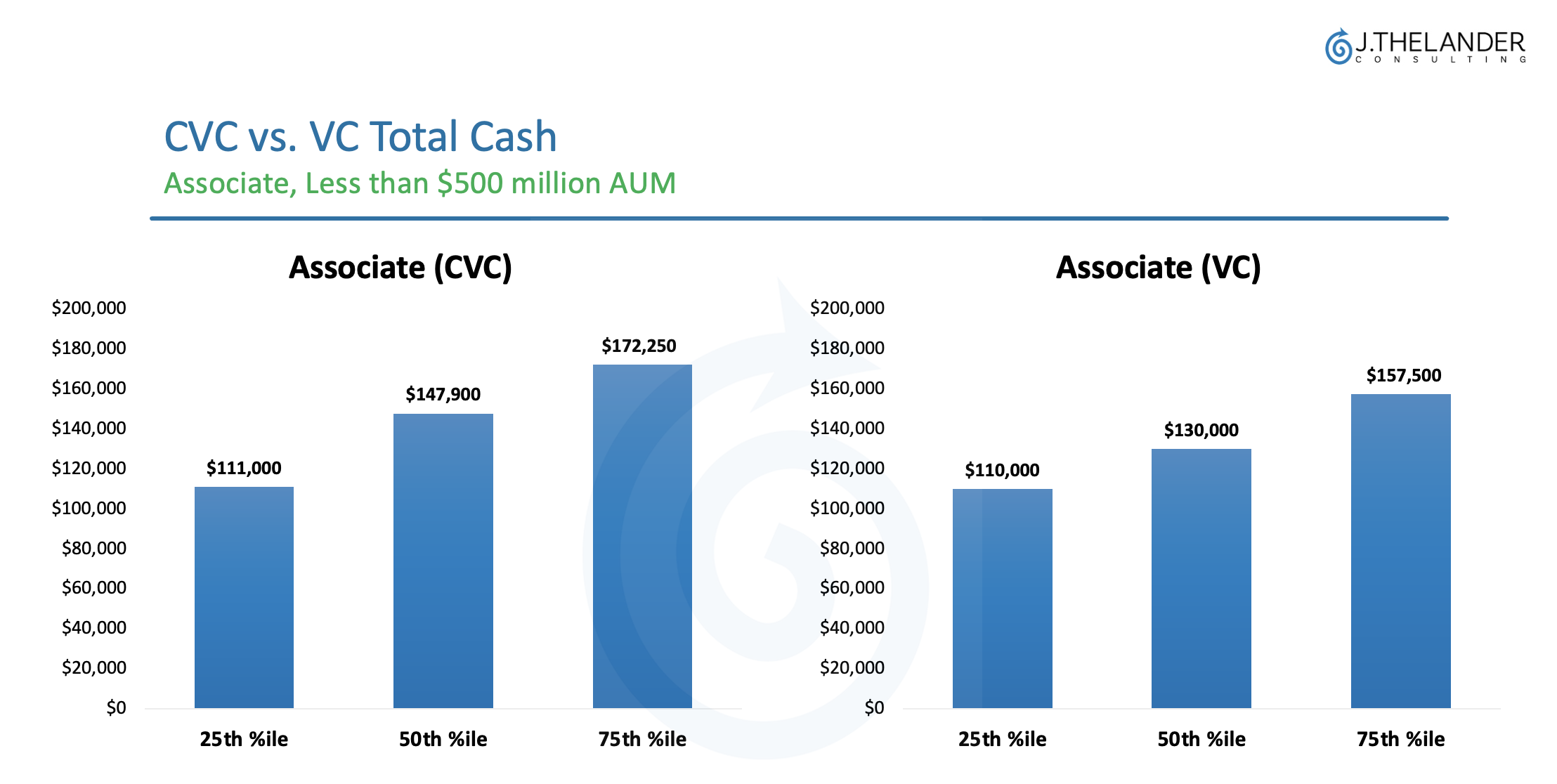

The median associate salary at a VC firm with less than $500 million in AUM is 1% lower at the 25th percentile, 12% lower at the median, and 9% lower at the 75th percentile.

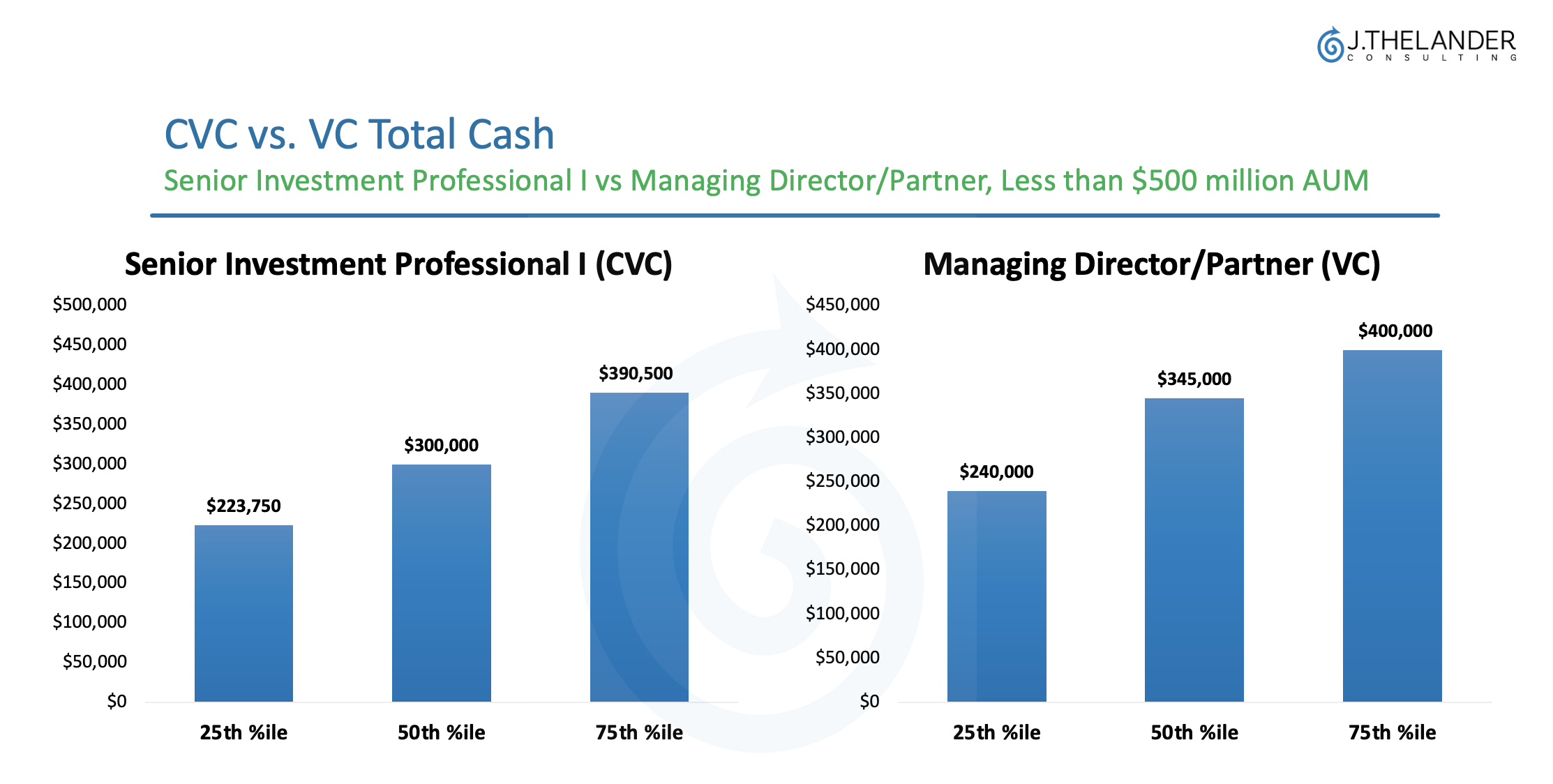

Senior Level Execs Make More at VCs

Cash compensation at venture firms and CVCs does a reversal when we look at the senior investment professional position, the equivalent of a managing director or partner at a VC firm. A managing director or partner at a venture firm makes 7% more at the 25th percentile, 15% more at the median and 2% more at the 75th percentile.

The higher the salary, the smaller the gap between what senior investment professionals I’s and managing directors or partners make at CVC vs. VCs.

Bottom line: What You Should Know about CVC and VC Compensation

When we compare total cash compensation for VC firms and CVC units with less than $500 million in AUM, CVC total cash gets increasingly competitive compared to VC as you move toward lower levels.

Of course, cash compensation is only a part of the overall picture that decision-makers at CVC and VC firms need to understand. Your free silver subscription to the Thelander platform and real-time compensation data can be activated by completing our no-cost survey here.

Participate in the CVC Compensation Survey For More Compensation Data

Tags: CVC, Newsletter