Thelander PC Digest: August 2024

M&A Activity is Up. Is Your Company Prepared?

We’re excited to continue our “Comp Talks for Private Companies” virtual series with Cooley. With two sessions behind us, we’ve delved into equity awards and compensation strategies amid market fluctuations, including refresh grants and option repricing. Our upcoming session on September 18th will explore how to level up your compensation strategies. Sign up for it here so you don’t miss out.

August’s Digest gives you an exclusive preview of the findings from our M&A and Change of Control & Severance Survey. Let’s dive into the data:

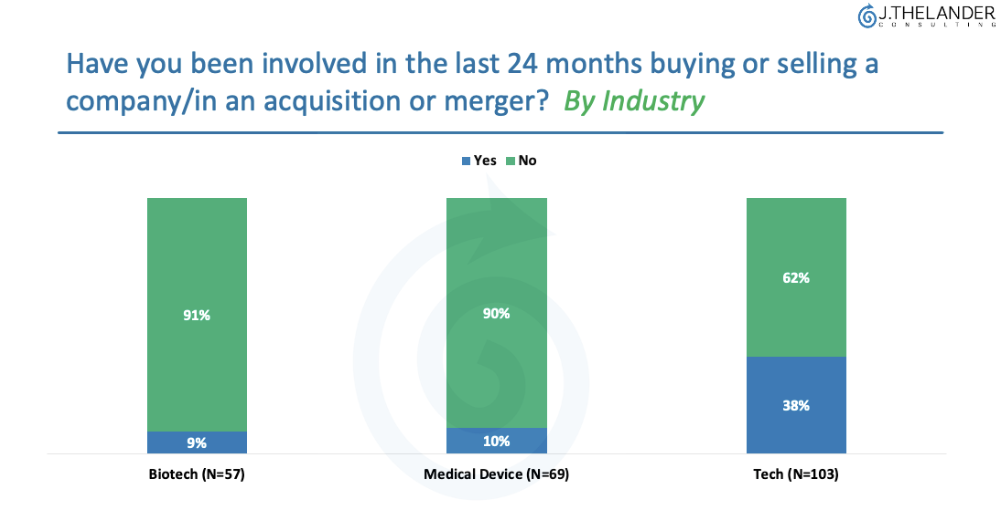

Chart 1 shows which industries have been involved in buying or selling a company in an acquisition or merger in the last 24 months. We see the following:

Tech companies are currently leading in M&A transactions when compared to life science companies.

According to PitchBook, “M&A activity is tracking 10% to 15% ahead of 2023 both in deal count and deal value.”

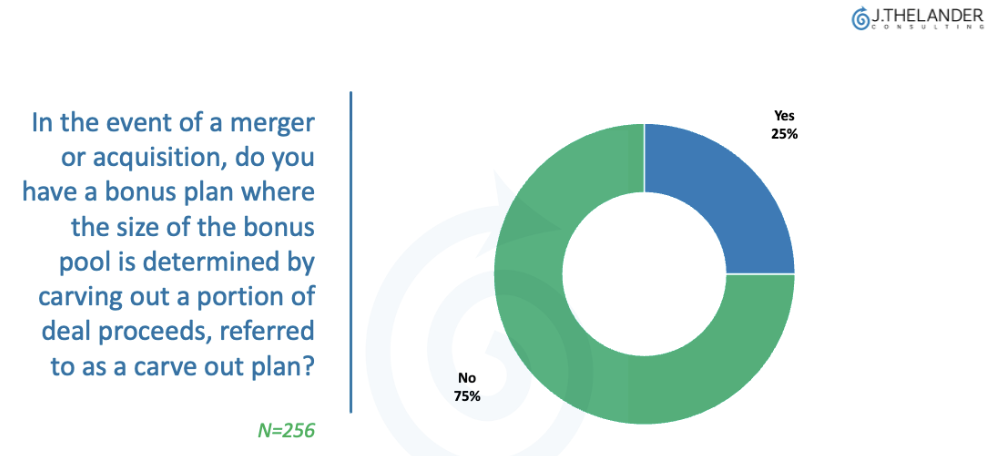

A carve-out plan is defined as a bonus plan, where the size of the bonus pool is determined by “carving out” a portion of the deal proceeds.This is often the only way for key employees to have liquidity during an M&A transaction.

Chart 2 examines carve out plans. We see the following:

25% of surveyed companies reported having a carve-out plan, a stable trend YoY.

Life science companies are slightly more likely to implement such plans compared to their tech counterparts. 20% for Tech vs. 22% and 23% for Medical Device and Biotech, respectively.

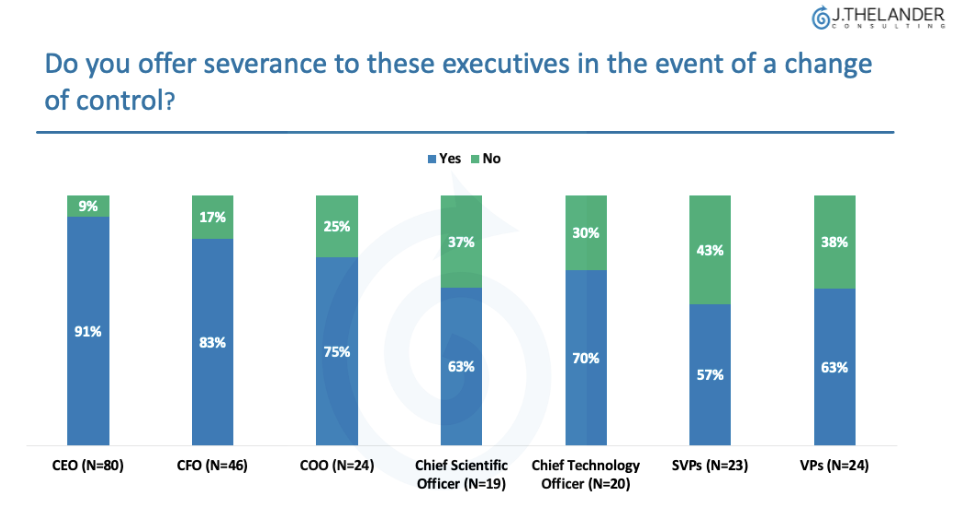

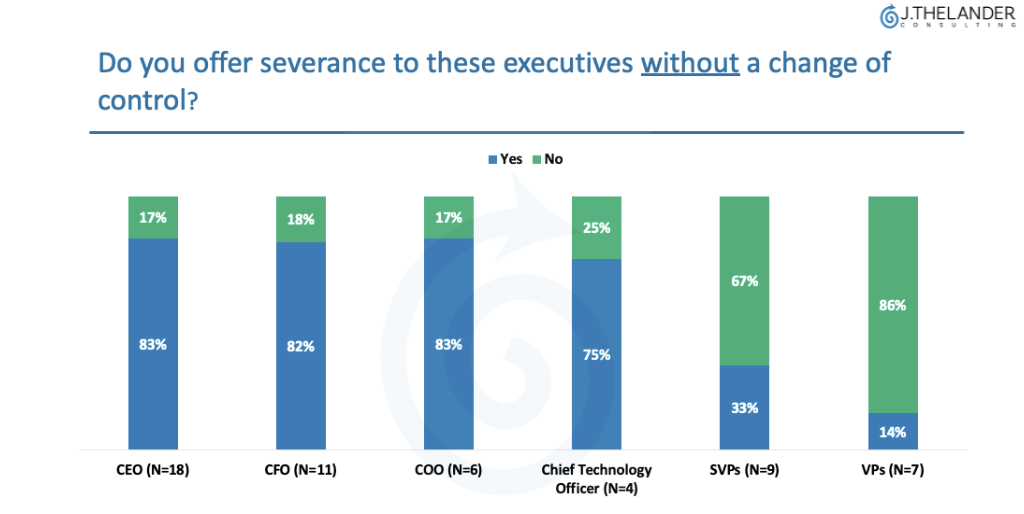

Our survey expanded this year to include details on severance in various scenarios, both with and without change of control.

Chart 3 & 4 examine different severance scenarios. We see the following:

CEOs are more likely to receive severance benefits during a change of control than in other circumstances, though severance is still likely.

For Senior VPs and VPs, the likelihood of severance in a change of control stands at 57% and 63% respectively, compared to significantly lower percentages (33% and 14%) when no change of control occurs.

What’s the bottom line?

Having structured plans for carve-outs and severance during mergers or acquisitions is valuable. These plans not only provide security to key players, but also ensure that they are compensated from the proceeds of a deal and motivated to stay through the transaction.

Don’t miss your chance to participate in the M&A and Change of Control & Severance Survey. The deadline to participate is September 19th. You will receive a free overview report and access to a subset of compensation data for 12 months.

Participate in the M&A and Change of Control & Severance Survey

To learn more about Thelander, respond to this email, schedule a demo with Morgan Thelander or call us +1.305.793.8605

Tags: Newsletter, Private Company