Thelander IF Digest: May 2025

What Investment Firms Need to Know Re: Cash & Carry Comp

Total compensation plays a critical role for investment firms and their teams. Retaining talent is important for firm stability, consistency with LPs as well as portfolio company relationships. As firms grow and expand their assets under management (AUM), the mix of cash and carried interest changes – and staying on top of market data and trends, gives you the competitive advantage you need to stay ahead.

The latest round of upgrades to the Thelander platform allows us (and you) to break down how total cash and carried interest percentages change as a firm’s AUM increases, providing a real-time framework with optics on impact. This newest dataset helps investment firms determine if their current compensation is in line with market, as well as plan for the future. Let’s dive in.

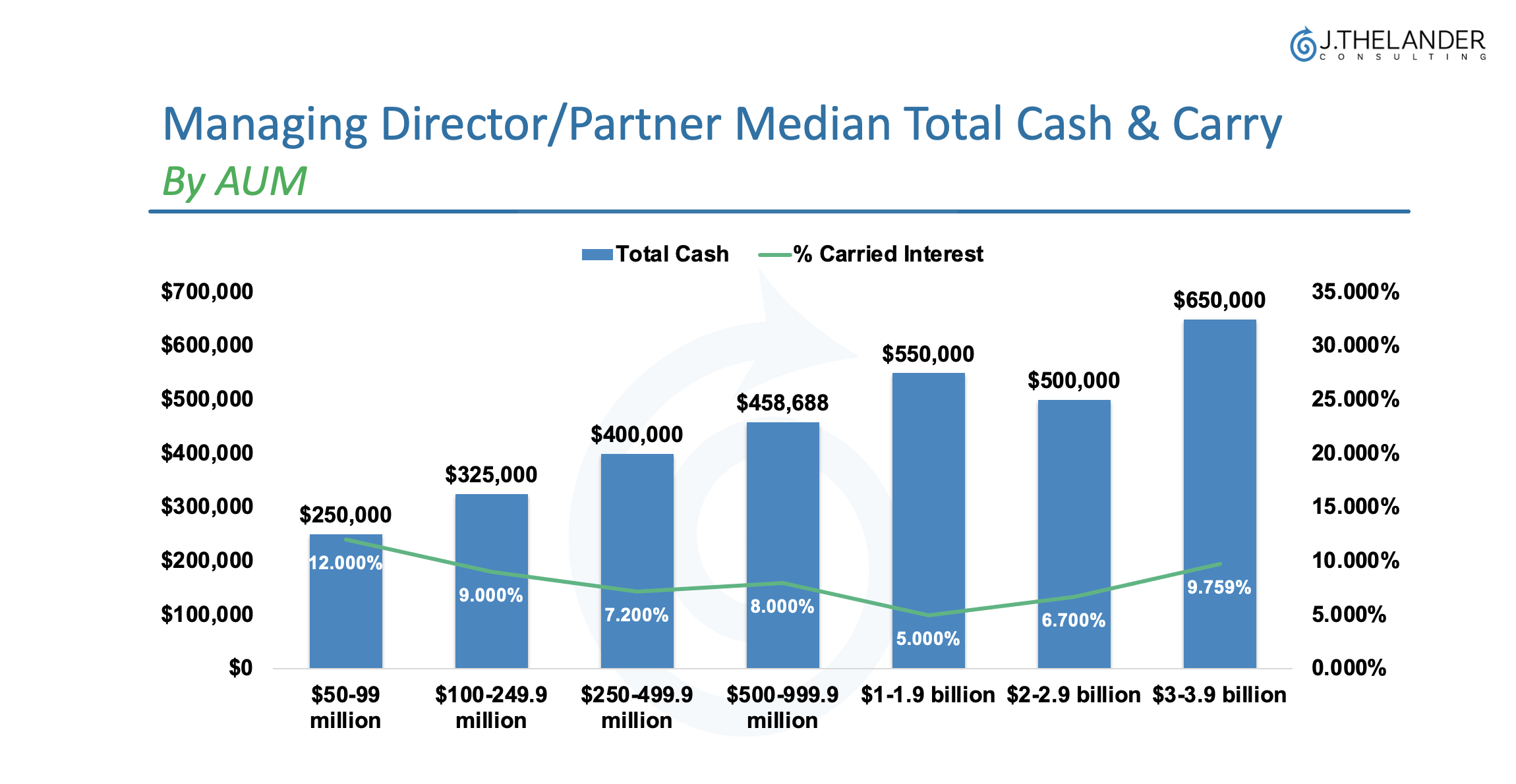

Exploring The Compensation Trajectory for Managing Directors/Partners

This chart generated from our new compensation planning tool shows:

How the median total cash compensation for managing directors / partners rises steadily from $250,000 to $550,000 as a firms AUM increases from $50 to $1.9 billion in total AUM.

While the cash steadily increases until $1.9 billion, the median carried interest percentage decreases from 12.00% to 5.50% with a slight jump in the $500 – $999.9 bracket at 8.00%.

The median total cash compensation drops by $50,000 – from $550,000 to $500,000 – when firms go from having $1.9 billion to $2.9 billion in total AUM. Meanwhile, the carried interest rises from 5.00% to 6.70% – a 1.70% increase.

Once a firm reaches $3 billion in AUM, cash compensation and carried interest both start to rise.

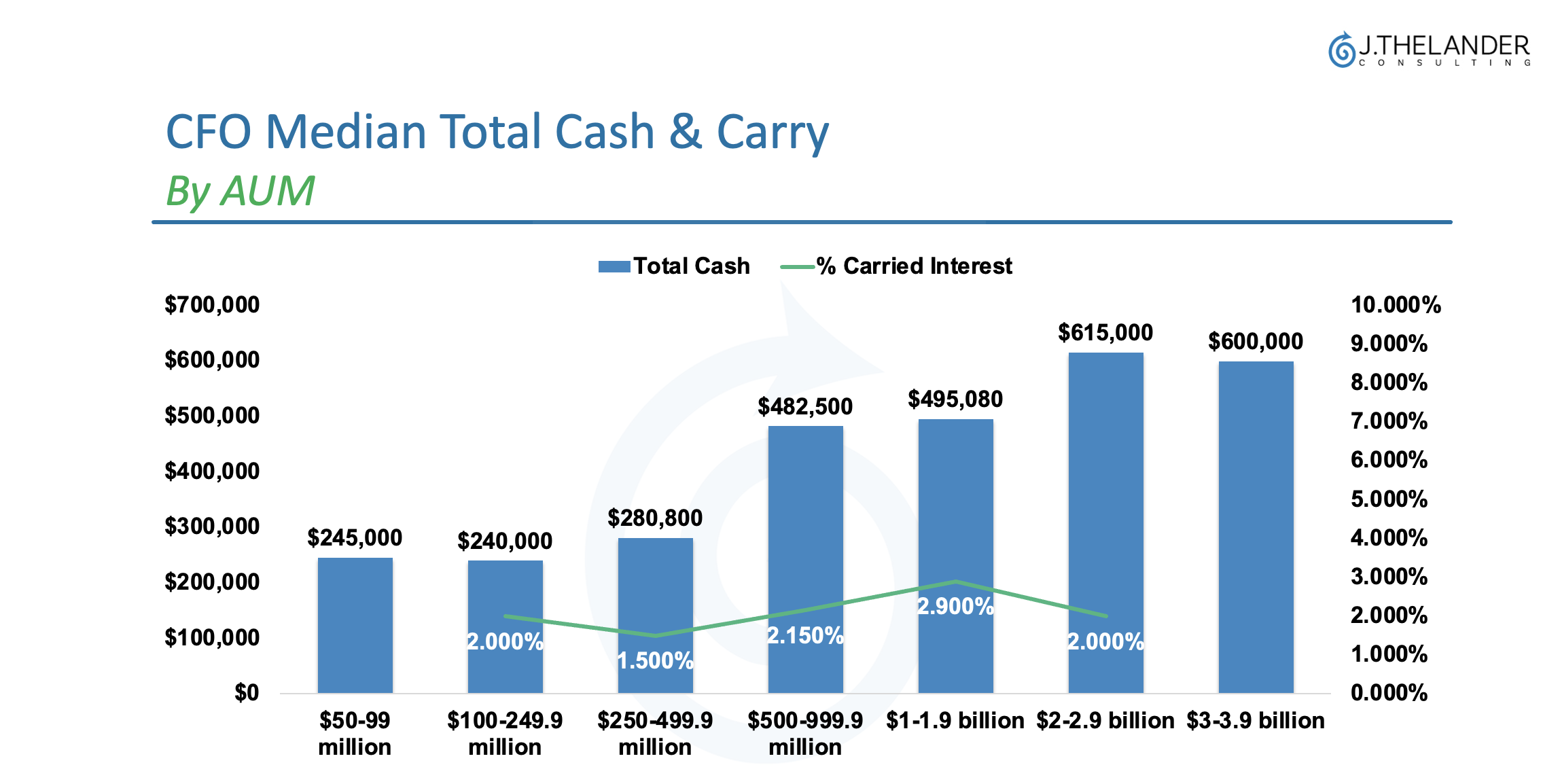

What the Data Says About CFO Compensation

This month we’re looking at the median total cash and carry figures for a key back office role, CFO, at investment firms with AUMs ranging from $50 million to nearly $4 billion.

Carried interest for CFOs remains steady at roughly 2% – between $100 million and $2.9 billion in AUM.

Median total cash compensation increases from $240,000 ($100 to $249.9 million) to $600,000 ($3 to $3.9 billion) in total AUM.

What’s The Bottom Line?

Thelander data shows that as the total AUM increases, the compensation does not follow a consistent linear pattern. There are various inflection points – like the $2 billion mark – that highlight the unique nature of how your firm will balance the mix of cash and carried interest for specific job titles. To stay competitive and win on a global level, it’s important to:

- Know who your key players are.

- Create a clear compensation philosophy to align with your firms’ goals.

- Have access to real-time market data to stay competitive and informed.

If you are interested in viewing the compensation planning tool in action, respond to this Digest and a member of the Thelander Customer Success Team will reach out to you directly. You can also read more about our latest features in our press release.

Tags: Investment Firm, Newsletter