Thelander CVC Digest: August 2025

How Can CVCs Leverage AI?

Always on the cutting edge of industry trends and innovation, Thelander has released its first AI & Compensation Report, with exclusive insights regarding the use of AI in investment firms of every size and type.

Our survey is ongoing, so you can still participate here and weigh in on how your CVC unit is using AI. Whether you’re seeking to hire people with AI experience and skills, and the types of AI support you’re seeking, or looking to understand what other firms are doing, Thelander is the only firm with these unique insights.

Participate in The Compensation Survey Today

How Important Is It For New Hires To Have AI Skills?

Many investment firms are already getting support from AI, but how far does this extend? Key job roles, especially in fields like investment management, are not looking like they will be replaced by AI. There’s too much knowledge, experience and expertise that goes into these top positions.

Our data shows that 59% of investment firms aren’t looking to hire employees with AI skills. Of the 41% who are, AI is important for mid-level roles or for technology focused positions.

Let’s dig into some more key takeaways from our exclusive AI in VC report.

Who We Surveyed

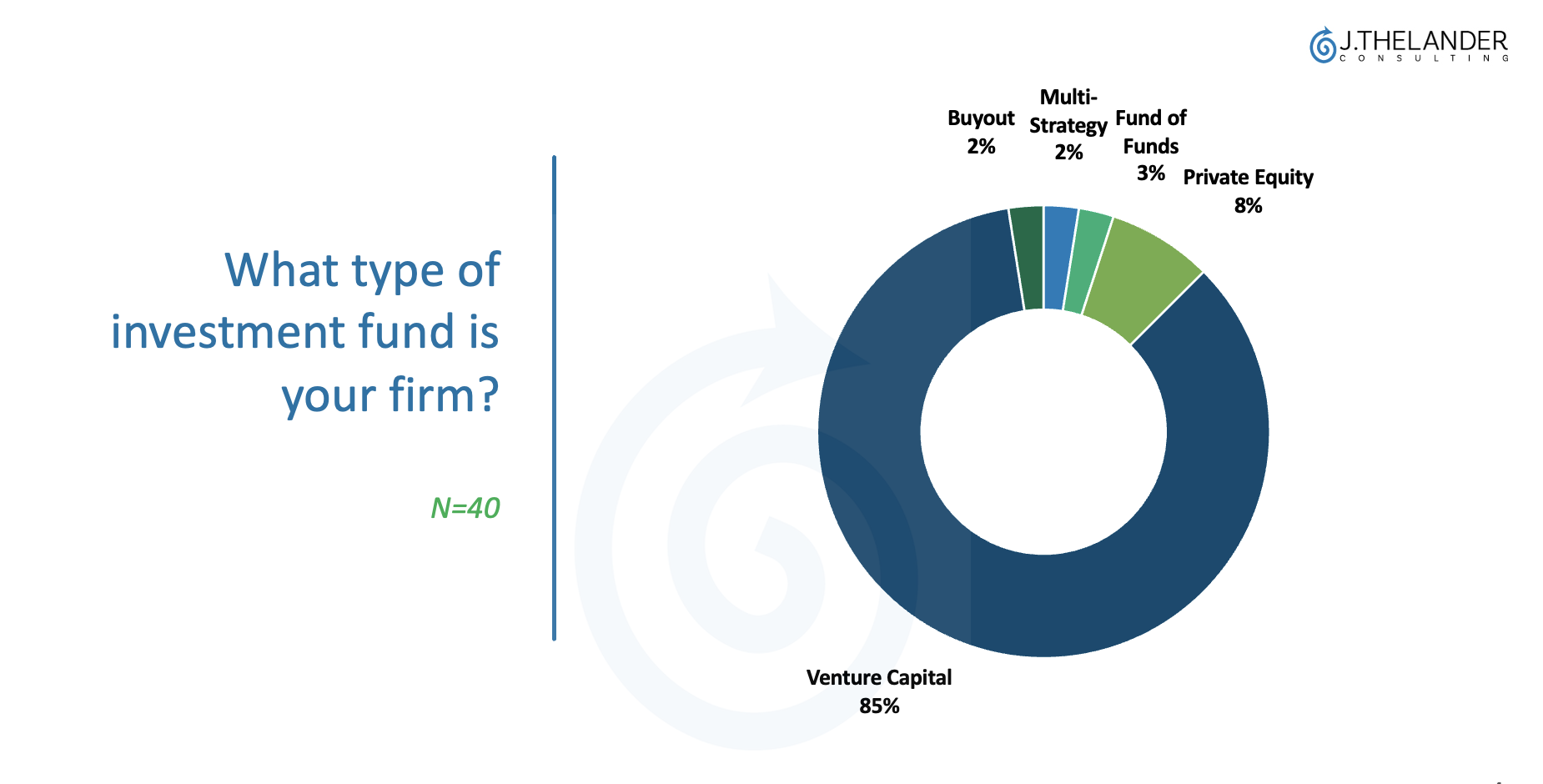

85% of survey participants are VC firms.

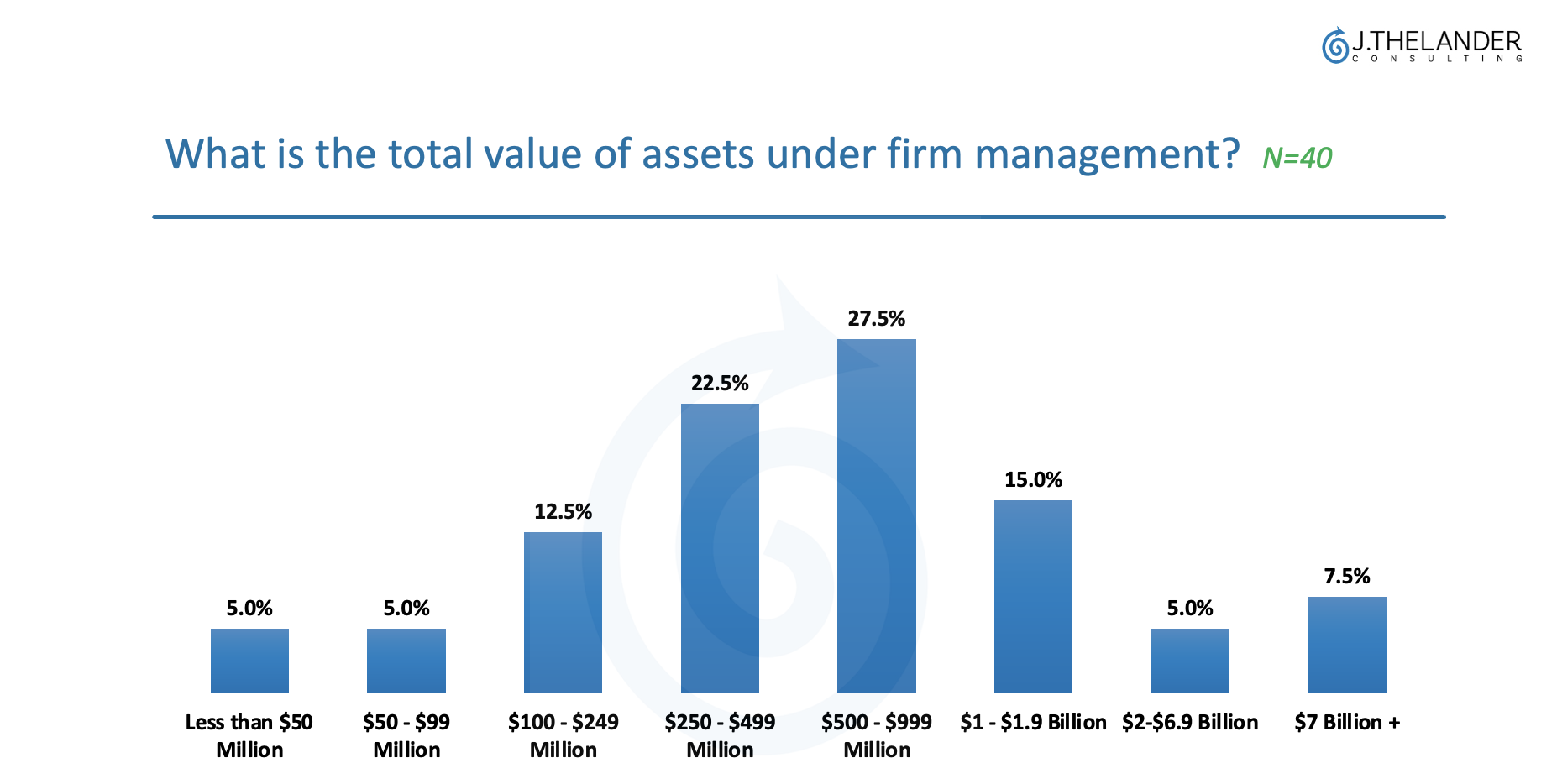

The majority of funds falls into the $250 – $999 million total AUM.

How Are Investment Firms Using AI?

Source: Thelander-PitchBook Investment Firm Compensation Survey

Key takeaways:

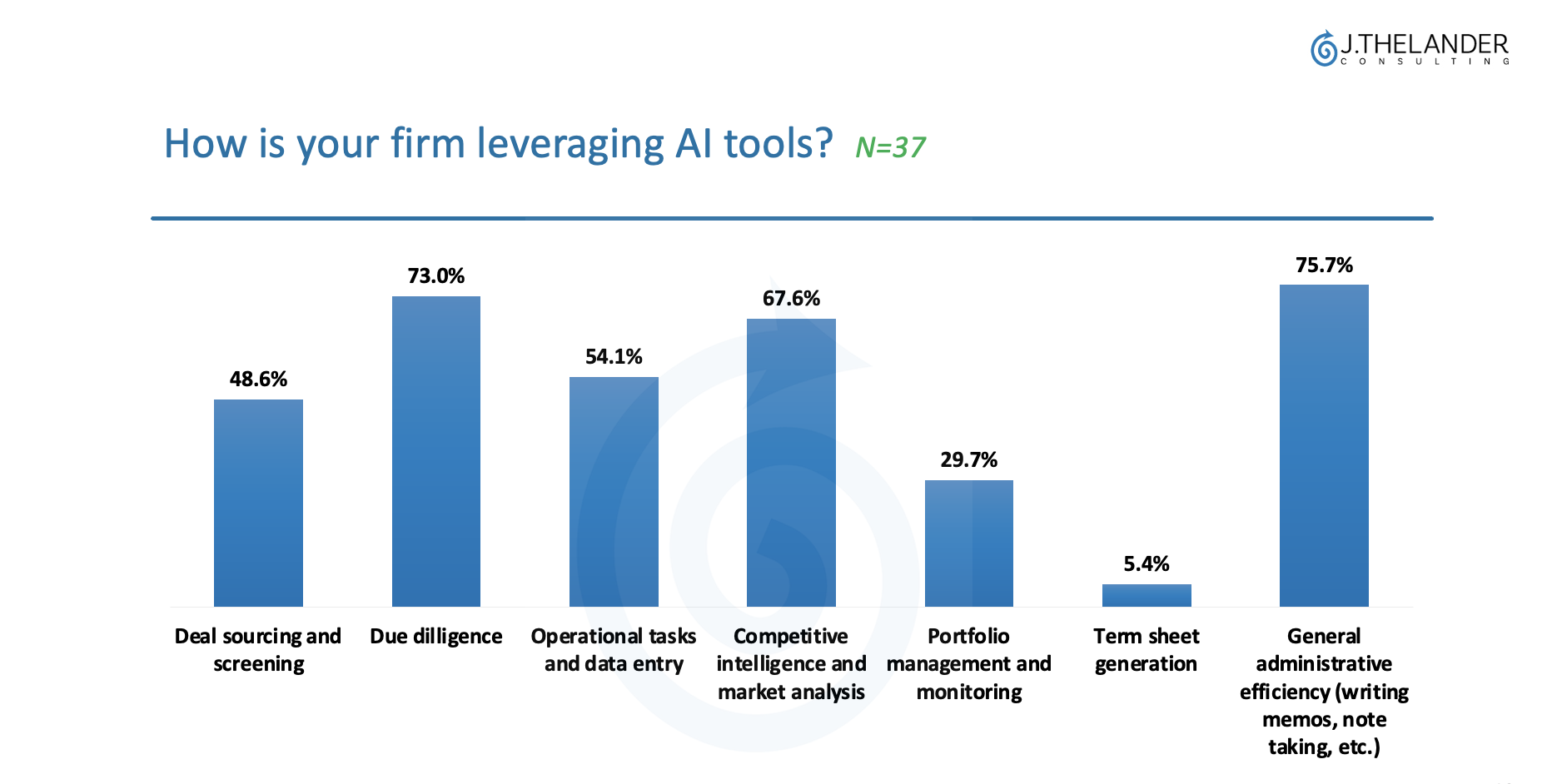

Of those using AI, the most common use (75.7%) is for general administration – note-taking, memos, etc.

Additionally, 73% are using it to streamline due diligence tasks.

Only 29.7% are using it for portfolio management and monitoring.

AI excels in sorting complex datasets, which makes the technology helpful for due diligence. It can also take notes and create meeting minutes, freeing up administrative personel for other tasks.

Source: Thelander-PitchBook Investment Firm Compensation Survey

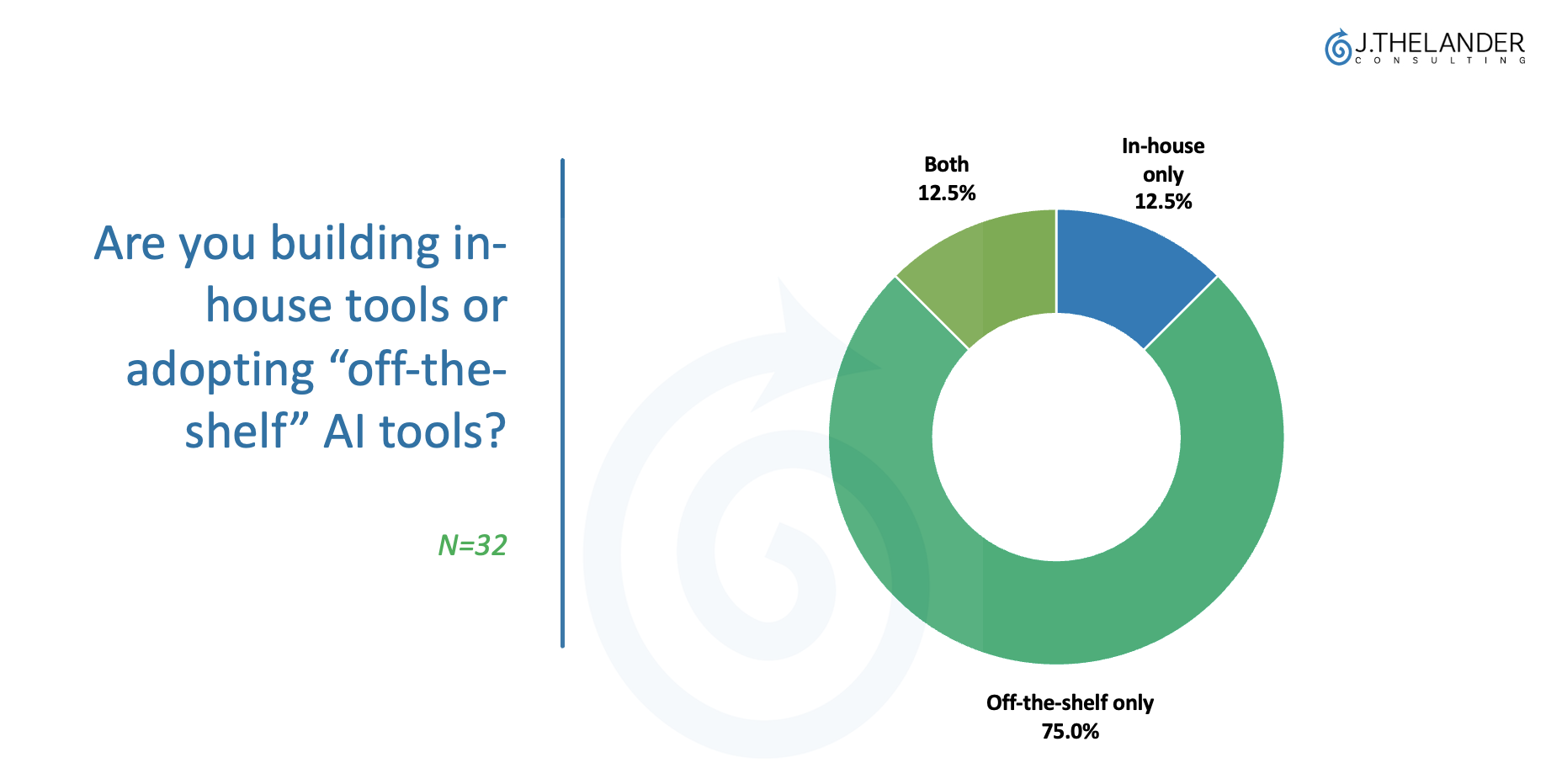

Most (75%) are using off-the-shelf only tools vs. custom tools developed in-house.

These survey results show that while AI has already begun to leave its mark on investment firms, there’s still plenty of room for growth and adoption of AI tools within the space.

To find out exactly what roles investment firms are looking to hire, participate in the Thelander-PitchBook CVC Compensation Survey here. You will receive access to real-time compensation data for all the job titles you complete as well as the the full AI in VC report.

Click Here to Complete the Compensation Survey Today

Tags: CVC, Newsletter