Thelander CVC Digest: July 2025

Successful CVCs Stay Ahead of the Innovation Curve

“The average lifespan of a Fortune 500 company has dropped from 61 years in 1958 to less than 18 today.” This statistic shocked us when our upcoming CapLander podcast guest, Mark S. Brooks shared it with us. But this shorter lifespan doesn’t mean the end of corporate venture capital firms – not by a long shot!

In fact, innovative CVC Units, ones who really “catalyze transformation,” as Brooks wrote in a recent article, work with leaders to reshape industries. “The best CVCs are powered by leaders obsessed with ground truth and curiousity. They meet founders. They explore edges,” Brooks wrote.

Make sure you’re subscribed to the CapLander podcast so you don’t miss an episode.

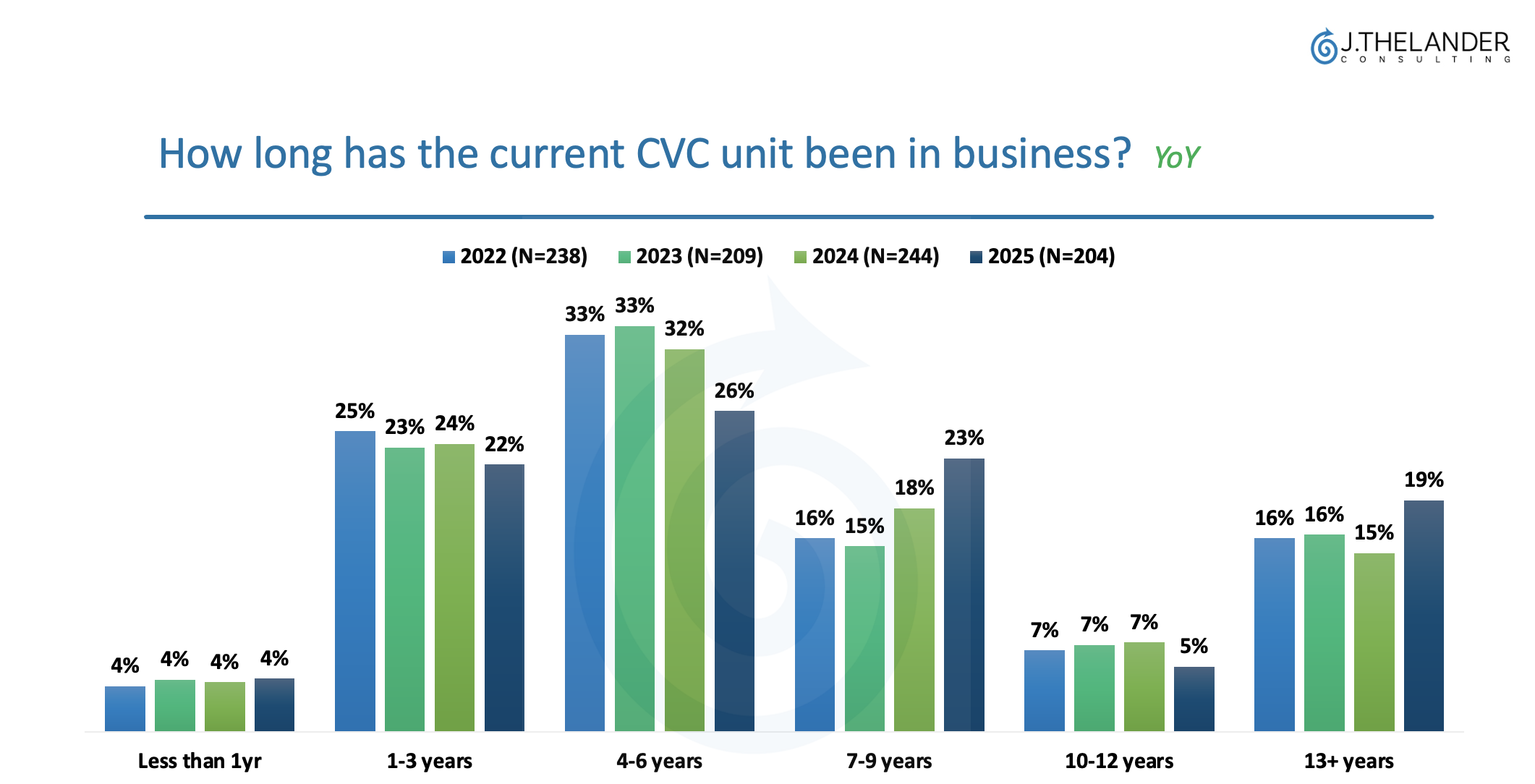

Recent data from J.Thelander Consulting shows that start-up CVC Units may have growing pains, but once they pass the seven-year mark, corporate venture capital firms are showing strength.

How long has your CVC Unit been in business?

Key takeaways:

CVC Units in business 1 to 3 years have gone slightly down since 2022.

Around one quarter of CVCs have been in business 4 to 6 years as of 2025, a significant decline since 2022.

The number of CVCs in business 7 to 9 years and 13+ years has increased, while those in business 10 to 12 years decreased slightly.

Our data suggests that there’s an increasing amount of closures among younger units while older, more established units are staying afloat.

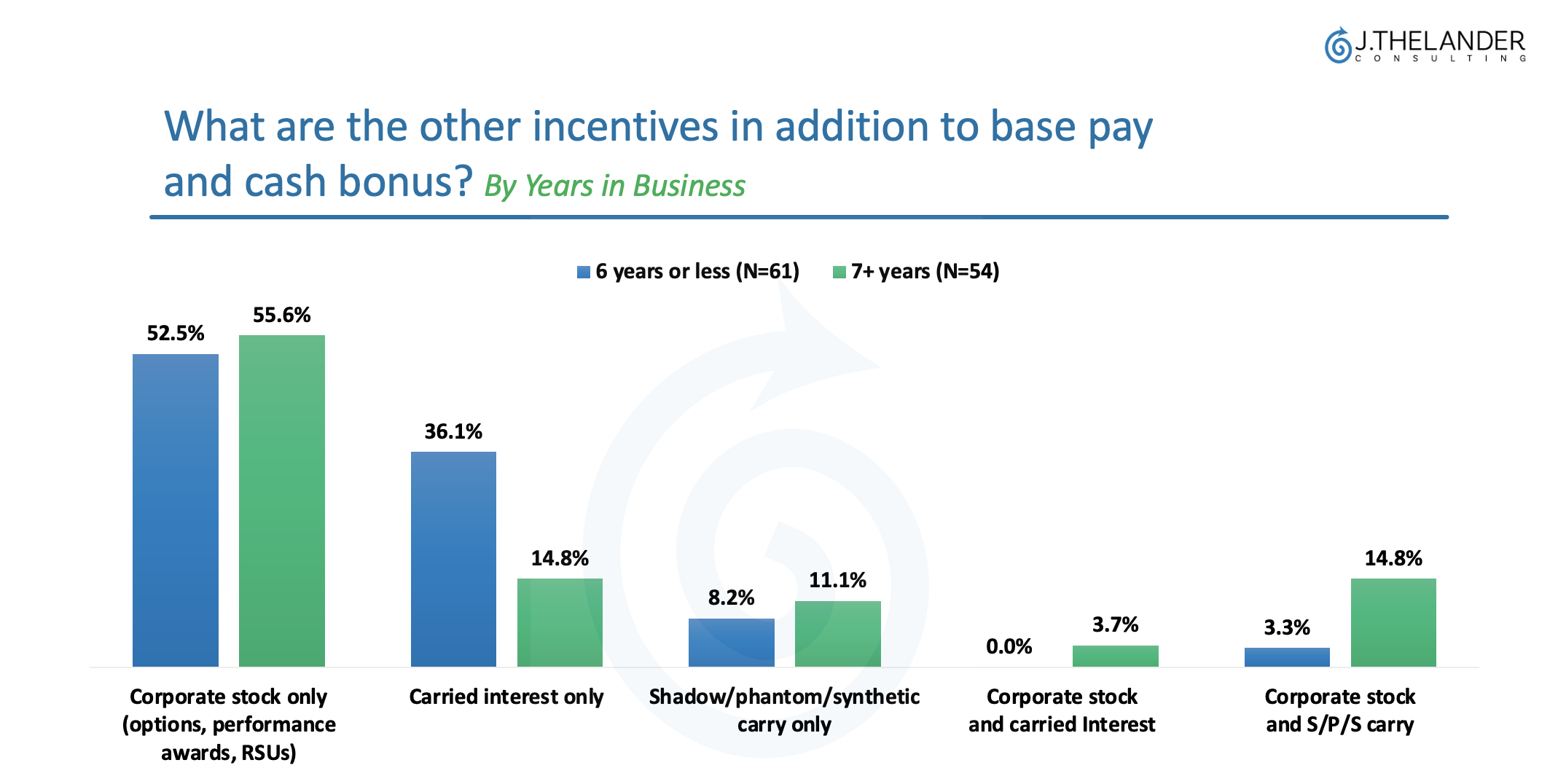

One of the ways CVC Units can stay innovative is with their compensation.

Key takeaways:

Newer CVC units (6 years or less) use traditional carried interest versus shadow/phantom/synthetic carry (SPS).

Firms who have been around for more than 7 years tend to use SPS carry more than traditional carry.

Subscribe to the CapLander podcast to hear our upcoming episode

Tags: CVC, Newsletter