Thelander IF Digest: June 2025

Intern Pay Benchmarks: How Investment Firms Are Compensating Pre-MBA Analysts

Recent Thelander IF Digests have focused on the mix of cash and carried interest at high levels within a firm. But adequately compensating analysts in entry-level roles creates consistency, paves a path for career growth and, ultimately, strengthens your firm from the inside.

With summer in full swing, college students and new graduates are looking to learn on the job. When your firm is ready to hire interns, how much should you pay and what is the going market rate?

From Entry Level to Six Figures: Broad Compensation Ranges

Compensation for interns at investment firms spans a wide gamut. In hot areas like Silicon Valley, tech-focused interns and pre-MBA analysts command premium rates. “It matters less about whether you’ve had experience versus whether you’ve [got] the talent,” Thelander founder & CEO, Jody Thelander said in a recent article published by PitchBook.

How to Benchmark Intern Pay

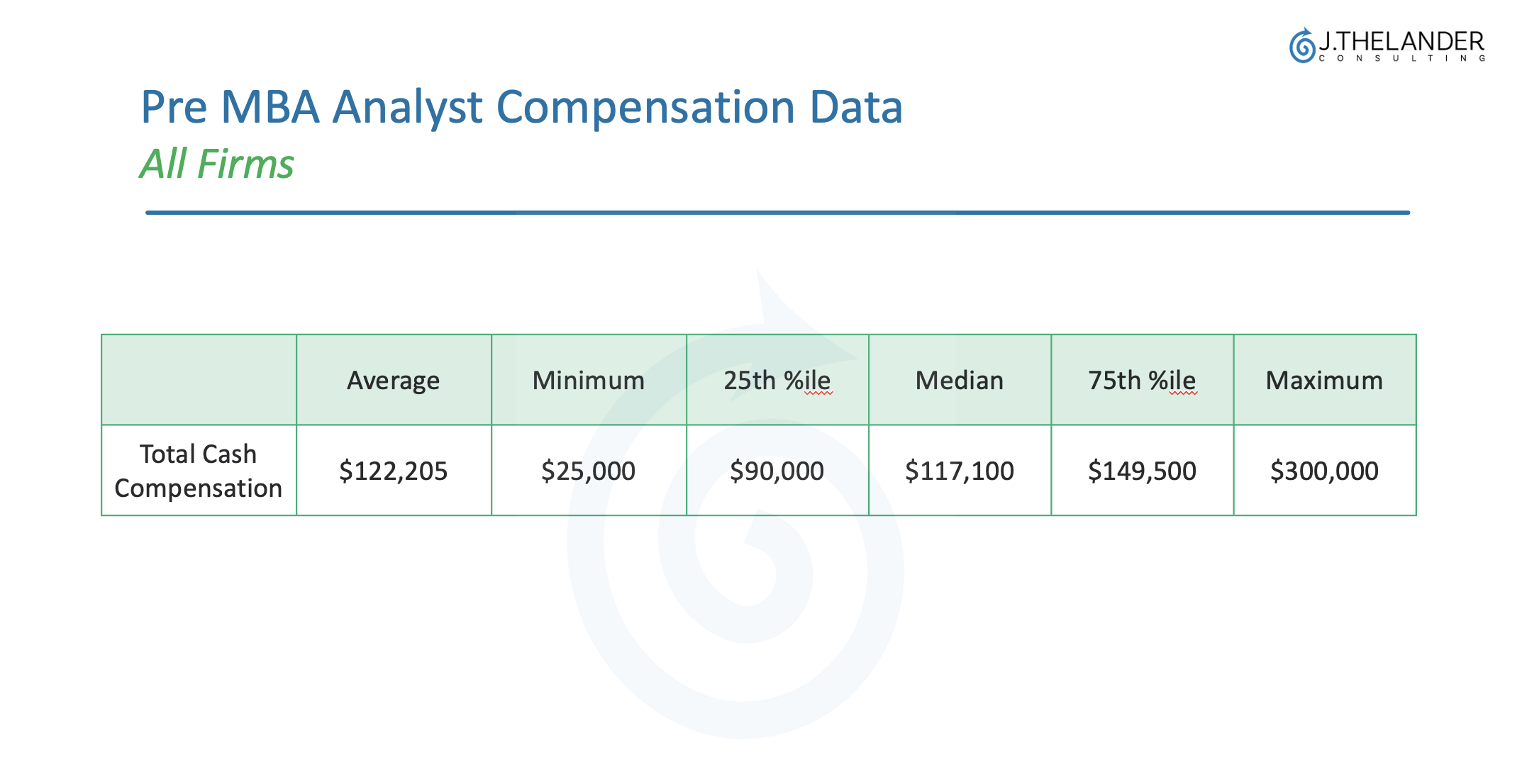

When you’re benchmarking intern pay, you want to look at the role the candidates would be hired into, which would be pre-MBA analysts. The chart below shows the various percentiles in total cash across all types of firms and AUMs for this entry level title.

By setting the standards with entry level roles, including the mix of cash and carried interest, you can set expectations for interns as they potentially are hired as full time employees and progress through the ranks of the firm. Of course, it depends on the persons’ specific skills and value they bring to the firm, but your comp structure gives interns an idea of the path they can expect to follow.

Key takeaways:

Minimum total cash compensation is $25,000.

Pre-MBA analysts at the top of their field each as much as $300,000 in total cash compensation annually.

The median total cash compensation at investment firms is $117,100.

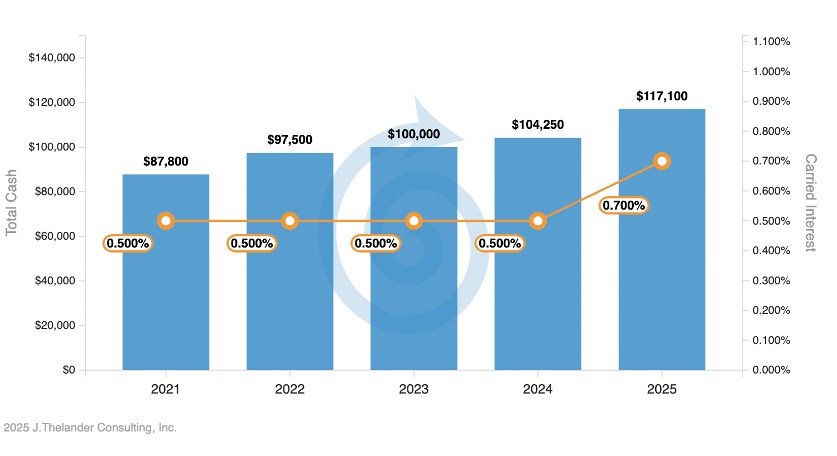

Mix of Cash & Carry: Carried Interest Rises in 2025 Along with Salaries

Pre MBA Analyst YoY Median Total Cash & Carried Interest

Source: Thelander-PitchBook Investment Firm Compensation Survey

Key takeaways:

Carried interest remained flat at 0.500% amongst all firms between 2021 and 2024, rising to 0.700% in 2025. Minimum total cash compensation is $25,000.

Median total cash compensation also jumped in 2025, rising to $117,100 compared to $104,250 in 2024. Pre-MBA analysts at the top of their field each as much as $300,000 in total cash compensation annually.

The $13,000 salary increase is the largest of the past five years, which occurred between 2024 and 2025.

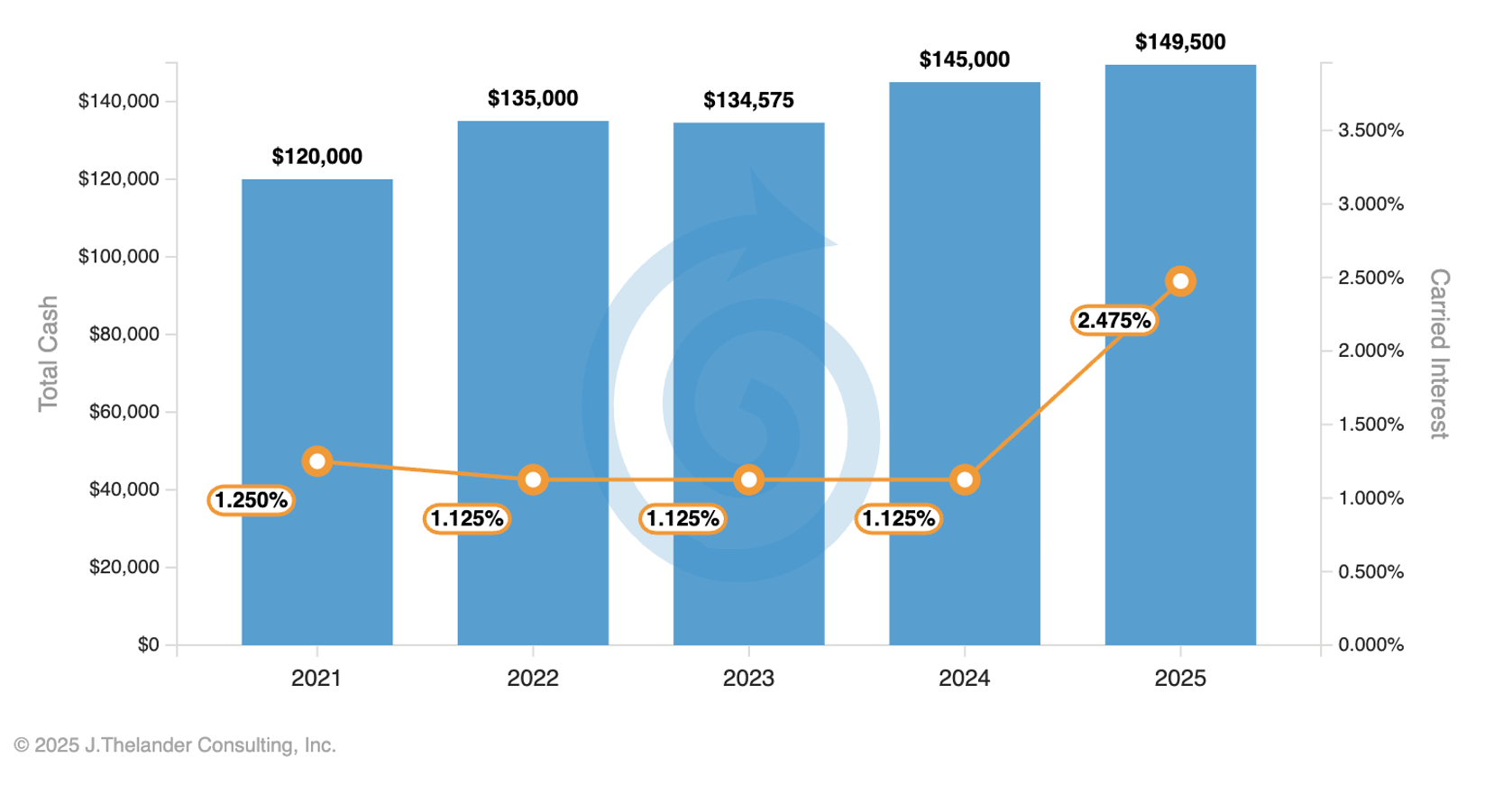

Carried Interest Doubles at the 75th Percentile

The 75th percentile paints a different picture for pre-MBA analyst compensation, as both carried interest and cash compensation rose this year. The chart below shows the changes in compensation and carried interest at the 75th percentile.

Pre MBA Analyst YoY 75th %ile Total Cash & Carried Interest

Source: Thelander-PitchBook Investment Firm Compensation Survey

Cash compensation was flat in 2022 and 2023 holding steady around $135,000 before rising in 2024 to $145,000.

The 75th percentile rose slightly in 2025 – from $145,000 to $149,500.

In contrast, carried interest more than doubled, from 1.125% for the past four years up to 2.475% in 2025.

The Bottom Line

Whether you’re running an emerging fund or a well-established firm, interns and entry-level roles should be paid in alignment with job market trends and the value they bring to your firm. Salaries for tech roles and positions that can’t easily be replicated or replaced by AI are likely to continue increasing for top talent, along with a percentage of carried interest.

Participate in the Thelander-PitchBook Investment Firm Compensation Survey For More Data Today

Tags: Investment Firm, Newsletter