Thelander IF Digest: October 2025

Are Bonuses A Part of Your Total Compensation Program?

This month, we are digging into bonuses. For investment firms, bonuses can come in a couple of forms:

- Annual bonuses – the classic form of short term incentive used to reward performance and align it with the firm, paid in cash.

- Equity or program distribution bonuses – these distribute earnings to the team upon the success of a deal, and can be in lieu of or in addition to carry, paid in cash. They provide a medium term incentive positioned between the annual bonus and carried interest, which can take a long time to pay off.

According to the PitchBook – NVCA Q3 Venture Monitor Report, “GPs are exploring ways to generate distributions. The use of secondaries continues to grow, and new ways to use continuation-style vehicles are starting to enter the market. Now, almost four years past the 2021 highs, the liquidity crunch is really beginning to be felt.”

In the analysis below, we’ll look at the factors used to set individual performance targets in the short term and the prevalence of medium term equity or program distribution bonuses to get a sense of how firms are adapting compensation to market conditions.

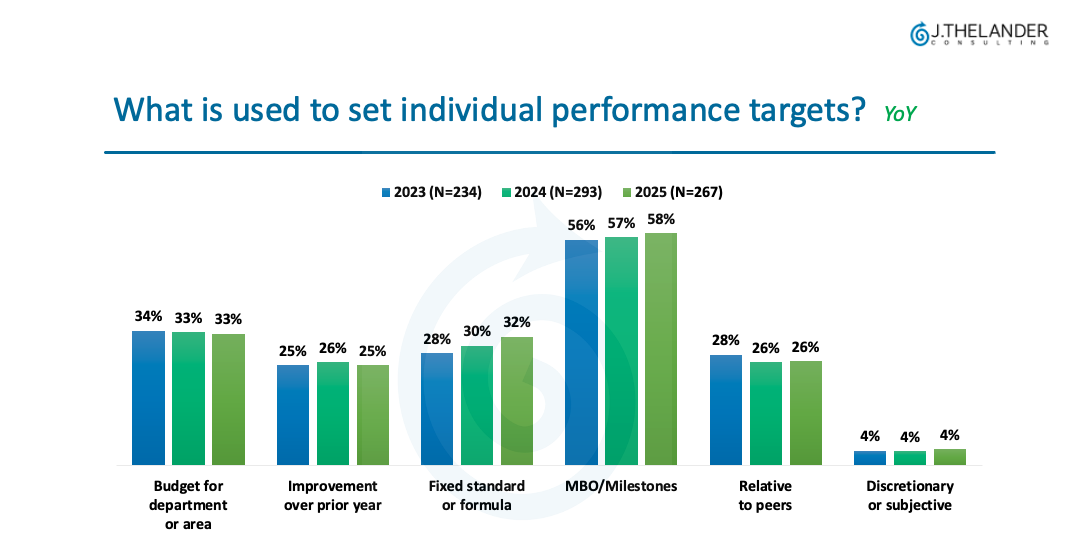

What Is Used To Set Individual Performance Targets? YoY

- Fixed standard or formula has steadily grown since 2023 from 28% to 32% in 2025.

- MBO / Milestones have also increased from 56% in 2023 to 58% in 2025.

- Improvement over prior year has stayed steady YoY – hovering around 25%.

- The rise in both fixed standards and milestones suggest that in the short term, firms are increasingly trying to both assure employees of consistent incentive pay in the face of longer fund cycles and ensure that those incentives have clear connections to company performance.

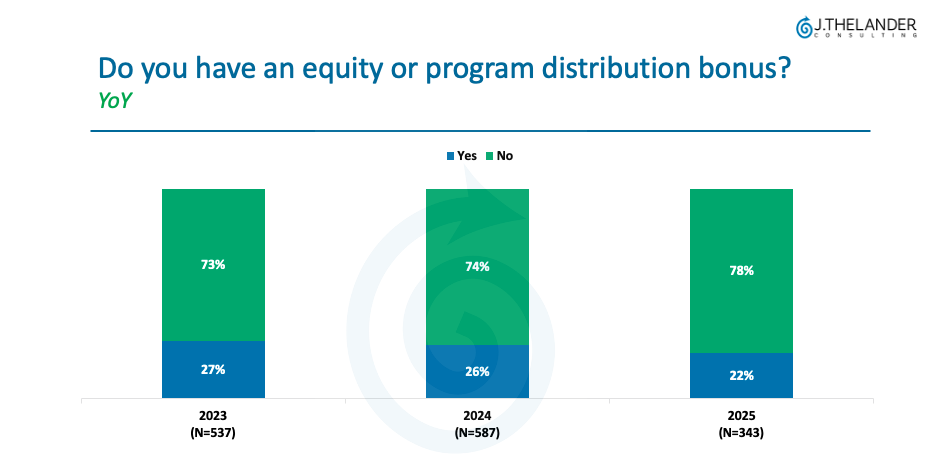

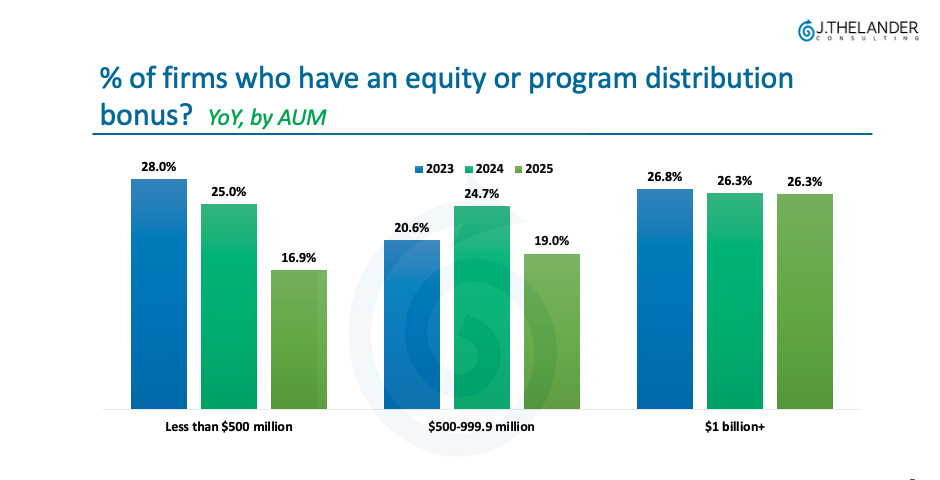

Does Your Firm Have An Equity or Program Distribution Bonus? YoY

- The proportion of firms with an equity or program distribution bonus has been shrinking over the past two years. This is mostly a result of a decreasing likelihood of having one among smaller firms, especially those with less than $500 Million in total AUM. While the likelihood for firms with $1 Billion+ in total AUM has remained relatively constant.

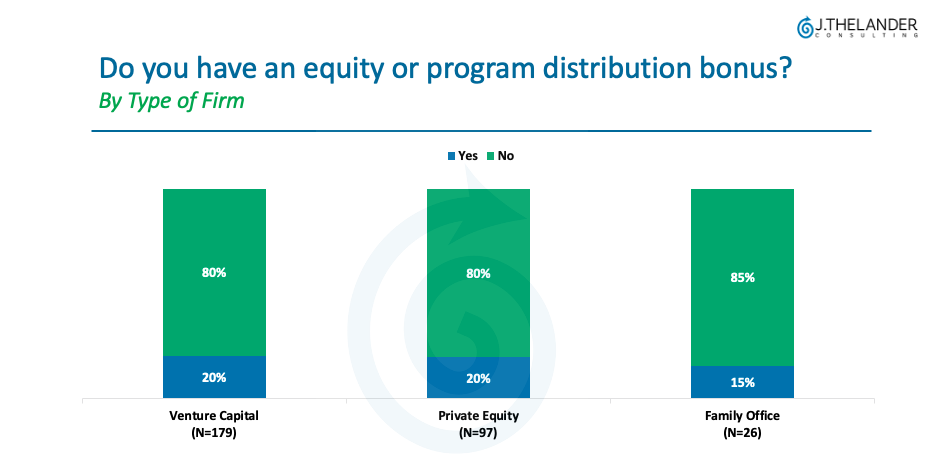

What Type of Firms Have An Equity or Program Distribution Bonus?

- Venture Capital and Private Equity Firms are equally positioned to have an equity or program distribution bonus.

- Those types of bonuses are not as common with Family offices – coming in at 15% vs. 20%.

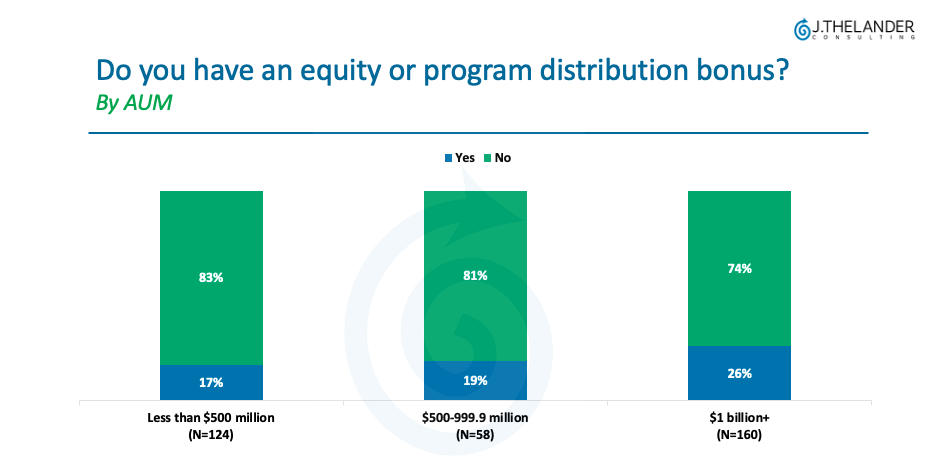

Does AUM Make a Difference In Whether A Firm Has An Equity or Program Distribution Bonus?

- Firms with more than $1 Billion in total AUM are the biggest winners when it comes to having an equity or program distribution bonus.

How Has This Changed YoY?

- In 2023, firms with less than $500 Million in total AUM were the most likely to have an equity or program distribution bonus.

- Since “emerging Managers are taking more than twice as long as established peers to raise successor funds” (PitchBook – NVCA Q3 Venture Monitor Report) it seems likely that this difficulty raising capital, combined with longer fund cycles, has made medium term incentives like equity or program distribution bonuses less viable for smaller funds.

- For the larger funds, who are better able to weather these market conditions, medium term incentives have remained a relatively stable option for bridging the gap between annual bonuses and carried interest.

What’s The Bottom Line?

As venture continues to be a career track, it is important for firms to think strategically about their compensation philosophy. And because vesting times are getting longer as is the path to liquidity for the portfolio, cash bonuses are a valuable retention tool. Having a well thought out and planned compensation program helps both investment professionals and staff stay focused on their jobs versus their compensation!

Want to see how your bonus amounts compare to real-time, vetted market data? Participate in the Thelander-PitchBook Investment Firm Compensation Survey today to find out. You will unlock compensation data for every job title you complete. We also have year over year trends, a compensation planning tool and interactive regional maps.

Thelander Compensation Consulting

The data is only as good as you know what to do with it. Have questions about your cash and carried interest mix, or thinking about putting a bonus program in place? Respond to this newsletter and a member of the Thelander team will reach out to schedule a call with Jody, our founder & CEO.

Tags: Investment Firm, Newsletter