Thelander PC Digest: May 2025

How Does Compensation Change as Private Companies Raise Capital?

You might think the more a private company continues to raise capital, the more they pay their team. After all, more money could mean bigger paychecks, right?

That’s not always the case for every position. Based on data and insights captured from our newest compensation planning tool – we analyze how total cash and equity compensation changes for two key roles – VP of Operations and Director Marketing – as companies raise more capital. Let’s dig in.

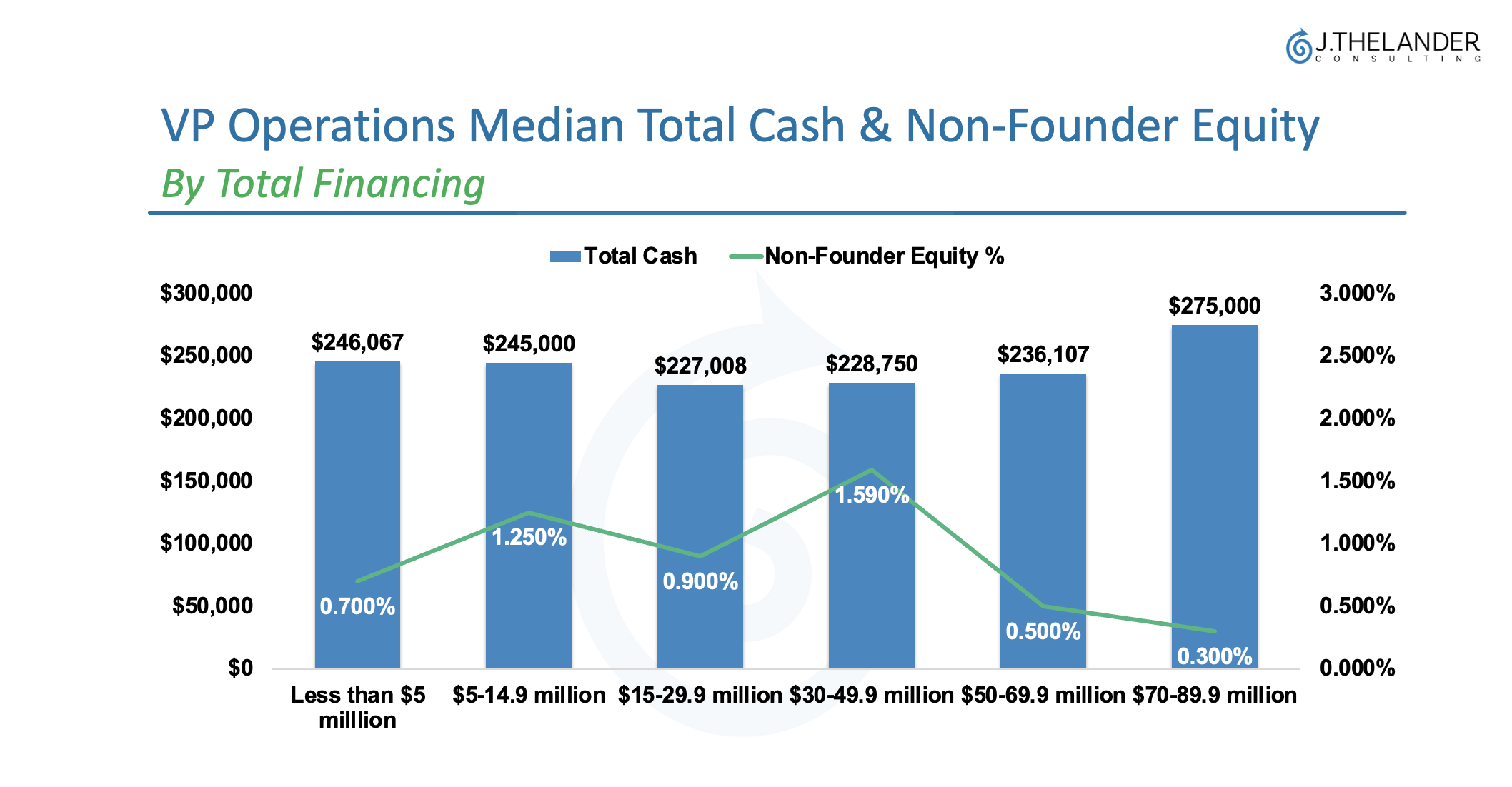

VP of Operations: Cash Holds Steady

ased on the chart above, Thelander data shows that:

Companies that have raised $50 to $69.9 million pay nearly $30,000 less in median total cash compared to companies that have raised $70 to $89.9 million.

The median total cash compensation for VP Operations stays relatively consistent until a company raises $70 to $89.9 million in total financing.

But, the real changes in compensation can be seen in the non-founder equity percentages.

Companies with less than $5 million in total financing start VP of Operations personnel with a median of 0.700% in non-founder equity.

The non-founder equity percentages jump to 1.250% for a company that has raised $5 to $14.9 million.

As the company climbs to the next financing bracket, $15 to $29.9 million, the equity gets diluted to 0.900%.

The median equity compensation spikes to 1.59% for companies with $30 to $49.9 million in funding, and then drops off for companies with more than $50 million in funding while the cash continues to increase.

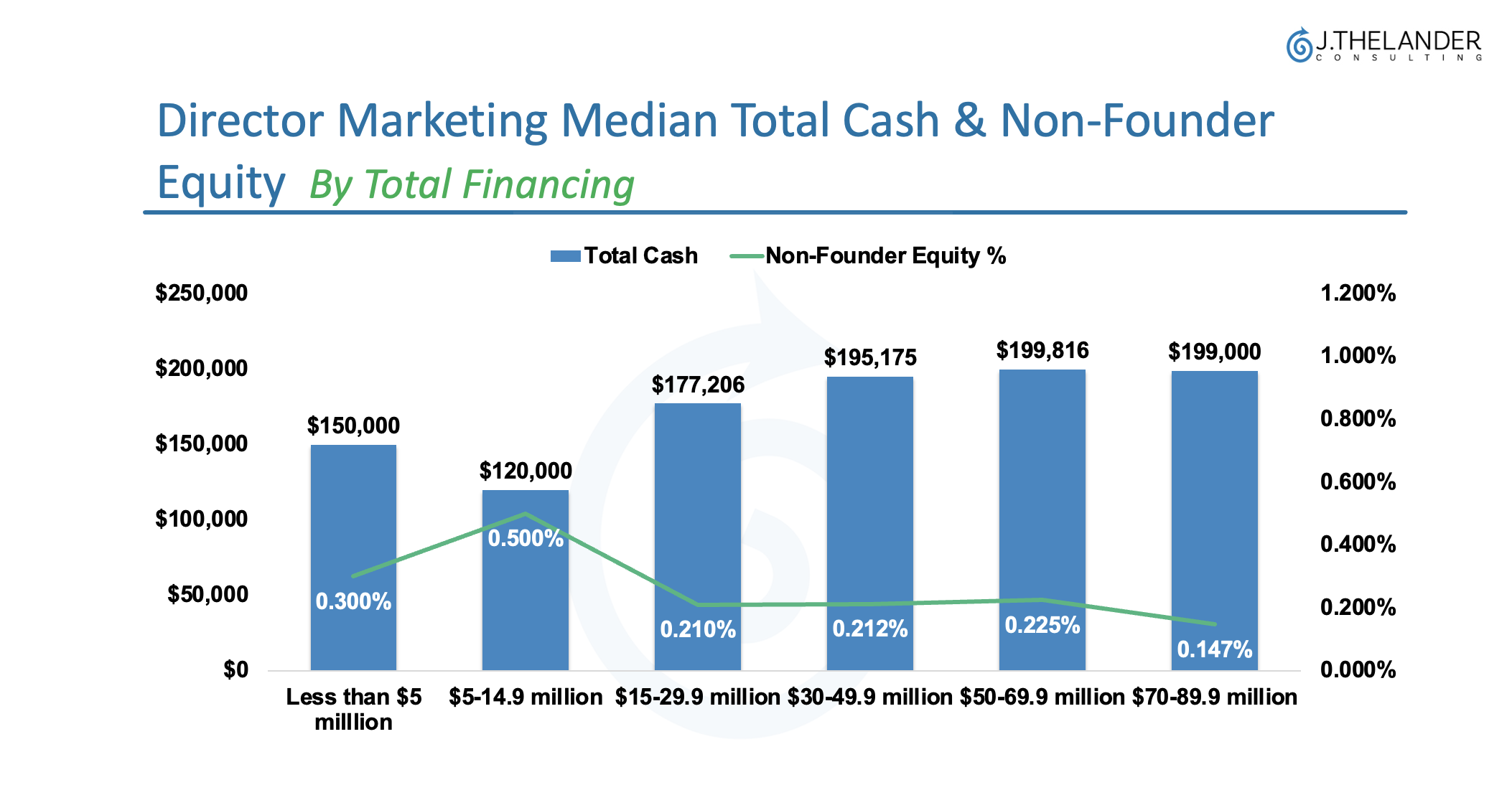

Director of Marketing: Inverse Relationship Between Cash and Equity

Marketing directors at private companies have a different compensation trajectory than the VP of Operations – one where cash and equity move in different directions.

Less than $5 million in total financing: Median total cash of $150,000 equity at 0.30%.

As a company raises more capital, the cash decreases by $30,000 to $120,000 in the $5 to $14.9 million financing bracket, while the non-founder equity increases by 0.200% to 0.500%.

This pattern does not stay the same once a company has passed the $15 million mark in total financing. Thelander data shows that cash steadily increases from $177,206 to $199,000 ($15 to $89.9 million) while the equity holds steady or slightly declines from 0.210% to 0.147% ($15 to $89.9 million).

What’s The Bottom Line?

As companies raise more capital, compensation does not simply increase across the board. With growth, there can be title adjustments and more formality with the compensation structure. At earlier stages, equity is often more available and this can shift with more capital.

The compensation planning tool is one of our powerful platform enhancements that allows users to deep dive into specific job titles like these and strategize for future compensation changes based on the company’s financing and trajectory. To learn more, respond to this Digest and a member of the Customer Success team will reach out to schedule a demo.

Want Even More Free Data? Fill out the Thelander Private Company Compensation Survey Today

Tags: Newsletter, Private Company