Thelander PC Digest: July 2025

Exclusive Data on M&A and Severance Plans

This month’s Thelander Digest dives into severance and change in control – which affects private company executives and key employees. It’s important to have a plan in place even if there’s no merger or acquisition on the horizon. And, to create that plan, you need access to relevant, real-time data specific to the global private capital market.

Below you’ll find an exclusive preview of data from the Thelander M&A with Change of Control & Severance Survey, which closes August 8th. Participate today to secure your complimentary overview report.

The Importance of Severance Plans

Two AI startups, along with tech giant Google, made headlines in July when Google hired Windsurf AI’s founder and CEO, Varun Mohan, along with other senior leaders in the company. AI company Cognition subsequently purchased Windsurf AI’s intellectual property, trademark, brand and significant talent, albeit without the CEO and key employees.

“In an M&A transaction, the acquiring company typically wants part or all of the team,” said Jody Thelander, founder & CEO of the namesake firm. “Making sure the cash/equity mix is competitive and in line with market is important. So when there is a potential transaction, there is precedent for the key employees to be retained and compensated.”

Severance Standards

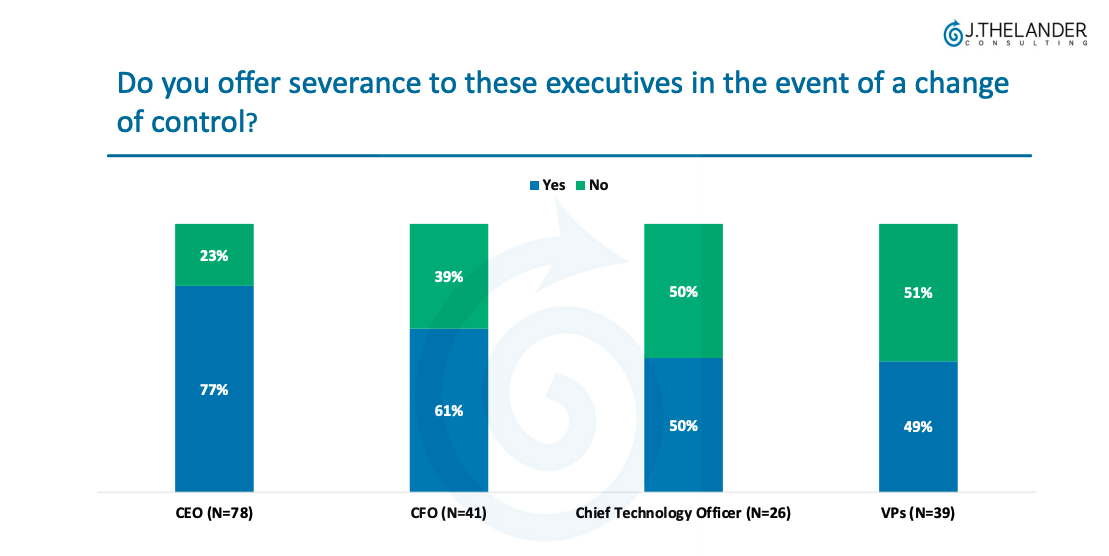

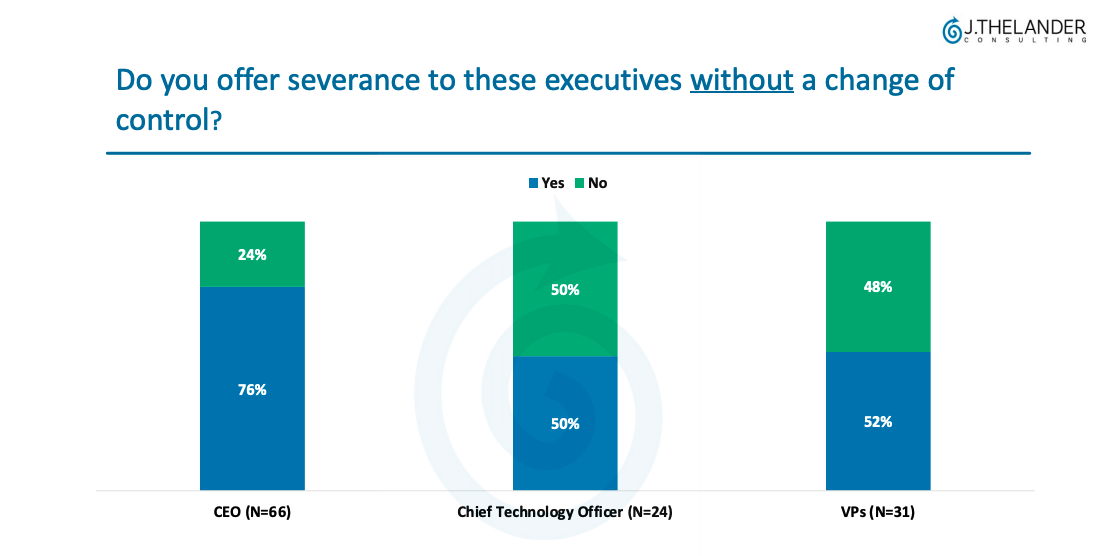

This exclusive preview of data compiled by Thelander shows that the majority of private companies offer severance to most executives, whether or not there is a change of control.

Key Takeaways:

Private company CEOs are likely to get severance with a change in control, but the vast majority receive severance in either case.

50% of CTOs get severance, whether or not there is a change in control.

VPs are more likely (52%) to get severance without a change in control than with a change of control (49%).

Exploring M&A Trends

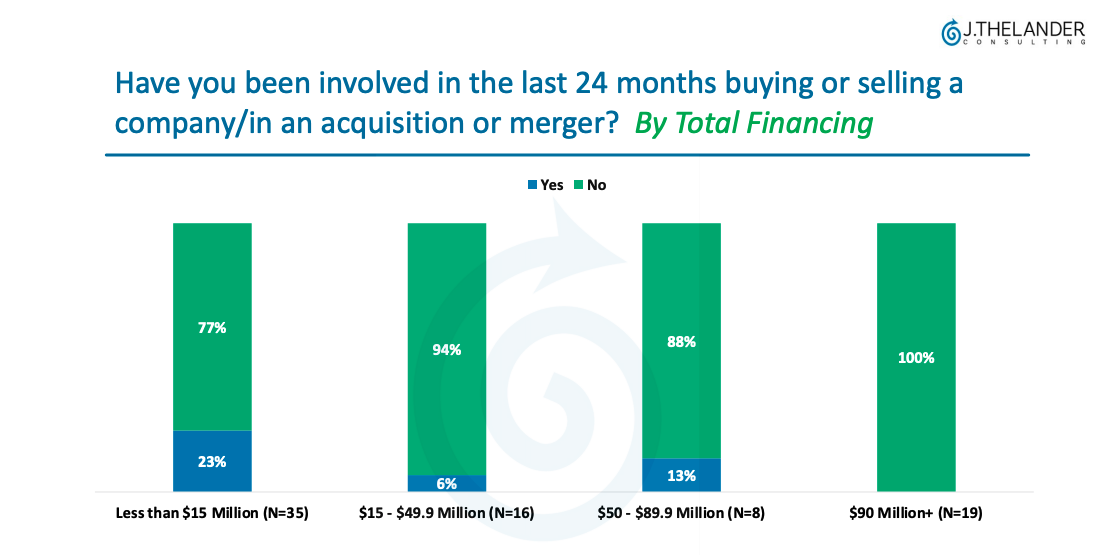

Next, we dive into the question: How does the total amount of financing impact whether a company has been involved in an acquisition or merger in the last 24 months?

Our data shows that smaller companies with less than $15 million in total financing, were more likely to have been involved in an M&A transaction in the past two years.

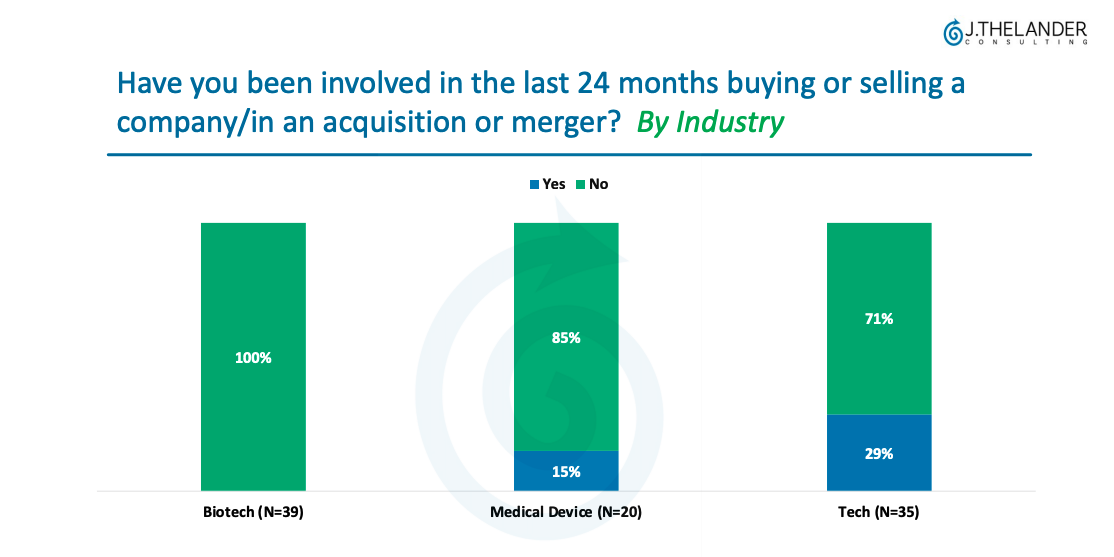

M&A By Industry

Of our survey participants, nearly one-third of tech companies were involved in buying or selling a company. M&A is a hot topic right now and as companies race to take the lead in AI and other industries, we are likely to see more deals on the horizon. How prepared are you?

Help Us Help YOU

The Thelander M&A with Change of Control & Severance Survey closes next Friday, August 8th. Don’t miss out on your chance to unlock exclusive data, including access to the 2024 report before the 2025 report is published.

Participation is free and unlocks access to personalized private company compensation data for a full year.

Have questions? Reply to this email and our customer success team is happy to help.

Tags: Newsletter, Private Company