Thelander CVC Digest: October 2024

Calculating Shadow / Phantom / Synthetic Carry for CVC Units

In this edition, we delve into the calculation of shadow/phantom/synthetic (SPS) carry in Corporate Venture Capital (CVC) units. SPS carry can be a key long-term incentive that aligns the interests of CVC professionals with the sustained success of their portfolio companies. We’ll explore various methodologies for computing SPS carry, including the application of vesting schedules and hurdle rates, to better understand their impact on CVC compensation and unit strategies. Let’s dive into the data.

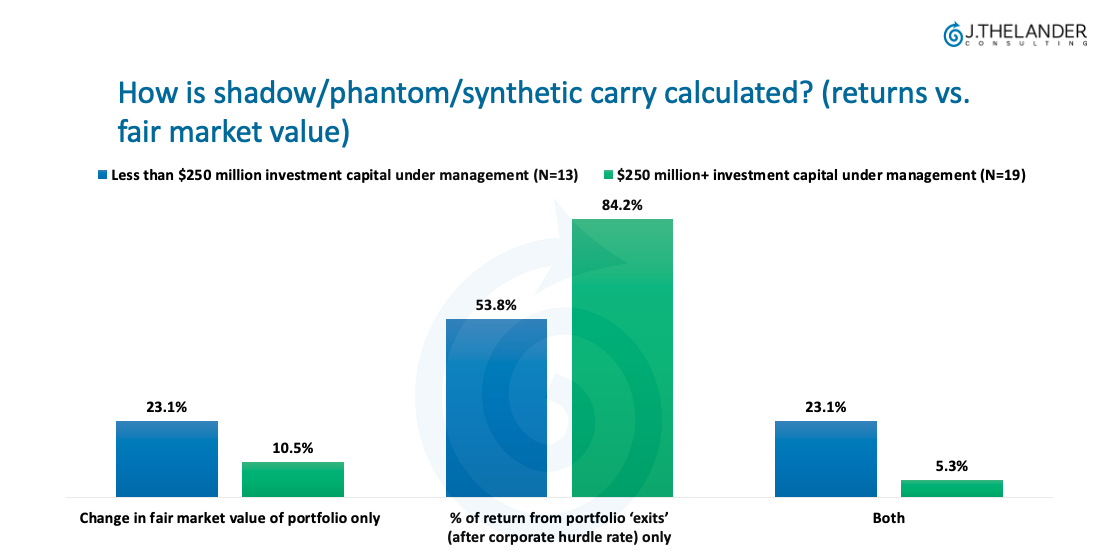

Chart 1 look at how shadow/phantom/synthetic carry is calculated by total investment capital under team management. We see the following:

The percentage of returns from the portfolio ‘exits’ is the most common regardless of how much investment capital is under team management.

Change in fair market value of portfolio only is more popular at CVC units with less than $250 Million in investment capital under team management.

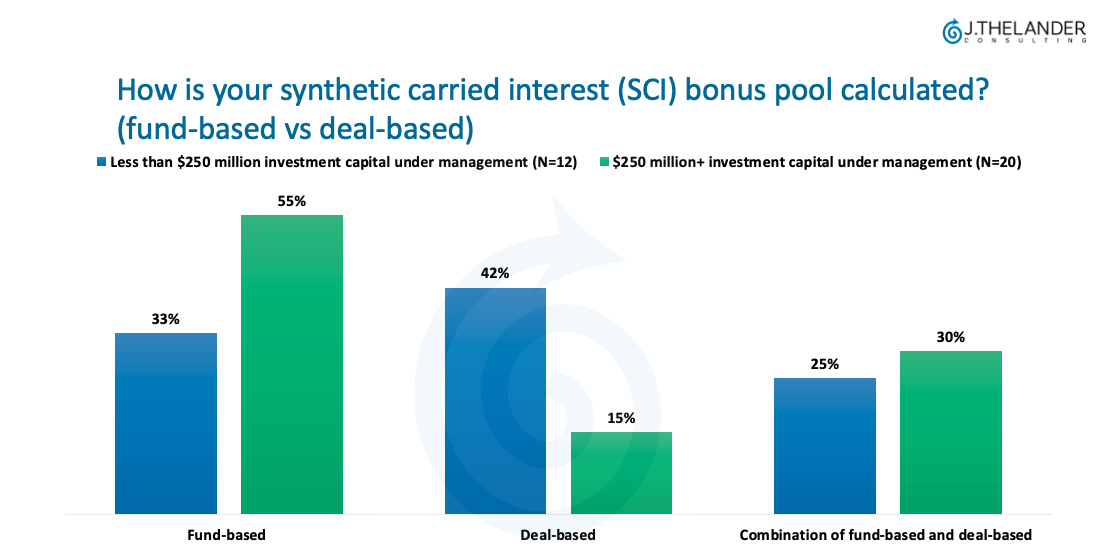

Chart 2 looks at how synthetic carried interest (SCI) bonus pool is calculated by total investment capital under management. We see the following:

Fund-based is the most popular option for CVC Units with more than $250 million in investment capital under team management.

Whereas, deal-based is more popular than fund-based for CVC units with less than $250 million in investment capital under team management.

The Bottom Line:

In shaping the long-term incentives for your CVC unit, consider whether your focus is on financial returns or technology transfer to the parent company. These objectives significantly influence the strategies to attract and retain top talent. For tailored guidance on aligning your compensation structures with your unit’s goals, connect with Thelander.

Want more comp data for your CVC Unit? Participate in the Thelander CVC Compensation Survey Today

The Thelander Digest is powered by the CVC Compensation Survey. We invite you to secure free compensation data for traditional investment firms and corporate venture firms for the next 12 months by completing your response today. Find out why thousands of the world’s top venture capital, private equity firms, family offices, CVC Units and their portfolio companies rely on Thelander’s real-time data and premier services to level up their compensation game.

To see what’s included in your free subscription, schedule a demo. You can also reach us by phone at +1.305.793.8605

Tags: CVC, Newsletter